If you’re interested in options trading, understanding the option chain is essential. But what is an option chain, and how can it help you make informed trading decisions? In this guide, we’ll break down the components of an option chain, explain how to read it and explore its significance in the world of trading. Whether you’re a beginner or an experienced trader, mastering the option chain is a crucial step toward success in options trading.

Understanding the Option Chain

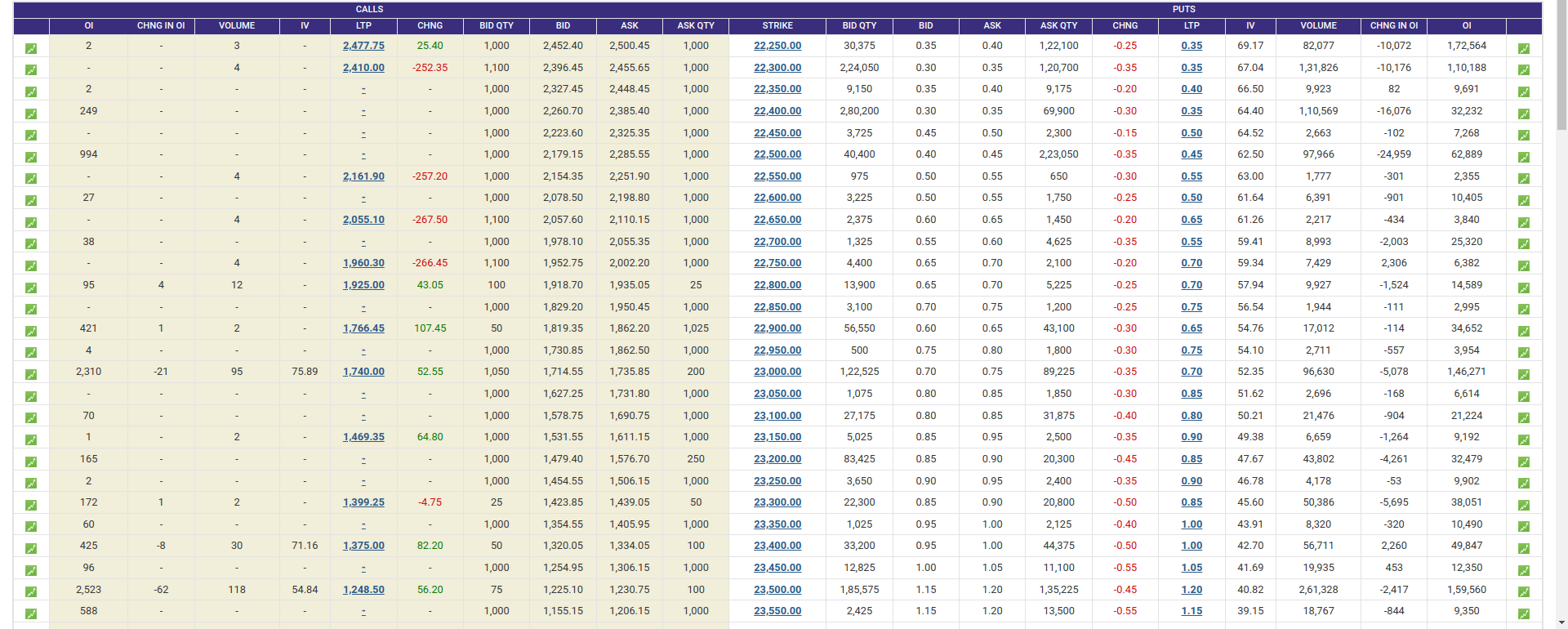

An option chain, also known as an options matrix, is a comprehensive list of all available options contracts for a particular underlying asset, such as a stock, index, or commodity. It displays key information like the strike prices, expiration dates, bid and ask prices, open interest, and implied volatility for both calls and put options.

In essence, the option chain provides a snapshot of the options market for a specific security, allowing traders to see all the available contracts and their respective details. By analyzing the option chain, traders can identify potential trading opportunities, compare different contracts, and make more informed decisions.

Components of an Option Chain

To effectively use an option chain, it’s important to understand its various components. Here’s a breakdown of the key elements you’ll find in an option chain:

- Underlying Asset: The security or index for which the options contracts are listed. This could be a stock like Apple (AAPL), an index like the S&P 500, or a commodity like gold.

- Expiration Date: Options contracts have specific expiration dates, and the option chain will list multiple expiration dates for the same underlying asset. Traders can choose contracts that expire in a few days, weeks, or even months, depending on their strategy.

- Strike Price: The strike price is the price at which the option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset. The option chain will display a range of strike prices, often centered around the current price of the underlying asset.

- Calls and Puts: The option chain typically divides the options into two columns: calls on the left and puts on the right. Call options give the holder the right to buy the underlying asset, while put options give the holder the right to sell.

- Bid and Ask Prices: The bid price is the highest price a buyer is willing to pay for an option, while the asking price is the lowest price a seller is willing to accept. The difference between the bid and ask prices is known as the bid-ask spread.

- Last Price: The last price is the most recent price at which the option was traded. This gives traders an idea of the current market value of the option.

- Open Interest: Open interest represents the total number of outstanding options contracts for a particular strike price and expiration date. High open interest indicates a high level of activity and liquidity for that contract.

- Implied Volatility (IV): Implied volatility is a measure of the market’s expectation of future price movements. A higher IV indicates greater expected volatility, which can affect the option’s price.

- Delta, Gamma, Theta, and Vega: These are the “Greeks,” which measure various risks and sensitivities of the option’s price relative to factors like the underlying asset’s price, time decay, and volatility. Delta, for example, measures the sensitivity of the option’s price to changes in the price of the underlying asset.

How to Read an Option Chain

Reading an option chain might seem complex at first, but with practice, it becomes second nature. Here’s a step-by-step guide to interpreting the information:

- Choose the Underlying Asset: Start by selecting the underlying asset you’re interested in trading. This could be a stock, index, or commodity.

- Select the Expiration Date: Decide on the time frame for your trade by choosing an expiration date. Short-term traders might prefer options expiring in a few days, while longer-term investors might opt for contracts expiring in several months.

- Compare Strike Prices: Look at the range of strike prices available. If you expect the price of the underlying asset to rise, you might consider buying a call option with a strike price near or below the current market price. Conversely, if you expect the price to fall, you might buy a put option.

- Analyze the Bid-Ask Spread: Check the bid and ask prices for the options you’re considering. A narrow bid-ask spread indicates a more liquid market, making it easier to enter and exit trades.

- Consider Open Interest and Volume: High open interest and volume can indicate strong market interest in a particular option, which can lead to better price execution and tighter spreads.

- Evaluate Implied Volatility: Look at the implied volatility to assess market expectations of future price movements. High IV can increase option premiums, while low IV can offer cheaper entry points.

- Understand the Greeks: If you’re trading more complex strategies, pay attention to the Greeks to manage your risk. Delta can help you gauge the likelihood of the option expiring in the money, while Theta helps you understand the impact of time decay.

Why the Option Chain Matters

The option chain is a vital tool for options traders for several reasons:

- Informed Decision-Making: By analyzing the option chain, traders can make more informed decisions about which options to trade. The detailed information allows you to compare different contracts and choose the ones that best fit your strategy.

- Risk Management: Understanding the option chain helps traders manage risk by selecting options with appropriate strike prices, expiration dates, and implied volatility. It also aids in the development of strategies like covered calls, straddles, and spreads.

- Market Sentiment: The option chain can provide insights into market sentiment. For example, high open interest in call options might indicate bullish sentiment, while high open interest in put options could suggest bearish sentiment.

- Flexibility: The option chain allows traders to see a wide range of possibilities, from speculative trades to hedging strategies. This flexibility is one of the key advantages of trading options.

Common Strategies Using the Option Chain

Here are a few popular strategies that rely on the information provided by the option chain:

- Covered Call: In this strategy, a trader who owns the underlying asset sells a call option with a strike price above the current market price. The goal is to generate income from the premium while retaining the asset unless the option is exercised.

- Protective Put: A trader who owns the underlying asset buys a put option with a strike price below the current market price. This strategy provides downside protection while allowing the trader to benefit from potential upside gains.

- Straddle: A straddle involves buying both a call and a put option at the same strike price and expiration date. This strategy is used when a trader expects significant price movement but is unsure of the direction.

- Vertical Spread: A vertical spread involves buying and selling options of the same type (calls or puts) with different strike prices but the same expiration date. This strategy is used to limit risk and reduce the cost of entering a position.

Conclusion

Understanding what an option chain is and how to use it is fundamental for anyone interested in options trading. The option chain provides a wealth of information that can help you make informed decisions, manage risk, and develop effective trading strategies. Whether you’re a beginner or a seasoned trader, mastering the option chain will enhance your ability to navigate the complex world of options trading.