Your cart is currently empty!

Trading Risk Reward Calculator

Managing risk is a fundamental part of successful trading. One of the key tools that traders use to assess and manage their risk is the trading risk reward calculator. This calculator helps traders evaluate whether the potential profit from a trade justifies the level of risk they are taking. In this comprehensive guide, we will discuss what a trading risk reward calculator is, how to use it, and how it can improve your trading strategy.

1. Understanding the Risk Reward Ratio

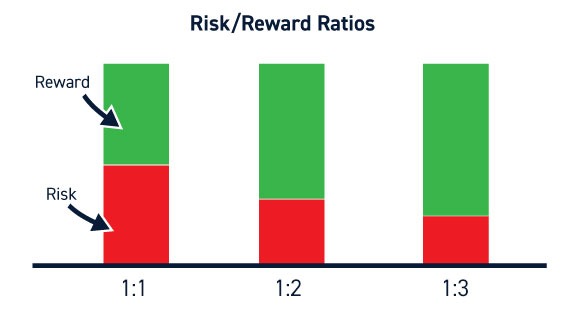

The risk-reward ratio is a metric used by traders to determine the amount of risk versus the potential reward of a trade. It is typically expressed as a ratio, such as 1:3, which means that for every unit of risk, there is a potential of three units of reward.

For instance, if a trader is willing to risk INR 500 to make a potential profit of INR 1500, the risk-reward ratio is 1:3. This means that the potential gain is three times greater than the potential loss, which makes the trade potentially worthwhile.

Most traders aim for a risk-reward ratio of at least 1:2, ensuring that even if they lose more trades than they win, they can still be profitable over time.

2. Why Use a Trading Risk Reward Calculator?

A trading risk reward calculator helps traders quickly and accurately assess if a trade is worth taking based on its risk-reward ratio. Here are some key benefits of using a trading risk reward calculator:

Objective Decision-Making: The calculator provides an objective evaluation of each trade, helping traders avoid emotional decision-making.

Better Risk Management: By calculating the risk-reward ratio before entering a trade, traders can ensure that they are only taking trades with a favorable potential for profit.

Quick Calculations: A trading risk reward calculator speeds up the process of evaluating trades, making it easier for traders to focus on strategy rather than calculations.

3. How to Use a Trading Risk Reward Calculator

A trading risk reward calculator requires three main inputs to calculate the risk-reward ratio:

- Entry Price: The price at which you enter the trade.

- Stop-Loss Price: The price at which you will exit the trade if it moves against you, thus limiting your loss.

- Target Price: The price at which you will make a profit if the trade moves in your favor.

Risk is calculated as the difference between the entry price and the stop-loss price, while Reward is calculated as the difference between the target price and the entry price.

The formula for calculating the Risk Reward Ratio is:

For example, if your Entry Price is INR 1000, your Stop-Loss Price is INR 950, and your Target Price is INR 1200, then:

- Risk = Entry Price – Stop-Loss Price = 1000 – 950 = INR 50

- Reward = Target Price – Entry Price = 1200 – 1000 = INR 200

The Risk Reward Ratio would be:

This means that for every rupee risked, there is a potential reward of four rupees, indicating a favorable trade setup.

4. Setting Up a Trading Risk Reward Calculator in Excel

Creating a trading risk reward calculator in Excel is simple and effective for traders who prefer to perform calculations independently. Here’s how to set it up:

Step 1: Define Key Columns

- Column A: Entry Price

- Column B: Stop-Loss Price

- Column C: Target Price

- Column D: Risk

- Column E: Reward

- Column F: Risk Reward Ratio

Step 2: Enter Formulas

- Risk Calculation: In Column D, use the formula

=A2 - B2to calculate the risk. - Reward Calculation: In Column E, use the formula

=C2 - A2to calculate the reward. - Risk Reward Ratio: In Column F, use the formula

=D2 / E2to calculate the risk reward ratio.

5. Practical Example of Using a Trading Risk Reward Calculator

Consider a scenario where a trader wants to evaluate a trade with the following details:

- Entry Price: INR 1500

- Stop-Loss Price: INR 1450

- Target Price: INR 1650

Using the trading risk reward calculator in Excel:

- Risk:

1500 - 1450 = 50 INR - Reward:

1650 - 1500 = 150 INR - Risk Reward Ratio:

50 / 150 = 1:3

This means that for every rupee risked, the trader stands to gain three rupees in profit, indicating a favorable trade setup.

Click below to download the spreadsheet and explore practical examples of risk-reward calculations for informed trading decisions.

6. Benefits of Using a Trading Risk Reward Calculator

Objective Evaluation: The calculator provides a clear and objective evaluation of whether a trade setup has a favorable balance between risk and reward.

Consistency: By using a risk-reward calculator, traders can evaluate each trade using the same criteria, ensuring consistent decision-making.

Improved Profitability: By focusing on trades with a favorable risk reward ratio, traders can improve their overall profitability by ensuring that the potential rewards justify the risks.

7. Incorporating Risk Reward Ratios into Trading Strategies

The risk-reward ratio is an essential component of any effective trading strategy. Here are a few ways to incorporate it into your trading approach:

Entry and Exit Decisions: Use the risk-reward ratio to determine whether a trade is worth entering. Only consider trades that offer a favorable risk-reward ratio, such as 1:2 or higher.

Setting Stop-Loss and Target Prices: Use the risk-reward ratio to set realistic stop-loss and target price levels, ensuring that you have an appropriate balance between risk and potential reward.

Evaluating Trading Performance: Review past trades to evaluate how well your strategy performed in terms of risk-reward. This helps refine your approach to maximize profitability.

8. Application Across Different Asset Classes

A trading risk reward calculator can be used across various asset classes, including:

Stocks: Traders can use the ratio to evaluate whether buying or selling a particular stock is worth the risk.

Forex: In currency trading, the risk-reward ratio helps traders ensure they are taking calculated risks, especially given the high volatility of the forex market.

Commodities: For commodities like gold and oil, the risk-reward ratio provides insights into whether a trade is worth pursuing.

Cryptocurrencies: The high volatility of cryptocurrencies makes risk management crucial, and a risk-reward ratio calculator helps set realistic profit goals.

9. Tools Available at RajeevPrakash.com

For traders seeking an easy-to-use online solution, RajeevPrakash.com offers a Trading Risk Reward Calculator that can help traders evaluate potential trades quickly. By entering the entry price, stop-loss price, and target price, traders can instantly determine if the trade setup is favorable without having to perform manual calculations.

This tool is particularly helpful for both beginners and experienced traders looking for a convenient and efficient way to evaluate their trades and make informed decisions.

10. Common Mistakes to Avoid with Risk Reward Ratios

While the risk-reward ratio is an effective tool, there are some common mistakes traders should avoid:

Ignoring Market Conditions: The risk-reward ratio should not be the only factor considered when making trading decisions. Always take into account market trends, news, and economic conditions.

Setting Unrealistic Profit Targets: Setting unrealistic targets can lead to an inflated risk-reward ratio that may not be achievable. Set reasonable and achievable targets based on market conditions.

Neglecting Position Sizing: The risk-reward ratio is only one part of effective risk management. Traders should also consider position sizing and overall risk exposure.

11. Conclusion: Using a Trading Risk Reward Calculator for Success

A trading risk reward calculator is an essential tool for traders who want to manage their risk effectively and make informed trading decisions. By using this calculator, traders can ensure that every trade setup has a favorable balance between risk and reward, leading to improved profitability over time.

Whether you create your own calculator in Excel or use the online tools available at RajeevPrakash.com, incorporating the risk-reward ratio into your trading strategy is crucial for long-term success. It helps traders maintain discipline, make objective decisions, and evaluate trades consistently to achieve better results.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.