Your cart is currently empty!

Stock Indices and Bullion for 6-10 May 2013

Global Stock Indices:

This week, heavy volatility is expected in global stock indices. Market shall have a ‘U’ turn on Thursday.

Day-wise analysis:

6-MAY-2013: Asian opening is expected to be positive but profit booking shall be observed at closing hours. UK opening shall be positive but closing may be negative.

US market shall be volatile to negative on Monday.

7-MAY-2013: Negative opening is expected in Asian market. Sharp decline is possible. Closing shall be negative. UK opening is expected to be negative but closing shall be positive. US market shall close in positive.

8-MAY-2013: Asian opening shall be flat to positive and closing shall be positive. UK shall also be positive. US market shall be volatile to negative.

9-MAY-2013: Asian opening shall be positive. UK shall also be positive. US market shall also be positive.

10-MAY-2013: Asian market shall have positive opening and closing shall be negative. UK market shall have positive opening but negative closing. Profit booking shall be observed in US market.

The major support of S&P500 is at 1,580 and resistance is at 1,630. If breaks 1,580 then sharp decline is possible.

The major support of DOW is at 14,520 and resistance is at 15,070. Below 14,401 a sharp fall is possible.

Weekly Trading Range:

S&P500: 1,625-1,570

HENG SENG IDX: 23,100-22,500

VIEW ON PRECIOUS METALS

On weekly basis, precious metal is expected to be heavily volatile but overall positive.

Day-wise analysis:

6-MAY-2013: Volatile to positive trend is expected in precious metals, which can continue till 8.20 HRS (IST). After 8.20 HRS (IST), a decline could be observed.

7-MAY-2013: Negative opening is indicated for bullion. Sharp decline is possible till US opening.

But sharp recovery shall again start from US opening & until US closing.

8-MAY-2013: Flat to positive opening is indicated for bullion. Profit booking is possible in late US hours.

9-MAY-2013: Volatile to positive trend is expected.

10-MAY-2013: Range bound to volatile trend is expected. Again shall turn positive from US hours. Closing shall be positive.

The major support of GOLD is at 1,436 and resistance is at 1,495.

The major support of SILVER is at 22.90 and resistance is at 24.80.

Weekly Trading Range:

-GOLD: 1,445-1,525

-SILVER: 22.90-25.20

View on Base Metals:

6-MAY-2013: Base metals shall be volatile to positive till US opening and then decline could be observed.

7-MAY-2013: Base metals shall be negative till US opening and again positive from then onwards.

8-MAY-2013: It shall be volatile to positive till US opening and then declining trend shall start in base metals, which shall continue with volatility till Friday.

View On Energy Products:

Crude Oil shall be volatile to positive till US opening but again profit booking is indicated after US opening. Tomorrow, it shall be negative but recovery shall be seen from tomorrow’s US opening.

Wednesday is expected to be positive for Crude Oil. But from Wednesday’s US opening, a negative trend shall be observed, which shall continue till Friday.

NG shall have volatile to both side trends. Sell Natural Gas on rise.

Currencies:

Today, volatile to positive trend is expected in EUR/USD. After US hours, it shall be volatile to negative, which shall continue till tomorrow’s eve.

View on Indian Stock Market:

Today, Indian stock market shall be volatile to positive in first half but second half shall be negative.

This week, market can have a sharp decline. So please be cautious!

This week, Nifty future has a chance to break 5,860 (only if 5,930is broken).

Tomorrow shall be negative day for Indian stock market.

Trading Range:

Nifty Fut: 6,040-5,880

BUY ON DIPS (WEEKLY):

- CAIRN INDIA

- JAIN IRRIGATION

- MARUTI

- MAHINDRA & MAHINDRA

- HUL

- ITC

- DABUR

SELL ON RISE:

- HPCL

- BPCL

- IDFC

- LIC HOUSING

- TATA STEEL

- ICICI BANK

- RCOMM

- AMBUJA CEMENT

TO SUBSCRIBE, E-MAIL: [email protected] or call : +91-9669919000

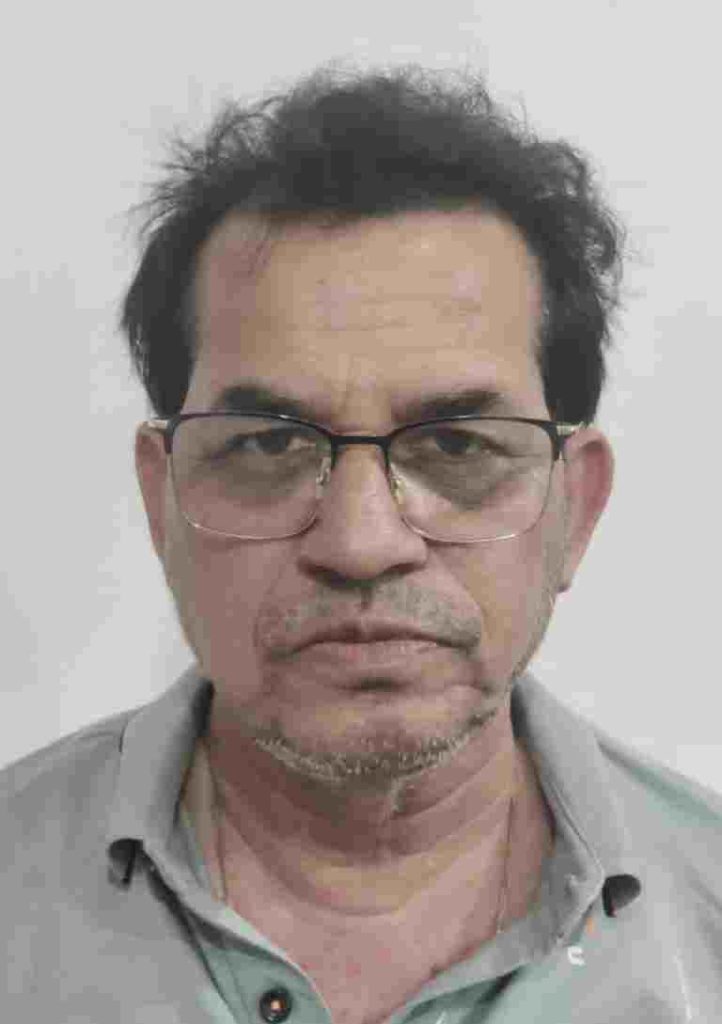

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply