Your cart is currently empty!

SPY Options Trading Signals: A Comprehensive Guide

Trading options on the SPDR S&P 500 ETF Trust (SPY) can be a lucrative endeavor, but it requires a solid understanding of market trends and signals. SPY options trading signals can help traders make informed decisions, optimize their strategies, and enhance their chances of success. This article will delve into the importance of trading signals, the different types available, and how to use them effectively in your SPY options trading.

Understanding SPY Options Trading Signals

What Are Trading Signals?

Trading signals are indicators or alerts that suggest when to buy or sell a specific financial instrument. In the context of SPY options trading, these signals provide insights into potential price movements of the SPY ETF and can help traders identify profitable opportunities.

Why Are Trading Signals Important?

Timeliness: Signals provide timely information, enabling traders to act quickly in fast-moving markets.

Decision-Making: They help simplify complex market data, allowing traders to make informed decisions based on analysis rather than emotions.

Strategy Optimization: Signals can enhance trading strategies by pinpointing entry and exit points, and maximizing potential profits while minimizing risks.

Types of SPY Options Trading Signals

1. Technical Analysis Signals

Technical analysis involves studying historical price movements and trading volumes to forecast future price movements. Common technical indicators used for SPY options trading include:

Moving Averages (MA): This indicator smooths out price data to identify trends over a specific period. Traders often use the 50-day and 200-day moving averages to spot potential bullish or bearish signals.

Relative Strength Index (RSI): The RSI measures the speed and change of price movements, indicating overbought or oversold conditions. An RSI above 70 suggests that SPY is overbought, while an RSI below 30 indicates it is oversold.

MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. A bullish signal occurs when the MACD line crosses above the signal line, while a bearish signal occurs when it crosses below.

2. Fundamental Analysis Signals

Fundamental analysis evaluates a security’s intrinsic value based on economic and financial factors. For SPY options trading, key signals include:

Earnings Reports: The performance of the S&P 500 companies can impact SPY’s price. Positive earnings reports can lead to bullish signals, while disappointing earnings can trigger bearish signals.

Economic Indicators: Economic data such as GDP growth, unemployment rates, and inflation can influence market sentiment. Traders should keep an eye on these indicators, as they can provide insights into future SPY price movements.

3. Sentiment Indicators

Market sentiment indicators gauge the overall attitude of traders toward a particular security. These indicators can help identify potential reversals or continuations in price trends. Common sentiment indicators include:

Put/Call Ratio: This ratio compares the number of put options traded to call options traded. A high put/call ratio may indicate bearish sentiment, while a low ratio suggests bullish sentiment.

Fear and Greed Index: This index measures market sentiment on a scale from extreme fear to extreme greed. A high reading may suggest that the market is overbought and due for a correction, while a low reading indicates oversold conditions.

4. Automated Trading Signals

Many traders use automated trading systems to generate SPY options signals. These systems utilize algorithms to analyze market data and generate buy or sell signals based on predetermined criteria. Benefits of using automated trading signals include:

Speed: Automated systems can analyze vast amounts of data quickly, allowing for timely trade execution.

Consistency: Automated signals help eliminate emotional decision-making, ensuring that traders stick to their strategies.

How to Use SPY Options Trading Signals Effectively

1. Develop a Trading Plan

Before relying on trading signals, create a comprehensive trading plan that outlines your goals, risk tolerance, and strategies. Your plan should include how you will use trading signals and the criteria for entering and exiting trades.

2. Combine Multiple Signals

Relying on a single trading signal may not provide a complete picture of the market. Instead, consider using a combination of technical, fundamental, and sentiment signals to confirm your trading decisions. For example, if a technical indicator suggests a bullish signal, check the fundamentals and market sentiment to support that decision.

3. Monitor Market Conditions

Stay updated on macroeconomic events and market conditions that could impact SPY options trading. News related to the Federal Reserve, geopolitical developments, and major economic reports can influence market sentiment and price movements.

4. Backtest Your Strategies

Before implementing any trading strategy based on signals, backtest it using historical data. This process helps you evaluate the effectiveness of your strategy and make adjustments as needed.

5. Keep a Trading Journal

Maintain a trading journal to record your trades, including the signals that prompted each decision. Reviewing your journal can help you identify patterns, refine your strategies, and improve your trading skills over time.

Common Mistakes to Avoid

Overtrading: Relying too heavily on signals can lead to overtrading. Ensure that you filter signals based on your strategy and avoid making impulsive trades.

Ignoring Risk Management: Always implement risk management strategies, such as setting stop-loss orders and limiting position sizes, to protect your capital.

Failing to Adapt: Markets are constantly changing. Be prepared to adapt your strategies and signals based on new information or evolving market conditions.

Conclusion

SPY options trading signals can be a valuable tool for traders seeking to navigate the complexities of the options market. By understanding different types of signals and incorporating them into a well-defined trading plan, you can enhance your decision-making process and increase your chances of success. Remember to combine signals with thorough market analysis, maintain a disciplined approach, and continuously refine your strategies to achieve your trading goals.

Call to Action

Ready to elevate your SPY options trading? Join our community of traders today for access to exclusive trading live signals, expert insights, and resources that can help you succeed in the options market. Don’t miss out on potential profits—start trading smarter now.

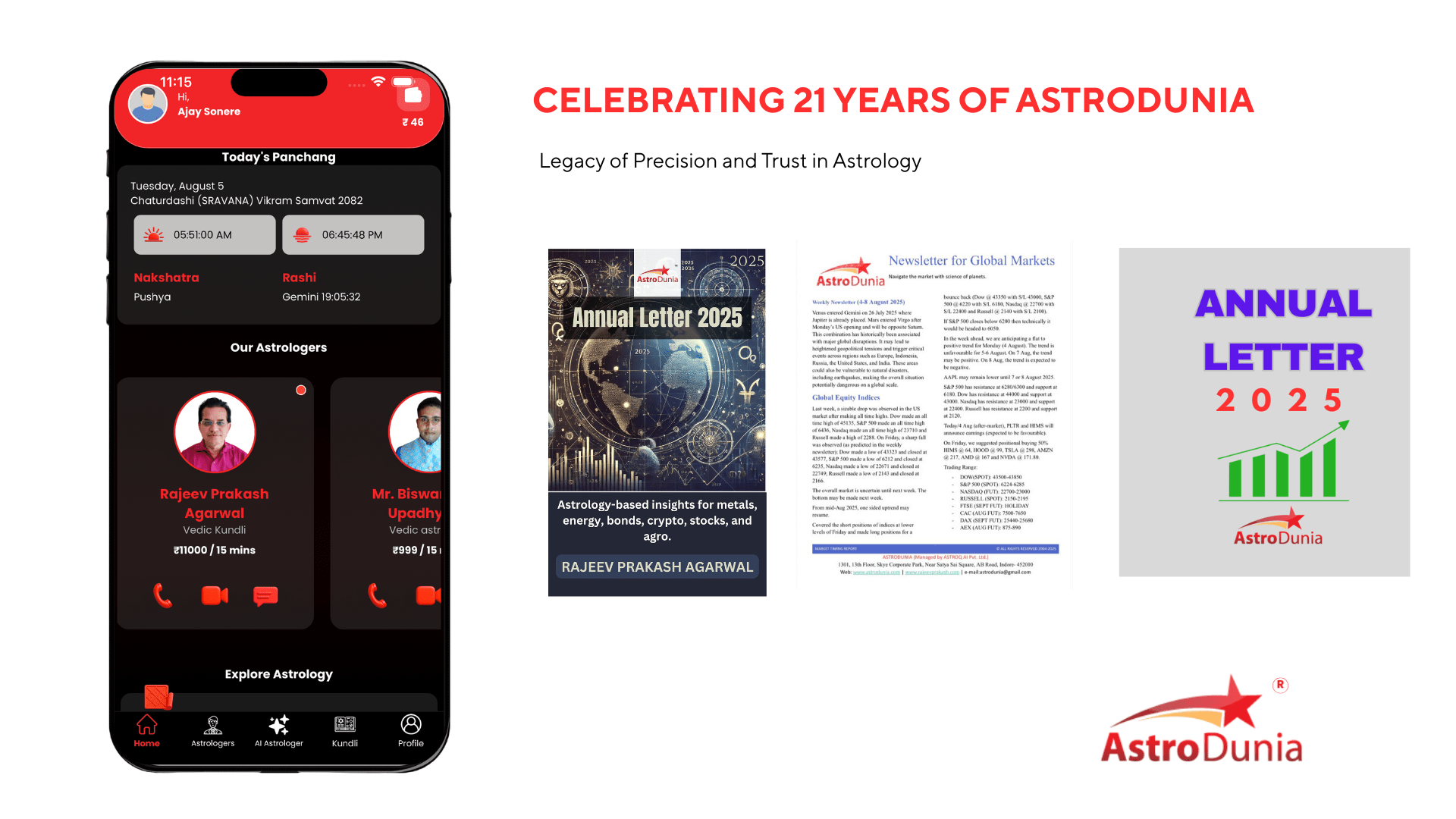

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.