Your cart is currently empty!

SPX 500 Forecast – US Stock market

The SPX 500, also known as the S&P 500, is a critical benchmark for the US stock market, comprising 500 of the largest publicly traded companies in the United States. As a market timing service, we provide comprehensive forecasts, real-time signals, and in-depth analysis to help investors navigate this vital index effectively.

Historical Overview

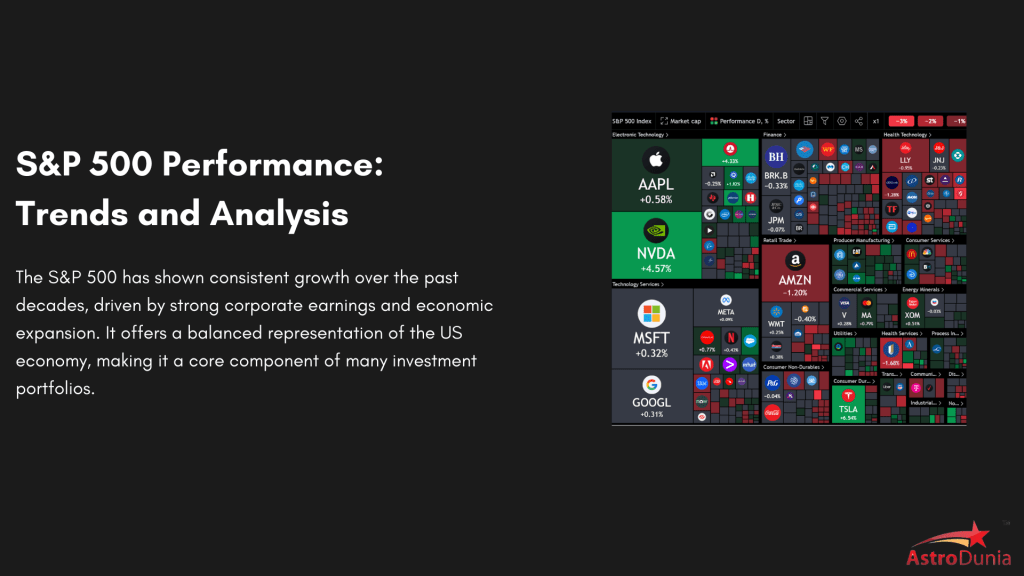

The SPX 500 has been a key indicator of the US economy since its inception in 1957. Covering a wide range of sectors, including technology, healthcare, finance, and consumer goods, it reflects the diverse and dynamic nature of the US market. Understanding its historical performance is crucial for making informed investment decisions. The SPX 500 has weathered various economic cycles, including recessions, booms, and financial crises, demonstrating resilience and long-term growth potential.

SPX 500 Forecast for 2024

Analysts predict a positive outlook for the SPX 500 in 2024, driven by strong corporate earnings, technological advancements, and robust consumer spending. The technology and healthcare sectors are expected to lead the growth. With the Federal Reserve’s policies and global economic stability playing significant roles, moderate growth is anticipated. Key factors influencing the forecast include interest rate adjustments, fiscal policies, and international trade agreements. Our live signals service provides real-time insights and updates, helping you make timely and informed investment decisions.

Daily Forecasts: What to Expect Tomorrow

The daily movements of the SPX 500 are influenced by a variety of factors, including corporate earnings reports, economic data releases, and geopolitical events. Key indicators to monitor include job reports, inflation data, and Federal Reserve statements. Market sentiment and investor behavior also play significant roles in short-term movements. Our Daily Newsletter provides timely updates and insights, helping you stay ahead of market trends. Subscribers receive early warnings on potential market shifts, ensuring you can react swiftly to new information.

Long-Term Projections: The Next 10 Years

Over the next decade, the SPX 500 is expected to benefit from technological innovation, demographic shifts, and evolving consumer preferences. Sectors such as technology, healthcare, and renewable energy are poised for substantial growth. Long-term growth will also be influenced by regulatory changes, advancements in artificial intelligence, and the increasing importance of ESG (Environmental, Social, and Governance) criteria in investment decisions. Our Annual Letter offers in-depth analysis and long-term forecasts, enabling you to make strategic investment decisions.

Technical Analysis of the SPX 500

Technical analysis of the SPX 500 involves studying chart patterns, RSI, MACD, and support and resistance levels. These tools help identify potential trading opportunities and market trends. Historical data and volume analysis can reveal insights into market momentum and investor psychology. Join our Live Signals Service for real-time insights and signals, ensuring you stay informed and ready to act on market changes.

Conclusion

The SPX 500 remains a critical barometer of the US economy and a cornerstone of many investment portfolios. By understanding its historical performance, current dynamics, and future projections, investors can make more informed decisions. Our market timing services, including live signals, daily newsletters, and annual letters, provide the tools and insights necessary to navigate this important index. Stay informed and make strategic decisions to maximize your returns in the ever-evolving market landscape.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.