Your cart is currently empty!

Risk Reward Ratio Calculator in India

The risk-reward ratio is an essential concept for every investor or trader, and using a risk-reward ratio calculator helps in making informed decisions about potential trades. It is a critical part of risk management and helps in determining if the potential profit justifies the risk being taken. In this comprehensive guide, we will explore what the risk-reward ratio is, how to use a risk-reward ratio calculator in India, and why it is crucial for both new and seasoned investors alike.

1. Understanding Risk-Reward Ratio

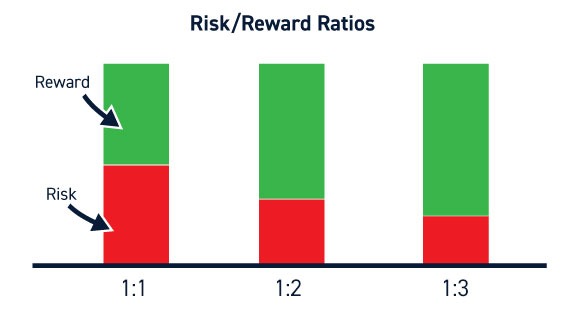

The risk-reward ratio is used to assess the potential return of an investment compared to the risk involved. It is simply a calculation of how much you stand to gain for every rupee you risk. A good risk-reward ratio varies from trader to trader, but typically, investors aim for a ratio of at least 1:2, meaning that they expect to gain two rupees for every rupee they risk.

For example, if a trader is willing to risk INR 500 to make a potential profit of INR 1000, the risk-reward ratio is 1:2. The higher the reward compared to the risk, the better the trade may be. This helps traders determine whether or not a particular trade is worth the potential risk involved.

2. The Importance of Using a Risk-Reward Ratio Calculator

A risk-reward ratio calculator simplifies the process of determining whether a particular investment is worth pursuing. In India, where the market is diverse, and opportunities are abundant, this tool can be particularly valuable. Investors and traders can use a risk-reward ratio calculator to input different levels of risk and reward, making it easy to visualize the potential outcomes of any given trade.

With the help of a risk-reward ratio calculator, traders can:

Set Appropriate Stop Loss and Target Levels: By entering their potential stop-loss and target prices, traders can determine whether the risk is justified.

Make Informed Decisions: It allows investors to evaluate the merits of each investment based on the ratio, thus avoiding emotional or impulsive decisions.

Improve Profitability: A well-calculated risk-reward ratio helps in maintaining a disciplined trading strategy, reducing losses, and increasing potential profits.

3. How to Calculate Risk-Reward Ratio

To calculate the risk-reward ratio, you need three main components:

- Entry Price: The price at which you enter the trade.

- Stop-Loss Price: The price at which you decide to exit if the trade goes against you.

- Target Price: The expected price level at which you plan to take profits.

Risk-Reward Ratio Formula:

The formula for calculating the risk-reward ratio is:

For instance, if your entry price is INR 100, your stop-loss is INR 95, and your target price is INR 110, the calculation would look like this:

- Risk = Entry Price – Stop-Loss Price = 100 – 95 = 5

- Reward = Target Price – Entry Price = 110 – 100 = 10

The Risk-Reward Ratio would be 5:10 or 1:2.

A risk-reward ratio of 1:2 means that for every unit of risk, there is twice the potential reward, which is generally considered favorable.

Click below to download the spreadsheet and explore practical examples of risk-reward calculations for informed trading decisions.

4. Using a Risk-Reward Ratio Calculator in India

In India, the financial markets are characterized by volatility, making risk management an integral part of trading. A risk-reward ratio calculator can be easily found online, and platforms such as RajeevPrakash.com offer tools to help traders determine the risk-reward ratio efficiently.

The steps involved in using a risk-reward ratio calculator are straightforward:

- Input Entry Price: Enter the price at which you plan to enter a trade.

- Input Stop Loss: Set the level at which you would exit the trade if it moves against you.

- Input Target Price: Enter your desired profit level or target price.

- Calculate: The calculator then provides the risk-reward ratio, allowing you to determine if the trade setup is favorable.

These tools are particularly useful for those trading in markets such as stocks, commodities, and foreign exchange, where proper risk management is essential.

5. Benefits of Using a Risk-Reward Ratio Calculator

The benefits of using a risk-reward ratio calculator include:

Objectivity: It helps traders make objective decisions by providing clear numerical values. This reduces the impact of emotions that often lead to poor trading decisions.

Consistency: Using a risk-reward ratio calculator allows traders to be consistent with their risk management practices, leading to better trading outcomes.

Informed Decision Making: Traders can easily compare multiple trades and choose the one with a favorable ratio, thereby enhancing their chances of making profitable trades.

6. Practical Example of Risk-Reward Calculation in India

Consider a scenario where an Indian trader is trading a popular stock listed on the NSE (National Stock Exchange). Suppose the entry price of the stock is INR 1500, the stop-loss is set at INR 1450, and the target price is INR 1600. Here is how the risk-reward ratio is calculated:

- Risk: 1500 – 1450 = 50 INR

- Reward: 1600 – 1500 = 100 INR

- Risk-Reward Ratio: 50:100 or 1:2

In this scenario, the trader stands to gain INR 2 for every INR 1 they risk. This is generally considered a favorable trade, making it worth pursuing.

7. Why Risk-Reward Ratio is Important for Indian Investors

The Indian stock market can be particularly volatile due to multiple factors, such as global economic conditions, local economic policies, and political changes. Having a well-defined risk-reward ratio is crucial for traders to survive and thrive in such an environment.

A strong understanding of risk-reward ratios helps Indian traders in:

Capital Preservation: By adhering to favorable risk-reward setups, traders can prevent catastrophic losses that could wipe out their trading capital.

Better Market Timing: It helps traders enter trades with a higher probability of success, thereby improving overall market timing.

Emotional Control: Traders often lose money due to emotional decisions, such as holding onto losing trades. A clear risk-reward ratio helps mitigate these tendencies by providing clear guidelines on when to exit a position.

8. Common Mistakes While Using a Risk-Reward Ratio Calculator

Even though risk-reward ratio calculators are beneficial, traders often make mistakes while using them:

Ignoring Market Conditions: The risk-reward ratio should not be the only factor considered while entering a trade. Traders must also consider market conditions, such as trends and economic news, which can influence the outcome.

Setting Unrealistic Targets: It is crucial to set achievable target prices. Setting overly ambitious targets may result in missed profit opportunities.

Not Adjusting Stop Loss: It is essential to adjust the stop loss based on market movements. Sticking to an initial stop loss that doesn’t account for market conditions can lead to unnecessary losses.

9. Risk-Reward Ratio in Different Asset Classes

The use of risk-reward ratio calculators is not limited to equity markets. It is widely used across different asset classes in India, such as:

Commodities: Commodities like gold and silver are popular among traders in India. A risk-reward calculator can be used to determine entry and exit levels, considering the high volatility of these assets.

Forex: Currency trading is another area where risk-reward ratios play a vital role. With the fluctuations in currency exchange rates, maintaining a favorable ratio ensures that traders only take trades with high potential rewards.

Cryptocurrencies: Although relatively new in India, cryptocurrencies have become popular among traders. Due to the highly volatile nature of digital currencies, risk-reward ratio calculators can be instrumental in managing risk effectively.

10. Tools and Platforms for Risk-Reward Calculations

Many tools and platforms offer risk-reward calculators for traders in India. RajeevPrakash.com provides a dedicated risk-reward ratio calculator tailored for the Indian market. It offers an easy-to-use interface that allows traders to input their desired values and receive instant results.

Other platforms also offer similar tools, but it is essential to choose one that caters to the local market dynamics, regulations, and unique trading conditions in India.

11. Enhancing Trading Strategies with Risk-Reward Analysis

Using a risk-reward ratio calculator is just one part of a comprehensive trading strategy. Traders can use this analysis to:

Refine Entry and Exit Points: By combining technical analysis with risk-reward calculations, traders can optimize entry and exit points.

Backtesting: Backtesting trading strategies with risk-reward ratios helps in evaluating their performance historically, which in turn helps in better strategy building.

Scenario Analysis: A risk-reward calculator can be used to create different scenarios and test the potential outcomes of trades, helping traders make more informed decisions.

12. Conclusion: Mastering the Art of Risk-Reward Management

Mastering the art of using a risk-reward ratio calculator is essential for every trader, especially in a dynamic market like India. Whether you are trading equities, commodities, or forex, understanding the risk-reward ratio helps in making informed decisions, managing your risk effectively, and improving profitability.

Using platforms like RajeevPrakash.com can give traders access to powerful tools that simplify the calculation process, allowing them to focus more on strategy and analysis. The Indian financial market offers a lot of opportunities, but the key to success lies in managing risks effectively. A risk-reward ratio calculator is a vital tool in every trader’s toolkit, ensuring that they only take calculated risks with the potential for favorable outcomes.

Download The Financial Calculator App

Discover all the incredible features of our app designed to enhance your experience. From intuitive tools to unique services tailored for your needs, the app offers endless possibilities. Don’t miss out—click the link below to learn more and see how it can make a difference in your life today.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.