Managing risk effectively is crucial for successful investing and trading. One of the fundamental aspects of managing risk is calculating the risk-reward ratio for every trade. This ratio provides insights into whether the potential reward of a trade justifies the amount of risk involved. By using a Risk Reward Calculator in Excel, traders and investors can easily visualize, analyze, and manage their trades in a more systematic manner. This guide explores how to create a risk-reward calculator in Excel and why it is a must-have tool for traders in India.

Risk Reward Ratio Calculator

1. Understanding the Risk-Reward Ratio

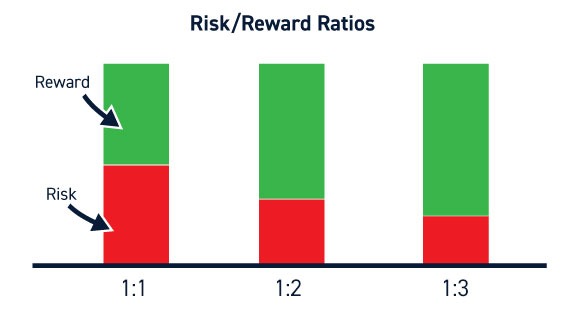

The risk-reward ratio is a measure that compares the potential risk of a trade to its potential reward. It is usually represented as a ratio, such as 1:2, which means that for every unit of risk, the potential reward is two units. This helps traders decide whether the reward justifies the risk.

For example, if you risk INR 500 on a trade and expect to make INR 1,500, the risk-reward ratio would be 1:3, indicating that you have the potential to gain three times what you are risking.

2. Why Use Excel for Risk Reward Calculation?

Excel is a powerful and versatile tool for traders. Using Excel for risk-reward calculations has several benefits:

Customization: Excel allows traders to customize calculations based on specific requirements and trading strategies.

Flexibility: With Excel, you can create different scenarios and perform sensitivity analysis to see how changes in price levels affect your risk-reward ratio.

Visualization: Excel provides options to create charts and graphs that visually represent risk and reward relationships.

Easy Updates: You can easily modify or update inputs and see the results instantaneously.

3. Creating a Risk Reward Calculator in Excel

To create a risk-reward calculator in Excel, follow these steps to set up a functional and easy-to-use spreadsheet:

Step 1: Define the Inputs

To calculate the risk-reward ratio, you need the following key inputs:

- Entry Price: The price at which you enter the trade.

- Stop-Loss Price: The price at which you will exit the trade if it goes against you.

- Target Price: The price at which you will make a profit if the trade moves in your favor.

These inputs will be the basis for calculating the risk and reward of each trade.

Step 2: Create the Structure in Excel

- Column A: Entry Price

- Column B: Stop-Loss Price

- Column C: Target Price

- Column D: Risk (to be calculated)

- Column E: Reward (to be calculated)

- Column F: Risk-Reward Ratio (to be calculated)

After setting up these columns, input the data in Columns A, B, and C.

Step 3: Calculating Risk and Reward

- Risk Calculation: Risk is the difference between the Entry Price and Stop-Loss Price.

- The formula in Column D:

=A2 - B2

- The formula in Column D:

- Reward Calculation: Reward is the difference between the Target Price and Entry Price.

- The formula in Column E:

=C2 - A2

- The formula in Column E:

Step 4: Calculating the Risk-Reward Ratio

The risk-reward ratio can be calculated by dividing the risk by the reward.

- The formula in Column F:

=D2 / E2

This calculation will provide a value that helps you determine whether the trade setup is favorable or not.

4. Example of Using a Risk Reward Calculator in Excel

Consider a trade scenario where you are looking to buy shares of a company listed on the NSE (National Stock Exchange) in India:

- Entry Price: INR 1000

- Stop-Loss Price: INR 950

- Target Price: INR 1150

Using Excel, you would calculate:

- Risk:

1000 - 950 = 50 INR - Reward:

1150 - 1000 = 150 INR - Risk-Reward Ratio:

50 / 150 = 1:3

In this scenario, the potential reward is three times the risk, indicating a favorable trade.

Click below to download the spreadsheet and explore practical examples of risk-reward calculations for informed trading decisions.

5. Benefits of Using a Risk Reward Calculator in Excel

There are several advantages of using an Excel-based risk reward calculator:

Objective Analysis: Calculating the risk-reward ratio allows traders to be objective about their trades. This helps in avoiding emotional decision-making.

Consistency: With an Excel-based calculator, traders can consistently evaluate trades based on the same parameters, leading to disciplined trading.

Customizable Features: Excel provides flexibility to add additional fields, such as position size, expected return percentage, or any other personalized criteria.

6. Enhancing Your Risk Reward Calculator in Excel

Here are a few suggestions to enhance your risk reward calculator:

Position Size Calculator: Add columns to calculate the ideal position size for each trade based on the amount of capital you want to risk. This can help in ensuring that no single trade results in excessive losses.

Win Rate Tracker: Add a section to track the win rate of your trades, as well as how frequently you meet your target vs. hitting your stop loss. This can help in refining your risk-reward strategy.

Graphical Analysis: Use Excel charts to create graphical representations of your risk and reward scenarios, which can make the analysis more intuitive.

7. Using a Risk Reward Calculator for Different Asset Classes

The risk-reward calculator in Excel can be applied across different asset classes in India:

Equities: For stocks listed on exchanges like the NSE and BSE, the calculator can help evaluate risk and reward before buying or selling.

Commodities: Commodities like gold and silver are popular trading assets. The risk-reward ratio helps traders manage the volatility often found in these markets.

Forex: Currency trading involves high volatility, and using a risk-reward calculator is crucial to making informed decisions in this space.

Cryptocurrencies: Cryptocurrencies are extremely volatile. A risk-reward calculator can provide guidance in setting favorable risk parameters.

8. Common Mistakes to Avoid

While using an Excel risk reward calculator, it is essential to avoid some common mistakes:

Overlooking Market Conditions: The calculator should not be the sole tool for making trading decisions. Market conditions, volatility, and news should also be considered.

Unrealistic Targets: Setting unrealistic stop-loss or target prices can skew the risk-reward ratio, giving misleading results.

Not Updating Calculations: Make sure to update the calculator with current market data before executing a trade. Using outdated numbers can lead to faulty decisions.

9. Practical Uses and Benefits of the Risk Reward Calculator

Pre-Trade Analysis: Before entering any trade, a risk-reward calculator helps in determining whether the trade setup is worth pursuing based on the reward potential relative to the risk.

Tracking Trade Performance: A risk-reward calculator can be used to keep track of multiple trades and their individual risk-reward ratios. This helps in optimizing strategy.

Goal-Oriented Trading: By setting a favorable risk-reward ratio, traders can be more focused and goal-oriented. This helps in reducing emotional bias and sticking to planned strategies.

10. Risk Reward Ratio Calculator Tool at RajeevPrakash.com

For those looking for a ready-made online solution, RajeevPrakash.com offers an easy-to-use risk reward calculator that can be very helpful for Indian traders. This online tool allows you to input the entry, stop-loss, and target price to calculate the risk-reward ratio instantly, making decision-making faster and more efficient.

The platform also provides tools specifically tailored to Indian market dynamics, helping traders take market conditions into account when making decisions.

11. Backtesting Strategies Using Excel

One of the benefits of using Excel is that it allows you to backtest trading strategies to see how well they would have performed historically. Traders can input historical data to evaluate whether their planned trades would have met the desired risk-reward ratio. This can provide insights into the effectiveness of the strategy and help refine it further.

Download The Financial Calculator App

Discover all the incredible features of our app designed to enhance your experience. From intuitive tools to unique services tailored for your needs, the app offers endless possibilities. Don’t miss out—click the link below to learn more and see how it can make a difference in your life today.

12. Conclusion: Mastering Risk Management with Excel

Using a Risk Reward Calculator in Excel is an effective way to enhance risk management in trading and investing. It provides traders with a structured approach to evaluate trades, minimize risk, and maximize potential rewards. By leveraging the flexibility of Excel, traders can customize the calculator to suit their specific needs and use it across different asset classes.

In the fast-moving world of financial markets, managing risk is just as important as seeking profit. Platforms like RajeevPrakash.com offer excellent online tools for calculating risk-reward ratios, complementing an Excel-based solution for traders who prefer customized approaches.

Excel is an incredibly versatile tool, and incorporating risk-reward calculations within your trading strategy is a significant step towards a disciplined, consistent, and informed approach to investing.