Your cart is currently empty!

Risk Reward Break Even Calculator

In the world of trading, understanding the concept of break-even is crucial for managing risk and evaluating potential profitability. A risk-reward break-even calculator is a tool that traders can use to determine the level of reward required to justify a certain level of risk. This calculator helps traders identify the minimum target profit they need to reach to offset their potential losses and achieve profitability over time. In this guide, we will delve into the significance of risk-reward break-even calculations, how to use a risk-reward break-even calculator, and how it can be integrated into your trading strategy for consistent success.

Risk Reward Ratio Calculator

1. What is the Risk-Reward Break Even Point?

The risk-reward break-even point is the point at which the potential profit from a trade equals the potential risk. It is a crucial calculation for traders because it allows them to determine whether a trade is worth taking, based on the amount of capital at risk compared to the expected profit.

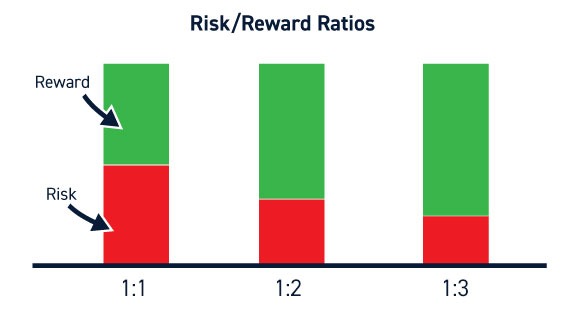

The break-even calculation takes into account the risk-reward ratio, which is the ratio between the amount of money being risked and the potential profit. The higher the reward compared to the risk, the more attractive the trade setup becomes.

2. The Importance of Break-Even Analysis for Traders

The concept of break-even is important for several reasons:

Risk Management: Traders must understand how much they need to profit to compensate for the risk they are taking. The break-even calculation helps manage risk effectively.

Profitability Assessment: Knowing your break-even point allows you to set realistic profit targets, ensuring that your trading strategy is profitable over the long term.

Disciplined Trading: Break-even analysis helps traders maintain discipline by providing a clear picture of whether a trade has a favorable probability of success.

3. How to Use a Risk Reward Break-Even Calculator

A risk-reward break-even calculator requires three key inputs to calculate the break-even point:

- Risk (R): The amount of money you are willing to lose if the trade goes against you.

- Reward (P): The potential profit you expect to gain if the trade goes in your favor.

- Win Rate (W): The percentage of successful trades over a given number of trades.

The break-even win rate can be calculated using the following formula:

This calculation gives traders an idea of the win rate required to break even given their risk-reward setup.

For example, if a trader risks $100 and expects to make $300, the break-even win rate would be calculated as follows:

- Break-even Win Rate:

This means that the trader must win at least 25% of their trades to break even.

4. Setting Up a Risk Reward Break Even Calculator in Excel

Excel can be used to create a simple risk-reward break-even calculator. Here’s how to set it up:

Step 1: Define Key Inputs

- Risk (Column A): Input the amount you are willing to lose on a trade.

- Reward (Column B): Input the potential profit you expect from the trade.

Step 2: Calculate Break-Even Win Rate

- Break-even Win Rate (Column C): Use the formula to calculate the break-even win rate.

5. Example of Using a Risk Reward Break-Even Calculator

Consider a trader who risks INR 5,000 and expects a profit of INR 15,000:

- Risk: INR 5,000

- Reward: INR 15,000

The Break-even Win Rate would be calculated as follows:

This means that the trader only needs to win 25% of the trades to break even with this risk-reward setup. A win rate above this point will lead to profitability.

Click below to download the spreadsheet and explore practical examples of risk-reward calculations for informed trading decisions.

6. Benefits of Using a Risk Reward Break-Even Calculator

Objective Analysis: The calculator provides a clear objective measure of what is needed to achieve profitability, helping traders avoid emotional decisions.

Realistic Expectations: Traders can use the break-even win rate to set realistic goals for their trading strategies and evaluate whether their strategy has the potential to be profitable.

Improving Strategies: By understanding the relationship between risk, reward, and win rate, traders can refine their strategies for better outcomes.

7. Integrating break-even Even Analysis into Trading Strategy

Break-even analysis should be an integral part of any trading strategy. Here are some ways to use break-even points effectively:

Setting Entry and Exit Points: Traders can use the break-even analysis to identify realistic entry and exit points in the market.

Assessing Market Conditions: If market conditions are highly volatile, traders can adjust their risk-reward ratios and assess whether the new setup still meets their break-even criteria.

Adapting Win Rate Goals: A break-even calculator can help traders understand what win rate is required given a specific risk-reward setup. This can help in goal-setting and strategy development.

8. Practical Applications Across Different Asset Classes

The risk-reward break-even calculator is applicable across various asset classes, including:

Equities: Traders can use the calculator to determine whether their stock trades have a favorable risk-reward ratio.

Forex: In currency trading, understanding the break-even point is crucial to managing the high volatility in the forex market.

Commodities: Commodity traders can benefit from knowing the required win rate for different commodities, such as gold and crude oil.

Cryptocurrencies: With high volatility in cryptocurrencies, a break-even analysis helps traders manage their risk more effectively.

9. Common Mistakes When Using Break-Even Calculations

While break-even analysis is an essential tool for traders, there are common mistakes to avoid:

Ignoring Market Conditions: Break-even calculations should not be used in isolation. Traders need to consider market conditions and other indicators before making decisions.

Over-Optimism: Setting unrealistic profit targets or underestimating risk can skew the break-even analysis, leading to faulty conclusions.

Neglecting Fees and Costs: When calculating risk and reward, traders should also account for trading fees, commissions, and other costs.

10. Tools Available at RajeevPrakash.com

For those who prefer ready-made tools, RajeevPrakash.com offers a comprehensive risk-reward calculator that can help traders determine their break-even points easily. The calculator is tailored for the Indian market, allowing traders to input their risk, reward, and expected win rate to evaluate whether their trading strategy can lead to profitability.

This tool is beneficial for both beginners and seasoned traders looking for a quick and reliable way to assess their trading setups.

11. Conclusion: Mastering Risk Reward Break-Even Analysis

The risk-reward break-even calculator is an invaluable tool for any trader looking to make informed decisions and manage their risk effectively. By understanding the break-even point, traders can evaluate whether the potential reward of a trade is sufficient to compensate for the risk involved. Using tools like Excel or the online calculators at RajeevPrakash.com, traders can easily integrate break-even analysis into their trading strategies and improve their long-term profitability.

Break-even analysis provides a solid foundation for disciplined and consistent trading, helping traders maintain objectivity, set realistic goals, and understand the dynamics of risk and reward. Whether you are new to trading or an experienced investor, mastering break-even analysis is a critical step toward achieving success in the financial markets.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.