Your cart is currently empty!

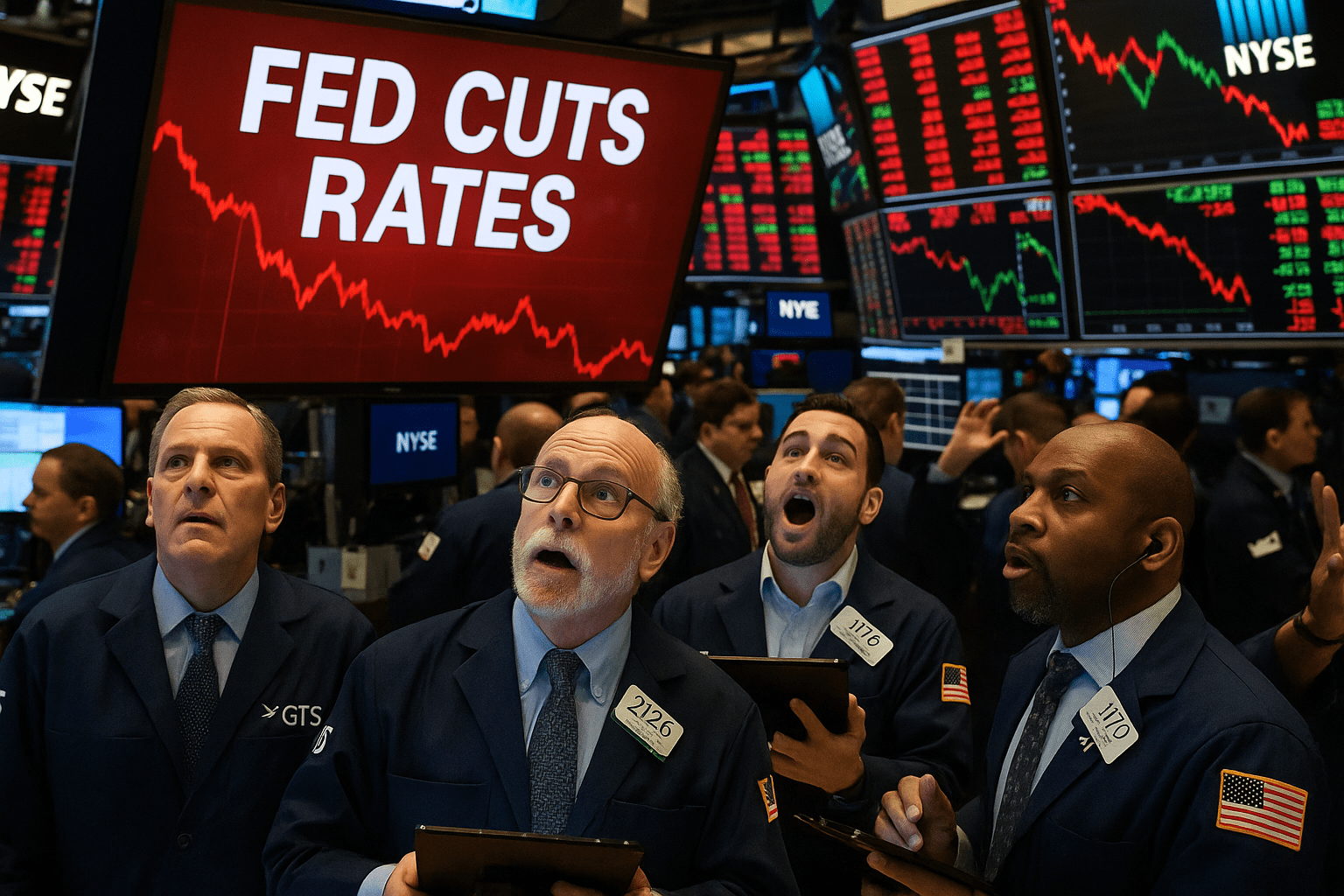

Prime Rate Today & Fed Funds: How Banks Price Your Loans

The prime rate today serves as a critical benchmark that banks use to set interest rates on credit cards, home equity lines of credit, and certain business loans. Although it’s not directly controlled by the Federal Reserve, the prime rate closely follows changes in the federal funds rate decided at FOMC meetings. When the Fed adjusts its policy, banks typically revise prime within days, affecting millions of borrowers. Understanding the connection between prime, Fed funds, and your loan’s APR can help you prepare for payment changes and choose the right financing structure. For households and small businesses, staying on top of the prime rate means anticipating higher or lower borrowing costs and making timely adjustments to debt management strategies.

It is a reference that many banks use to price variable-rate products like credit cards, HELOCs, and certain small-business loans. While prime is not set by the Federal Reserve, it closely follows the Fed funds target range and typically moves within days of a policy change. Here’s how the chain works—and how it affects your wallet.

Prime, Fed Funds, and Your Borrowing Costs

| Rate | Set By | Moves With | Impacted Products |

|---|---|---|---|

| Fed Funds | FOMC | Policy decisions | Short-term money markets |

| Prime | Banks | Fed funds (closely) | Credit cards, HELOCs, some SMB loans |

| Mortgage | Market | MBS, 10-yr Treasury | Home loans (30-yr, 15-yr, ARMs) |

How Fast Do Banks Adjust Prime?

- Quick: Within days of a Fed change, prime usually resets.

- Predictable: Statements and pressers guide expectations ahead of time.

- Variable Spread: Your final APR is prime plus a margin based on credit profile and product type.

What It Means for Household Budgets

Because prime flows through to credit cards and HELOCs, minimum payments can rise or fall within a billing cycle or two. If you carry balances, even a small prime shift can meaningfully alter interest costs. Consider refinancing high-rate debt into fixed-rate products if you expect rates to rise, and keep emergency cash in competitive savings accounts when rates are elevated.

Simple Example

| Product | Pricing | Rate Example | Payment Impact |

|---|---|---|---|

| Credit Card | Prime + 12.99% | APR shifts with prime | Balance costs rise/fall with Fed moves. |

| HELOC | Prime + 1.00% | Variable monthly | Budget cushion helps absorb resets. |

| SMB LOC | Prime + 3.50% | Reflected quickly | Cash-flow planning is key. |

Smart Moves When Prime Changes

- Pay down variable-rate balances first.

- Shop fixed-rate consolidation if spreads widen.

- Revisit HELOC vs. cash-out refinance math.

- Leverage higher savings yields on emergency funds.

FAQs

Is prime the same at every bank? Often similar, but margins and underwriting differ by institution.

Does prime affect 30-year mortgages? Indirectly. Mortgages price off MBS/Treasuries rather than prime directly.

For education only; verify specifics with your bank.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.