Your cart is currently empty!

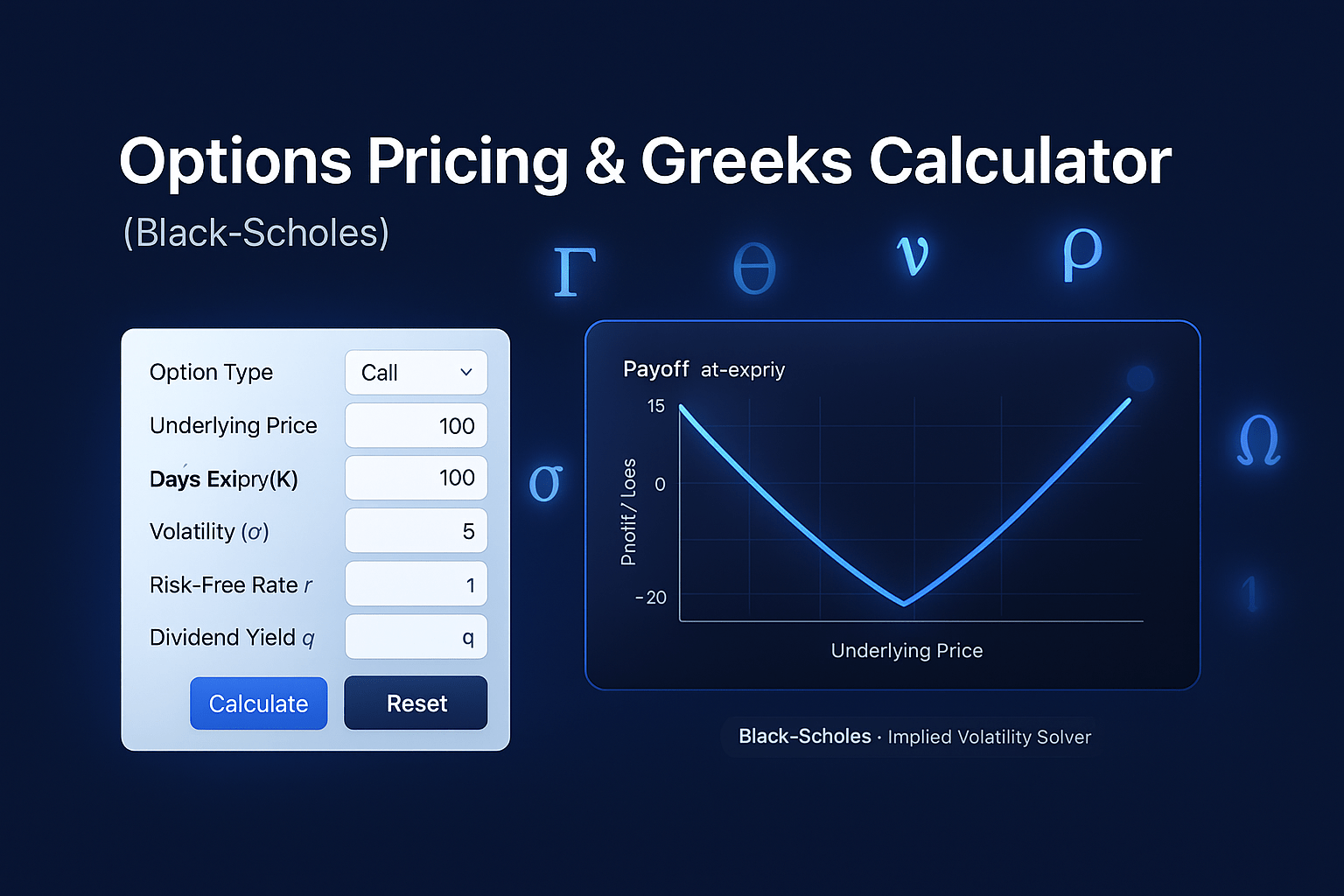

Options Pricing & Greeks Calculator (Black-Scholes)

Use this page to learn how options are priced, what each Greek means in real trades, how to solve for implied volatility, and how to read volatility smiles, term structure, and probabilities. We’ve also added futures options (Black-76) context, American-style considerations, and India-specific notes so your workflow is complete.

What this calculator does best

Enter your inputs and get theoretical price, Delta, Gamma, Theta (per calendar day), Vega (per 1%), Rho (per 1%), break-even, and an instant payoff chart. If you know the market premium but not volatility, leave σ blank and enter the premium-the tool solves implied volatility and updates all outputs. That mirrors how pros use model-based pricing in practice.

Options Pricing & Greeks (Black-Scholes)

Payoff at Expiry (Profit/Loss)

How to use the Black-Scholes options calculator

Pick Call or Put, set the Underlying (S), Strike (K), Days to Expiry, Risk-free rate, and Dividend yield if applicable. Enter Volatility (σ) to view theoretical price and Greeks. If you don’t know σ but have a market option price, enter that instead to solve IV. This approach is standard on institutional tools and exchange education portals.

Tip: Implied volatility is the only unobserved input in Black-Scholes. Solving IV from the observed market premium is how traders infer the market’s forward uncertainty.

Pricing models you’ll see in the wild (and when to use them)

Black-Scholes (European, continuous yield)

Suitable for European-style equity and index options under standard assumptions. It’s the workhorse model behind most “Greeks” you see. Remember: markets set prices; models estimate fair value.

Binomial / Trees (American & early exercise)

If you need to account for early exercise-especially with discrete dividends—a binomial tree is commonly used by brokers and education sites for American options.

Black-76 (Futures & commodities)

For options on futures, industry tools frequently use Black-76 with the futures price as the underlying. You’ll see this in professional and retail platforms.

Greeks explained with practical takeaways

Delta estimates how much the option price should change for a small move in the underlying and is often read as an approximate probability of expiring in-the-money. Gamma is how fast Delta itself changes. Theta is daily time decay. Vega is sensitivity to implied volatility. Rho measures the (usually smaller) impact of interest rates. These are the core risk dimensions every platform teaches and displays.

Advanced Greeks (for deeper risk)

Beyond the basics, many advanced pages now discuss Vanna (Delta sensitivity to volatility), Charm (time decay of Delta), and Vomma (change in Vega as IV changes). Including these on your site helps serve advanced users who search for “Vanna/Charm/Vomma explained.”

Implied volatility, expected move, and probabilities

Your solved IV feeds into two things users love: expected move and probabilities. Some education sites and tool suites provide expected move from IV and probability-of-finish tools (above/below/between targets). Add a short panel that converts annual IV to daily and to a “± move” over your chosen horizon; optionally show probability ITM/OTM or “probability of touch.”

Volatility smile, skew, and term structure

Real markets don’t produce a flat IV. Smiles and skew by strike-and term structure by expiry-are central to how traders compare premiums. Education pages that visualize skew and surfaces rank and retain users because they answer “why is this option so expensive vs that one?” Consider adding short, static examples or live visualizations.

For examples and definitions traders recognize, competitor resources show skew charts across expiries and compare current vs historical skew. Use this as a content benchmark and link target.

Strategy builder and multi-leg P/L

Popular tools let users combine legs, see net Greeks, max profit/loss, breakevens, and P/L by price and date. If you later add a multi-leg section to this page, you’ll hit parity with top “strategy builder” experiences.

Futures & commodity options notes

If you trade options on futures (indices, rates, energy, metals), pricing typically uses Black-76 rather than equity Black-Scholes. Retail and pro sites often highlight this difference and let users input contract-specific details like multipliers and tick size. A short explainer here improves accuracy and search visibility for “futures options calculator” queries.

India-specific notes (for NSE users)

Indian F&O has details that matter for pricing and P/L planning:

• Lot sizes and recent revisions: Exchanges periodically revise lots (for example, a recent Bank Nifty lot size change). Keep a short “What changed” note with a link to the latest circular.

• Settlement: Stock F&O positions may be physically settled at expiry; this impacts how you think about assignment/exercise risk. A plain-English paragraph helps users avoid surprises.

• Risk-free rate preset: Many traders use the 91-day T-Bill as a practical INR risk-free proxy; include a one-line preset and short note.

If market-wide expiry day conventions change, add a one-liner in this section for clarity.

Limitations and model caveats

No model captures reality perfectly. Even exchange education pages stress that actual premiums are set by supply/demand, events, and volatility dynamics like skew and smile. Treat your theoretical price and Greeks as guideposts, not guarantees.

Worked example

Assume a call with S = 100, K = 100, DTE = 30, r = 5%, q = 0%. Enter σ = 20% to view a theoretical premium and Greeks. If your quoted market premium differs, use it to solve IV and compare whether options are relatively rich or cheap vs your assumption. This mirrors how brokers and exchange tools teach users to sanity-check quotes.

Best practices for traders using Greeks

Use Delta to size directional exposure, Gamma to understand convexity into events, Theta to anticipate decay, and Vega for earnings and macro catalysts. Broker education hubs and pro-trader resources emphasize exactly these habits.

FAQs

Does the calculator handle dividends?

Yes—continuous dividend yield is supported here; American options with discrete dividends are best handled with a binomial model, which we plan to add.

Can I price options on futures?

Use Black-76 with the futures price as the underlying. Many sites default to this for commodity and index futures options.

Why doesn’t the model match the market?

Models are estimates. Markets reflect supply/demand, event risk, and IV skew/term structure—so theoretical values can differ from quotes.

What’s “expected move”?

A quick range estimate derived from IV. Education sites often compute it from the ATM straddle or by scaling annual IV to the target horizon.

Where can I learn more about Greeks?

Exchange and broker education pages have excellent primers and deep dives on Delta, Gamma, Theta, Vega, and Rho.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Financial Astrology Terminal

The Financial Astrology Terminal is a web platform that combines real-time U.S. market data (S&P 500, Nasdaq, Dow, Russell, key stocks and commodities like gold and silver) with planetary cycles, giving traders and investors astro-timing signals on top of normal charts and analysis.

Whether you’re a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited) – 2025