Options day trading has emerged as one of the most powerful tools for retail and professional traders alike. With the potential for quick profits due to leverage and volatility, options can outperform stocks — but they also carry higher risk. In this guide, we’ll cover everything you need to know about options day trading, including strategies, timing, instruments, and the psychology behind successful trades.

What Is Options Day Trading?

Options day trading refers to buying and selling options contracts — either calls or puts — within the same trading day. These trades are typically short-term bets on price direction or volatility. Unlike long-term options investing, the goal here is to capitalize on intraday moves with tight entries, quick exits, and strict risk control.

Why Trade Options Instead of Stocks?

Options give traders unique advantages compared to equities:

Leverage: Control 100 shares of stock with one contract

Lower Capital Requirement: Enter trades for a fraction of stock value

Defined Risk: You can set your maximum loss in advance

Flexibility: Profit in bullish, bearish, or sideways markets

Volatility Plays: Use volatility to your advantage during earnings or news events

Best Options to Day Trade in 2025

The best options for day trading are:

- Highly liquid

- Tight bid-ask spreads

- Actively traded underlying stocks or ETFs

Popular Choices:

- SPY – S&P 500 ETF (perfect for market-based setups)

- TSLA – High volatility = big intraday moves

- AMD / NVDA – Great for tech momentum

- AAPL – Liquid and predictable

- BANKNIFTY / NIFTY 50 (India) – Ideal for weekly expiry trades

- RELIANCE, ADANIENT, ICICI BANK (India) – News-sensitive and option-rich

Best Time Frames and Expiry for Day Trading Options

- Use 1-min, 5-min, or 15-min charts for entries

- Choose same-day (0 DTE) or next expiry (1-2 DTE) for fast movement

- Avoid deep OTM contracts — go ATM or slightly ITM for better delta and fill quality

Top Strategies for Options Day Trading

1. Intraday Breakout Strategy

Buy calls/puts on break of previous high/low with confirmation from volume and VWAP.

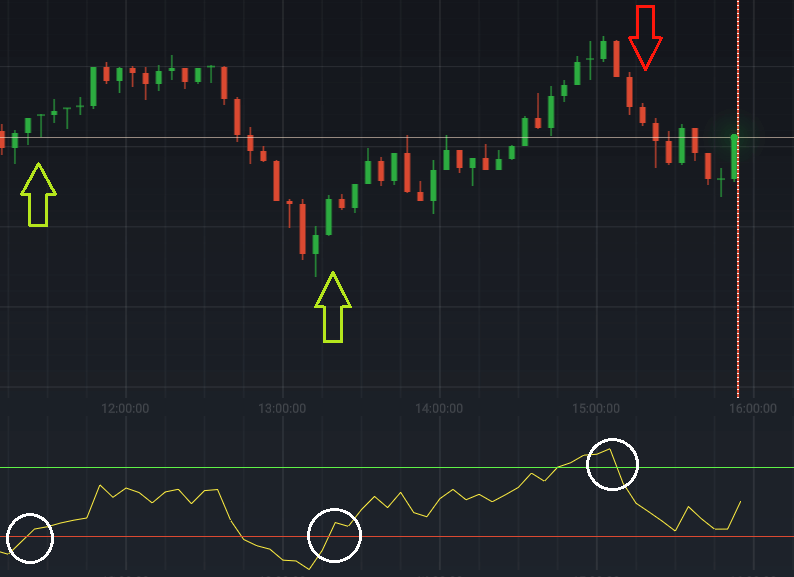

2. Reversal Strategy

Fade overextended moves with a confluence of RSI divergence, price action, and resistance/support.

3. VWAP Reclaim Strategy

Trade when price reclaims or rejects VWAP after an initial fake-out.

4. Scalping Weekly Options

Scalp quick 10–30% moves using liquid instruments like SPY or BANKNIFTY, with tight stops and fast exits.

5. Option Buying on News Spike

React to news events with call or put buying when volume spikes and breaks key levels.

Risk Management Rules

Options can double or go to zero quickly. These are non-negotiable:

- Risk only 1–2% per trade

- Use stop-losses based on premium or underlying price

- Avoid revenge trading after losses

- Don’t hold losing positions hoping for reversal

- Track implied volatility and avoid entering during sudden spikes

Tools & Indicators for Options Traders

- Option Chain Analysis: To track premiums, open interest, and Greeks

- VWAP and EMA (9/21): For entry/exit confirmation

- Volume Profile / Heatmaps: For identifying liquidity zones

- Delta and Theta Awareness: Especially for 0 DTE contracts

- Charting Platforms: TradingView, ThinkOrSwim, Zerodha Kite

Options Day Trading in India (NSE)

India has seen a retail trading boom, especially in index options like:

- NIFTY 50 Weekly Options

- BANKNIFTY Weekly Options

- FINNIFTY (newer but gaining traction)

These are ideal for day traders due to:

- High liquidity

- Expiry-day volatility

- Tight spreads

- Scalping opportunities during event-driven days (RBI, Budget, Election)

Common Mistakes in Options Day Trading

Overleveraging – Trading too many lots without planning risk

Buying Far OTM Options – Cheap but decay fast

No Exit Plan – Holding too long waiting for a miracle

Ignoring Greeks – Not understanding Delta/Theta leads to misjudged risk

Trading Without a Setup – Random entries lead to consistent losses

How to Start Day Trading Options (Beginner Guide)

Open a brokerage account with options trading enabled

- Learn to read option chains and analyze volume/open interest

- Backtest simple strategies on paper first

- Start with 1 lot and increase size slowly as confidence builds

- Review every trade – wins and losses – for continual improvement

FAQs About Options Day Trading

Q: Is it profitable to day trade options?

Yes, but only with strict discipline and risk management. The high potential also comes with high risk.

Q: Should I buy or sell options intraday?

Beginners should focus on buying options. Selling requires advanced understanding of Greeks and margin.

Q: How much capital is needed?

In the US, $2,000–$5,000 is a good start. In India, ₹25,000–₹50,000 is sufficient to begin small trades.

Q: Can I trade options daily?

Yes, but it’s best to focus on quality setups instead of forcing trades every day.

Q: Which day is best for trading options?

Weekly expiry days (Thursday in India, Friday in US) are the most active and volatile.

How to Read an Options Chain for Intraday Trades

Understanding the options chain helps you make better decisions quickly.

Key Metrics:

- Open Interest (OI): Higher OI = more liquidity = easier entries/exits

- Volume: Check for surge in volume relative to previous days

- Delta: Choose options with delta between 0.3 to 0.7 for directional trades

- Implied Volatility (IV): Avoid overly inflated IV unless you’re trading a news event

- Bid-Ask Spread: Tighter = better execution, especially for scalpers

Tip: Use OI and volume changes to identify where institutions are building positions intraday.

Options Day Trading vs. Swing Trading Options

| Feature | Options Day Trading | Swing Trading Options |

|---|---|---|

| Holding Period | Intraday (minutes to hours) | Multi-day to weeks |

| Goal | Quick profits from short-term price moves | Capture broader trends |

| Risk Profile | Higher (due to rapid time decay) | Moderate (with planned entries/exits) |

| Strategy Focus | Scalping, breakouts, news plays | Chart patterns, trend following |

| Option Type | Near-the-money weekly options | Monthly ATM/ITM options |

| Ideal for | Active traders with screen time | Busy professionals with overnight plans |

Both styles have their place. Beginners may start with day trading to learn price action before progressing to swing trading for portfolio diversification.

Live Examples: Option Day Trades that Worked

Example 1: SPY 0DTE Call Option

- Entry: Break above VWAP + previous day’s high

- Strike: ATM

- Target: 25% profit

- Time: Trade closed in 14 minutes

Example 2: BANKNIFTY Weekly Put Option

- Entry: After reversal pattern + bearish divergence

- Strike: Slightly ITM

- Target: ₹150 to ₹225 premium

- Risk: ₹40 stop-loss

Live journaling of trades builds discipline and helps identify repeating setups.

Building a Winning Mindset for Options Day Trading

Success in options trading is 80% psychology and 20% execution. Cultivate these habits:

- Detachment from outcomes: Focus on process, not profit

- Controlled aggression: Take decisive action when setup aligns

- Discipline with losses: Accept small losses as part of the game

- No FOMO: Missed a move? Let it go

- Daily review: What worked, what didn’t, what can be improved

Reading trading psychology books like Trading in the Zone helps reinforce mental resilience.

Realistic Profit Expectations with Options Day Trading

Many new traders expect to double their money daily. Here’s a more grounded view:

- Average daily ROI goal: 1%–2% of capital

- Win rate target: 55%+ with 1.5–2x reward/risk

- Monthly goal: 10%–20% ROI (compounding effect is powerful)

- Drawdowns: Should not exceed 15–20% of capital

Trading is a long-term game — focus on consistency over spikes.

Final Thoughts on Options Day Trading

Options day trading can be incredibly rewarding, but only if approached with discipline, education, and a solid trading plan. Focus on liquid instruments, avoid chasing cheap OTM options, and always manage your downside. Whether you’re trading SPY in the US or BANKNIFTY in India, the principles remain the same: Plan your trade, trade your plan, and control your emotions.