In the world of trading, understanding and mastering Bullish Candlestick patterns is crucial for any trader aiming to succeed. These patterns are powerful tools that help traders predict market trends and make informed decisions. By recognizing these patterns, traders can anticipate potential upward movements in the market, providing opportunities to enter trades with higher probabilities of success. Whether you’re a beginner or an experienced trader, a solid grasp of Bullish Candlestick patterns can be a game-changer in your trading journey.

What Are Bullish Candlestick Patterns?

Bullish Candlestick patterns are chart formations that indicate a potential reversal from a downtrend to an uptrend. They are essential in technical analysis as they provide visual cues that the market may be about to experience upward momentum. These patterns are characterized by the position and length of the candle body and wicks, signaling a shift in market sentiment from bearish (downward) to bullish (upward). Understanding these patterns can give you an edge in identifying the best times to enter or exit a trade.

The Importance of Bullish Candlestick Patterns

For traders, identifying Bullish Candlestick patterns is a key skill. These patterns often form at critical levels of support and resistance, where the market’s direction may change. Recognizing these signals early can lead to more profitable trades and better risk management. Moreover, Bullish Candlestick patterns often signal the start of a new uptrend, allowing traders to capitalize on early entry points. By mastering these patterns, you can enhance your ability to make timely and profitable trading decisions.

Common Bullish Candlestick Patterns

- Hammer: The Hammer is a single candle pattern that forms after a decline, signifying a potential reversal. It has a small body and a long lower wick, indicating that sellers pushed prices lower but buyers managed to push them back up. The Hammer is most effective when it appears at the bottom of a downtrend, suggesting that the market has found a strong support level and is ready to move higher.

- Bullish Engulfing: This two-candle pattern occurs when a smaller bearish candle is completely engulfed by a larger bullish candle. It suggests that buyers have taken control from sellers, signaling a strong potential for upward movement. The Bullish Engulfing pattern is particularly powerful when it appears after a prolonged downtrend, as it indicates a sharp reversal in market sentiment.

- Morning Star: A three-candle pattern that indicates a reversal from a downtrend. It consists of a bearish candle, followed by a small-bodied candle (which can be bearish or bullish), and then a larger bullish candle that closes above the midpoint of the first candle. The Morning Star pattern is a reliable indicator of a market bottom and the beginning of a new uptrend.

- Piercing Line: This is a two-candle pattern where the first candle is bearish, followed by a bullish candle that opens lower but closes above the midpoint of the previous candle. It signals a shift in momentum from selling to buying. The Piercing Line pattern often occurs after a significant decline and can be an early signal of a market turnaround.

- Three White Soldiers: A strong bullish reversal pattern consisting of three consecutive long bullish candles with small or no wicks. Each candle opens within the body of the previous one, indicating sustained buying pressure. The Three White Soldiers pattern is a sign of strong bullish momentum and is often seen at the start of a prolonged uptrend.

How to Trade Using Bullish Candlestick Patterns

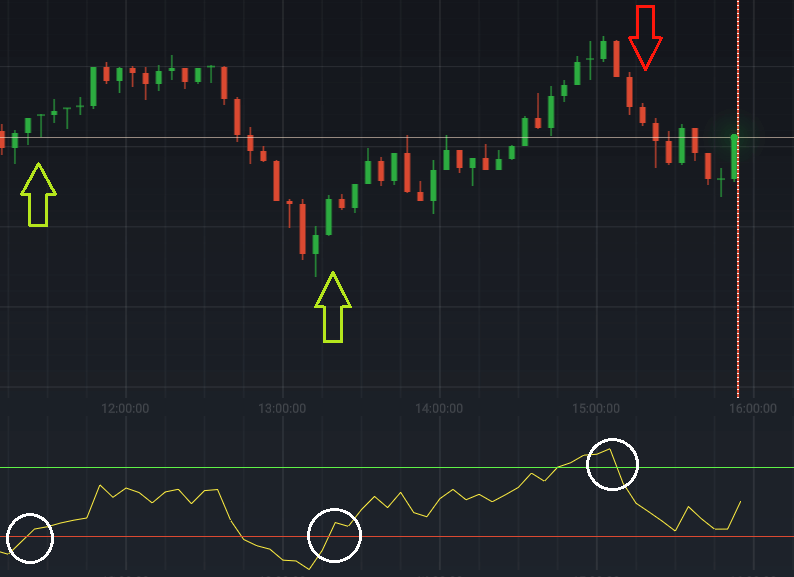

To effectively trade using Bullish Candlestick patterns, it’s important to combine them with other technical indicators like moving averages, RSI, or MACD. This confluence increases the probability of success. Additionally, always consider the context of the market, such as the overall trend and key support/resistance levels.

- Confirmation: Wait for confirmation of the pattern before entering a trade. This could be in the form of higher volume, or a subsequent candle confirming the bullish direction. Confirmation reduces the likelihood of false signals and improves the accuracy of your trades.

- Entry and Exit Points: Enter trades at the close of the confirmation candle. Set stop-loss orders just below the low of the pattern to minimize risk. For exit points, look for resistance levels or use trailing stops to lock in profits. Proper entry and exit strategies are crucial for maximizing profits and minimizing losses in trading.

- Risk Management: Proper risk management is essential. Even with high-probability setups like Bullish Candlestick patterns, unexpected market conditions can lead to losses. Always use stop-losses and manage position sizes appropriately. By adhering to strict risk management principles, you can protect your trading capital and ensure long-term success.

- Practice and Patience: Mastery of Bullish Candlestick patterns requires practice and patience. Use demo accounts to practice identifying and trading these patterns without risking real money. Over time, you’ll develop the confidence and skill to apply these patterns effectively in live trading.

Real-World Examples of Bullish Candlestick Patterns

Let’s consider a few real-world examples to illustrate how Bullish Candlestick patterns can be used in trading:

- Hammer Pattern in Apple Inc. (AAPL): In a recent chart of Apple Inc., a Hammer pattern appeared after a period of decline. Following the appearance of this pattern, the stock price reversed and began a new uptrend, providing a profitable entry point for traders who recognized the signal.

- Bullish Engulfing in S&P 500 Index: The S&P 500 Index experienced a significant Bullish Engulfing pattern after a week of losses. The pattern indicated a shift in market sentiment, and the index subsequently rallied, highlighting the effectiveness of this pattern in identifying market reversals.

- Morning Star in Bitcoin (BTC): Bitcoin’s chart showed a Morning Star pattern at a key support level, signaling the end of a downtrend. Traders who acted on this signal benefited from a strong upward move in the cryptocurrency market.

Conclusion

Mastering Bullish Candlestick patterns can significantly enhance your trading strategy. These patterns provide insights into market sentiment and potential reversals, allowing traders to make more informed decisions. By understanding and applying these patterns within a broader trading strategy, you can improve your chances of success in the markets. Remember to always use them in conjunction with other analysis tools and maintain disciplined risk management to achieve consistent trading results.

Moreover, as you continue to refine your skills in recognizing and trading Bullish Candlestick patterns, you’ll gain greater confidence in your ability to navigate the complexities of the market. Whether you’re trading stocks, forex, or cryptocurrencies, these patterns will remain a valuable part of your technical analysis toolkit. Keep learning, stay patient, and let the Bullish Candlestick patterns guide you to more successful trades.