The breakout strategy is one of the most popular and effective trading techniques used by traders to capitalize on market movements. By identifying key levels of support and resistance, traders can use the breakout strategy to enter the market at the beginning of a trend, potentially maximizing their profits. In this guide, we will explore the breakout strategy in detail, discussing how it works, the tools and indicators that can enhance its effectiveness, and the best practices for applying it in different market conditions.

What is the Breakout Strategy?

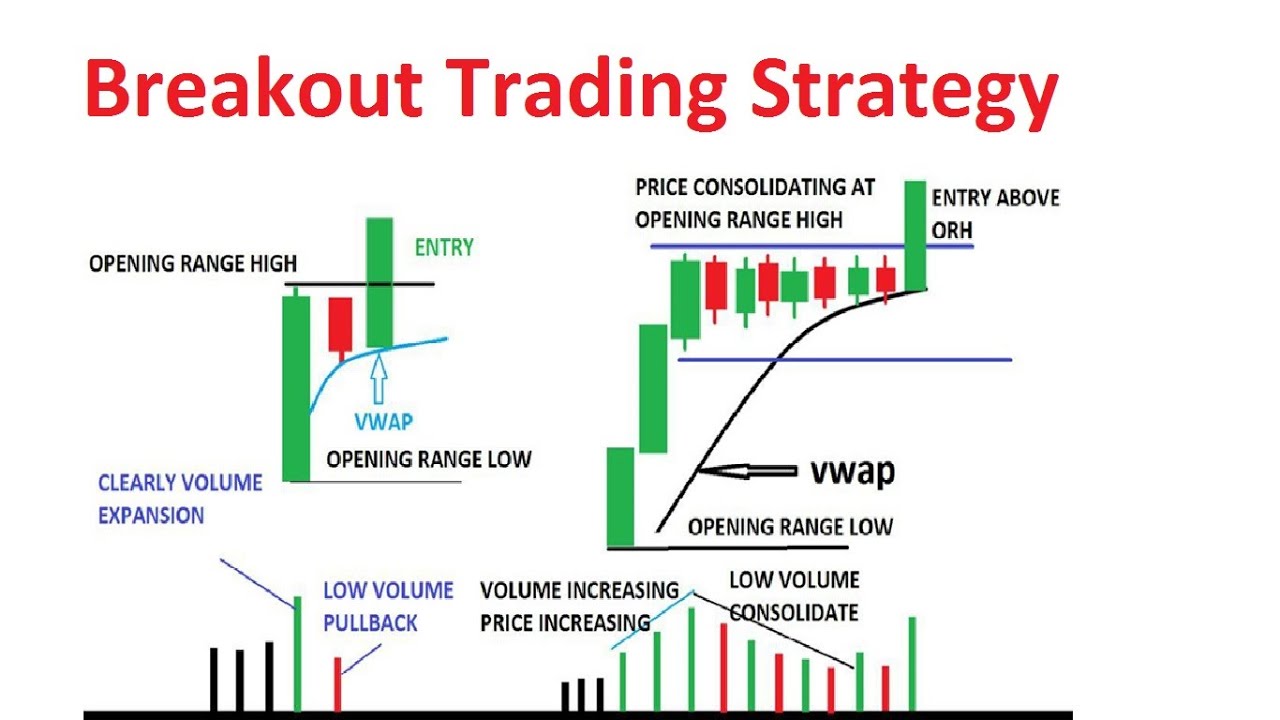

The breakout strategy involves entering a trade when the price of a financial instrument moves beyond a defined level of support or resistance. A breakout occurs when the price closes above a resistance level or below a support level, signaling a potential new trend. Traders use this strategy to take advantage of the momentum that often follows a breakout, aiming to profit from the price movement that occurs after the breakout is confirmed.

Breakouts can occur in any time frame, but they are most effective when they align with longer-term trends. The breakout strategy is particularly popular among day traders, swing traders, and those who seek to capture significant price movements in a relatively short period.

Identifying Key Support and Resistance Levels

To successfully implement the breakout strategy, traders must first identify key support and resistance levels on their charts. These levels represent areas where the price has historically struggled to move beyond, either reversing direction or consolidating.

- Support Levels: A support level is a price level where the asset tends to find buying interest, preventing it from falling further. Support levels are often identified by looking for previous lows on the chart.

- Resistance Levels: A resistance level is a price level where the asset faces selling pressure, preventing it from rising further. Resistance levels are identified by looking for previous highs on the chart.

When the price approaches these levels, traders monitor the market closely to see if a breakout will occur.

Tools and Indicators for the Breakout Strategy

Several tools and indicators can help traders increase the accuracy of their breakout strategy:

- Moving Averages: Moving averages smooth out price data and can help identify trends. Traders often use the 50-day and 200-day moving averages to confirm breakouts in line with the prevailing trend.

- Volume Indicators: Volume is a crucial factor in confirming breakouts. A breakout accompanied by high trading volume is more likely to be sustained, as it indicates strong interest from market participants.

- Bollinger Bands: Bollinger Bands consist of a moving average and two standard deviations above and below it. When the price moves beyond the upper or lower band, it can indicate a potential breakout.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. An RSI above 70 may indicate an overbought condition, while an RSI below 30 may indicate an oversold condition, both of which can precede a breakout.

Types of Breakouts

There are two main types of breakouts that traders focus on:

- Continuation Breakout: This occurs when the price breaks out in the direction of the prevailing trend, indicating that the trend is likely to continue. Continuation breakouts are often seen as less risky and are favored by trend-following traders.

- Reversal Breakout: A reversal breakout occurs when the price breaks out in the opposite direction of the prevailing trend, signaling a potential trend reversal. Reversal breakouts can offer significant profit opportunities, but they are also riskier, as they involve going against the current trend.

Common Breakout Strategies

- Pullback Breakout: In this strategy, traders wait for the price to break out and then retrace or pull back to the breakout level before entering a trade. This allows traders to enter at a better price and reduces the risk of a false breakout.

- Range Breakout: Traders identify a range where the price has been consolidating and enter a trade when the price breaks out of this range. The range breakout strategy is effective in markets that have been moving sideways for an extended period.

- Volatility Breakout: This strategy focuses on breakouts that occur during periods of low volatility, expecting that a significant move will follow once the price breaks out. Traders often use tools like Bollinger Bands to identify periods of low volatility before a breakout.

Managing Risks in Breakout Trading

While the breakout strategy can be highly profitable, it also carries risks, particularly the risk of false breakouts. A false breakout occurs when the price moves beyond a support or resistance level but then quickly reverses direction, trapping traders in a losing position.

To mitigate this risk, traders can use the following techniques:

- Wait for Confirmation: Rather than entering a trade immediately after a breakout, wait for the price to close beyond the support or resistance level on a higher volume. This helps confirm the breakout and reduces the likelihood of entering a false breakout.

- Use Stop-Loss Orders: Placing a stop-loss order just below the breakout level for a long position (or above for a short position) can limit potential losses if the breakout fails.

- Position Sizing: Proper position sizing is essential to manage risk. Traders should only risk a small percentage of their trading capital on any single trade, typically 1-2% of the account balance.

Conclusion

The breakout strategy is a powerful tool in a trader’s arsenal, allowing for the capture of significant price movements as they occur. By understanding how to identify key support and resistance levels, using the right tools and indicators, and managing risks effectively, traders can enhance their chances of success with the breakout strategy. Whether you are a day trader looking for quick gains or a swing trader aiming to catch larger price moves, mastering the breakout strategy can help you achieve your trading goals.