Your cart is currently empty!

How to trade SPY options daily

Trading SPY options daily can be an exciting and potentially profitable venture for traders looking to capitalize on the fluctuations of the S&P 500 ETF. In this guide, we will explore the fundamentals of SPY options, the strategies for daily trading, and key considerations to help you navigate this market effectively.

What are SPY Options?

SPY options are contracts that give traders the right, but not the obligation, to buy or sell shares of the SPDR S&P 500 ETF Trust (SPY) at a predetermined price, known as the strike price, before a specified expiration date. These options allow traders to speculate on the price movements of the underlying ETF without having to buy the shares outright.

Types of SPY Options

1. Call Options: These options give the holder the right to buy SPY shares at the strike price before expiration. Traders buy call options when they anticipate that the SPY price will rise.

2. Put Options: These options give the holder the right to sell SPY shares at the strike price before expiration. Traders buy put options when they believe that the SPY price will fall.

Why Trade SPY Options?

Leverage: Options allow traders to control a larger position with a smaller amount of capital.

Flexibility: SPY options can be used for various trading strategies, including hedging and speculation.

Liquidity: SPY options are among the most liquid options in the market, allowing for quick entry and exit.

Setting Up for Daily Trading

Before you start trading SPY options daily, it’s essential to set up the necessary tools and establish a trading plan.

1. Choose a Trading Platform

Select a reliable brokerage that offers SPY options trading. Ensure the platform has robust tools for analysis, charting, and risk management. Popular platforms include:

TD Ameritrade: Known for its advanced trading tools and research resources.

E*TRADE: Offers a user-friendly interface with powerful options trading capabilities.

Interactive Brokers: Suitable for active traders seeking low commissions and advanced features.

2. Educate Yourself

Take the time to learn about options trading, including terminology, pricing models, and strategies. Consider resources such as online courses, webinars, and trading forums to enhance your knowledge.

3. Develop a Trading Plan

A well-defined trading plan is crucial for success. Your plan should include:

Trading Goals: Define your profit targets and risk tolerance.

Entry and Exit Criteria: Determine the conditions under which you will enter and exit trades.

Risk Management: Set guidelines for position sizing and stop-loss orders to protect your capital.

Daily Trading Strategies for SPY Options

When trading SPY options daily, various strategies can help you maximize your potential profits. Here are some popular approaches:

1. Day Trading SPY Options

Day trading involves buying and selling options within the same trading day. Here’s a simple approach:

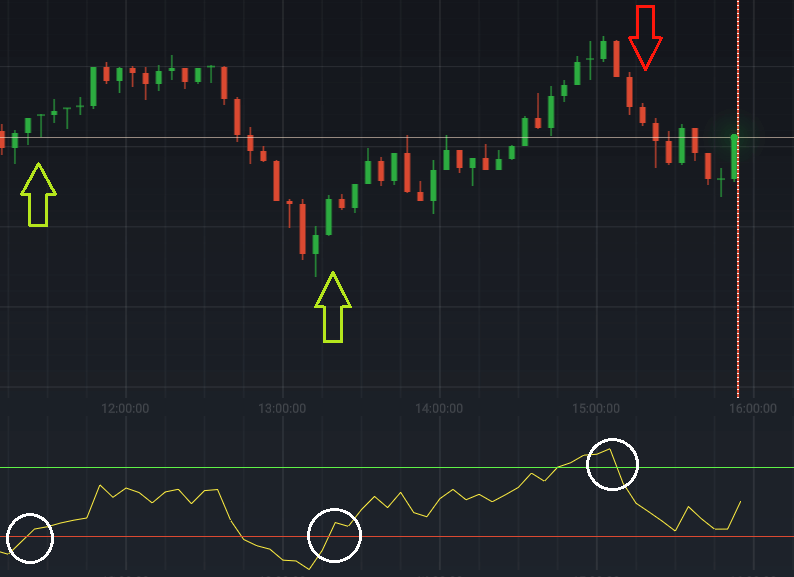

1. Identify Key Levels: Use technical analysis to identify support and resistance levels.

2. Watch for Breakouts: Enter a trade when the SPY breaks above resistance or below support, confirming a new trend.

3. Set Tight Stops: Use stop-loss orders to minimize losses if the market moves against you.

2. Selling Options Premium

Another popular strategy is selling options to collect premiums. This strategy works well in stable or sideways markets. Consider the following:

Sell Out-of-the-Money (OTM) Options: Look for a call or put options that are OTM with a low probability of being exercised.

Time Decay: Take advantage of time decay (theta) by selling options that lose value as expiration approaches.

Risk Management: Be prepared for potential losses if the market moves against your position.

3. Using Spreads

Options spreads involve buying and selling different options simultaneously to limit risk. Common spreads include:

Bull Call Spread: Buy a lower strike call and sell a higher strike call.

Bear Put Spread: Buy a higher strike put and sell a lower strike put.

Iron Condor: Sell an OTM call and put while buying further OTM options to limit risk.

4. Volatility Trading

Understanding market volatility is essential for SPY options trading. Higher volatility typically increases option premiums. Consider the following:

Use Implied Volatility: Analyze implied volatility (IV) to assess options pricing. Consider buying options when IV is low and selling when it’s high.

News Events: Be aware of earnings reports, economic indicators, and geopolitical events that can impact SPY volatility.

Key Considerations for Daily Trading

Market Conditions: Always be aware of the overall market trend. Bullish trends may favor call options, while bearish trends may favor put options.

Timing: Monitor the time of day. The first hour of trading often sees higher volatility, while the last hour can also provide opportunities as traders adjust their positions.

News Impact: Keep track of economic reports and news releases that may affect the SPY price, as these can create sudden price movements.

Risk Management: Always have a risk management plan in place. Determine your maximum loss per trade and avoid risking too much capital on a single trade.

Conclusion

Trading SPY options daily can be a rewarding endeavor for those willing to learn and adapt. By understanding the mechanics of SPY options, developing a solid trading plan, and implementing effective strategies, traders can capitalize on the price movements of the S&P 500 ETF. Always remember to practice risk management and continuously educate yourself to stay ahead in this dynamic market.

Ready to take your SPY options trading to the next level? Join our exclusive trading community today to receive daily market insights, live trading signals, and a comprehensive daily newsletter delivered straight to your inbox. Start making informed trading decisions and enhance your trading skills.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.