Your cart is currently empty!

GOLD & Silver To Make New High in February 2013

22nd November 2012

On thanksgiving day, we are keeping the newsletter open to all.

Also remember that, we will not do the same every day. So if you want to get access to our newsletters, please send e-mail to [email protected]

HAPPY THANKSGIVING DAY TO OUR MEMBERS (ESPECIALLY THOSE FROM USA) – WITH BEST WISHES FROM TEAM ASTRODUNIA

Global Stock Indices:

Today, Asian market has been positive. Closing is also expected to be positive. UK market will open positive. Closing of UK shall be positive as well but profit booking can come at higher levels.

Tomorrow Asia may have bearish opening. However, next week is bullish.

Don’t panic if it opens bearish tomorrow.

S&P is in good bullish tone. So please hold your long position in S&P for next week.

And positional traders don’t SELL S&P 500.

Trading Range (22nd November 2012):

- DOW JONES (FUT): HOLIDAY

- S&P 500 (FUT) :1,382-1,402

- NASDAQ (FUT):HOLIDAY

- FTSE (FUT): 5,745-5,810

- CAC40(FUT):3,455-3,482

- DAX (FUT): 7,120-7,220

- HANG SENG IDX (FUT): 21,570-21,780+

- NIFTY (SPOT):5,590-5,650-5,670

Precious & Industrial Metals:

We have been recommending to make buying position in Bullion since last month at lower levels.

Today and tomorrow, bullion is in bullish trend with volatility.

ALERT: Gold & Silver volatile to bullish till 26th-27th November 2012.

Our target should be 1,760-1,775 for Gold while 34.70-35.00 for Silver any time before 26th/27th November 2012.

After 27th November 2012, again some profit booking can come in bullion for some days.

But we are very bullish from 25th December 2012 till June 2013.

However, we expect the new HIGH by 2nd week of February 2013.

Target for Gold: 1,980, Silver around 52.00 within the said time frame (by 2nd week of February 2013).

Trading Range (22nd November 2012):

- GOLD: 1,724-1,742

- SILVER: 33.05-33.60-33.90

- COPPER: 349.00-353.00

Copper had come in bullish tone last week. Copper can go to 365.00-375.00 in short term.

Base metals such as Aluminum, Lead, Zinc, Nickel are volatile to positive.

Energy Products:

Crude Oil is highly volatile. You can Sell Oil on higher level around 89.90 with stop loss 93.00 for target 86.00 and make long position in Oil at 86.00 with stop loss 85.00 for target 89.90.

But we are bullish in Crude Oil with volatility.

Trading Range (22nd November 2012):

- Crude Oil: 85.50-89.00

Currencies:

Euro is in positive tone. We have been saying that since last week. It’ll continue bullishness till next week with volatility.

Trading Range (22nd November 2012):

- DOLLAR INDEX:81.00-80.60 (Next week, Dollar Index can go lower than 80.20)

- EURO: 1.2780-1.2880 & ABOVE 1.2880 CAN GO TO 1.2940

- USD/INR: 55.35-54.88 (Next week, USD v/s INR can go down to 53.90. You can hold short position in USD v/s INR with stop loss 55.60).

Indian Commodity Market/ MCX:

For Today and tomorrow, gold and silver are positive with volatility.

Trading Range:

- Gold:31,680-31,950-32,050

- Silver: 61,500-62,500-63,000

- Copper: 422.00-427.00

- Crude Oil: 4,780-4,860-4,880

Indian Stock Market:

Today, Indian stock market is volatile to bullish.

Trading Range:-

- Nifty Fut: 5,590-5,660-5,680

- Bank Nifty Fut: 11,390-11,540

Tomorrow, Indian stock market can have negative opening. It’s advisable to profit book in long position today.

Buy: Dena Bank, IDBI, Yes Bank, Century Textile, Unitech, L&T, KTK Bank, Jet Airways, Tata Steel.

(Updated at : 22/11/2012 8:12:55 AM (IST))

Disclaimer: The above calculations are based on astrology and technical analysis. This is an indicative report only and not to be considered as live trading calls, which is a proprietary service by our team. This report is meant for educational purpose only.

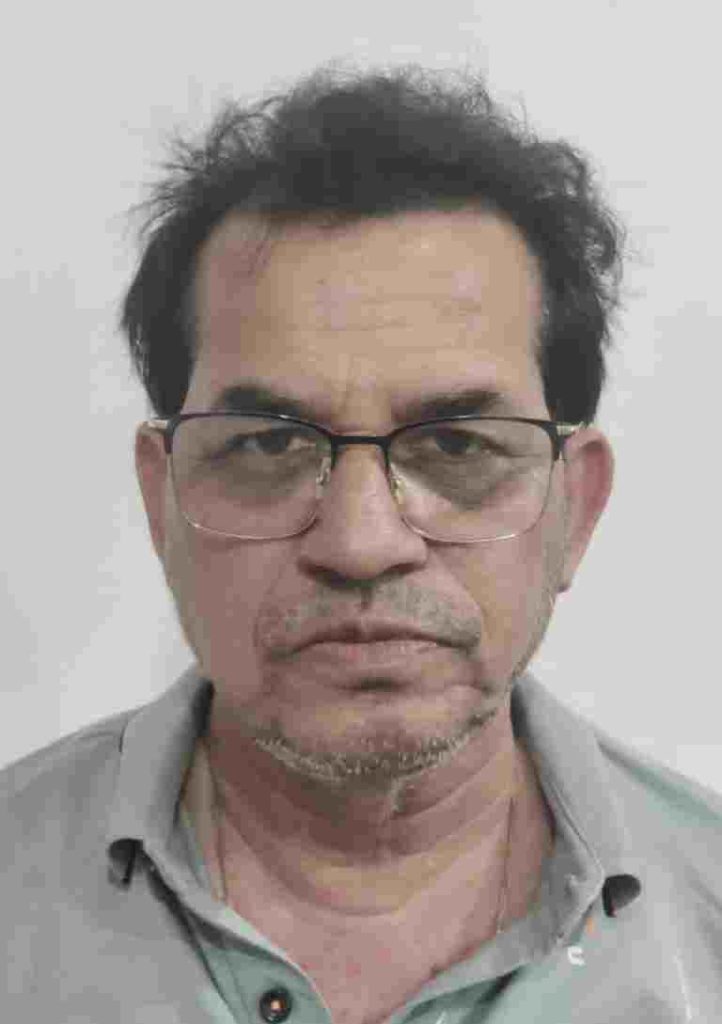

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply