In the world of options trading, understanding and identifying The Most Active Options is a crucial skill for any trader. These options attract significant trading volume, indicating strong interest from market participants. By focusing on The Most Active Options, traders can take advantage of the liquidity and potential price movements that come with high-volume trading. Whether you’re an experienced trader or just starting, learning how to navigate the market for Most Active Options can lead to more informed and profitable trading decisions.

What Are the Most Active Options?

Active Options refer to options contracts that have the highest trading volume on a given day. These options are heavily traded due to various factors, including news events, earnings reports, market sentiment, and speculation. The high trading volume makes these options more liquid, meaning they can be bought and sold more easily without significantly affecting the price. Traders often gravitate towards these options because the increased activity can lead to larger price movements, presenting both opportunities and risks.

Why Focus on the Most Active Options?

Focusing on The Most Active Options provides several advantages for traders:

- Liquidity: High trading volume in The Most Active Options ensures ample liquidity. This means traders can enter and exit positions more easily and at better prices, reducing the risk of slippage.

- Price Transparency: With high trading activity, the bid-ask spread (the difference between the buying and selling prices) tends to be narrower, providing better price transparency. This allows traders to get in and out of trades with minimal cost.

- Potential for Quick Profits: The significant price movements associated with The Most Active Options offer opportunities for quick profits. However, this also means that traders must be vigilant and ready to act on market signals.

- Market Sentiment Insight: The Most Active Options often reflect the broader market sentiment. For instance, if a particular stock’s options are heavily traded, it could indicate strong market interest or speculation regarding the underlying asset.

Factors Driving Activity in Options

Several factors can lead to an option becoming one of The Most Active Options:

- Earnings Reports: Companies release quarterly earnings reports, which can lead to significant price movements in their stocks and corresponding options. Traders often speculate on these outcomes, leading to a surge in options activity.

- Market News and Events: Major news events, such as mergers, acquisitions, or geopolitical developments, can cause spikes in options trading. Traders react to these events by buying or selling options in anticipation of price changes.

- Volatility: Higher volatility in the underlying asset often leads to increased activity in its options. Volatility presents opportunities for traders to capitalize on price swings, making the options more attractive.

- Implied Volatility Changes: Changes in implied volatility, which represent market expectations of future volatility, can drive activity in options. Traders may buy or sell options based on anticipated changes in volatility.

- Expiration Dates: As options approach their expiration dates, trading activity typically increases. This is because traders look to close positions or roll them over to future dates, leading to heightened activity.

How to Find the Active Options

To find the Active Options, traders can use several tools and resources:

- Options Market Scanners: These tools allow traders to scan the market for Most Active Options based on volume, open interest, and other criteria. Many brokerage platforms offer built-in scanners that update in real time.

- Financial News Websites: Websites like CNBC, Bloomberg, and MarketWatch regularly publish lists of the Most Active Options. These lists provide a quick snapshot of where the market’s attention is focused.

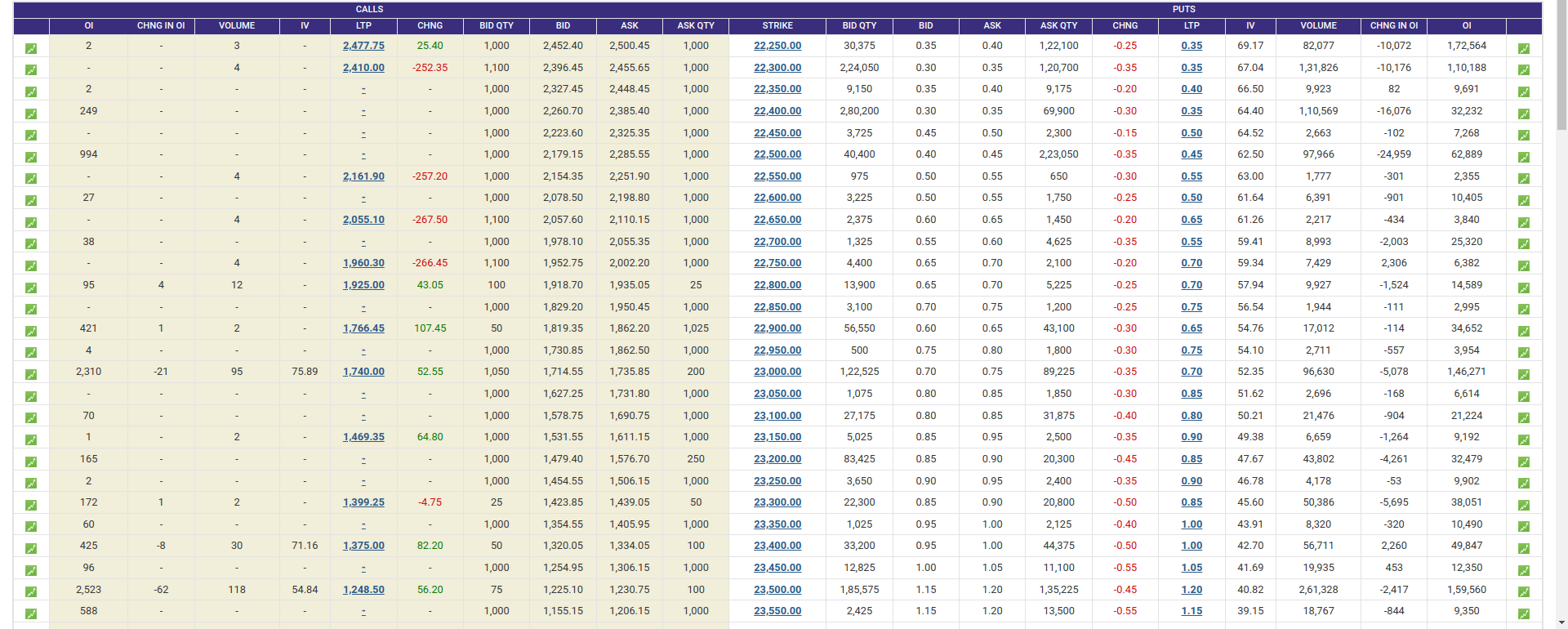

- Options Chain Data: Reviewing the options chain data for specific stocks can reveal which contracts are experiencing the most activity. This data typically includes information on volume, open interest, and implied volatility.

- Brokerage Platforms: Many online brokerage platforms provide tools and features to track Active Options throughout the trading day. These platforms often include customizable alerts and filters to help traders stay informed.

Trading Strategies for the Active Options

Trading the Active Options requires a strategic approach. Here are some popular strategies:

- Day Trading: Given the liquidity and price movements in the Active Options, day trading can be a profitable strategy. Traders enter and exit positions within the same day, capitalizing on short-term price fluctuations. This approach requires a deep understanding of market trends and quick decision-making.

- Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from price swings. For Active Options, swing trading can be effective when a trader anticipates continued momentum or a reversal in price direction.

- Volatility Trading: Traders can take advantage of high implied volatility by using strategies like straddles and strangles. These strategies involve buying or selling options to profit from expected volatility, regardless of the direction of the price movement.

- Covered Calls: This strategy involves holding a long position in the underlying asset while selling call options on the same asset. It’s a way to generate income from the options premium while holding the stock. This strategy can be particularly effective in a stable or slightly bullish market.

- Protective Puts: For those holding a stock, buying protective puts on Active Options can be a way to hedge against potential losses. This strategy provides downside protection while allowing the trader to benefit from any upside in the stock.

Risks of Trading the Active Options

While trading the Active Options can be profitable, it’s important to be aware of the risks:

- Increased Volatility: High activity often correlates with high volatility, leading to significant price swings. While this presents opportunities, it also increases the risk of losses.

- Overtrading: The excitement of trading Active Options can lead to overtrading. Traders might take on too many positions or make impulsive decisions, leading to increased transaction costs and potential losses.

- Time Decay: Options lose value as they approach expiration due to time decay. Traders focusing on short-term activity must be mindful of how quickly their options can lose value, especially if the anticipated price movement does not occur.

- Market Impact: In some cases, trading large volumes in Active Options can impact the market. While liquidity is generally high, extremely large trades can still move prices, especially in less liquid options.

- Emotional Trading: The fast-paced nature of trading Active Options can lead to emotional decision-making. It’s important to stay disciplined and stick to your trading plan to avoid unnecessary risks.

Conclusion

The Active Options represent opportunities for traders to capitalize on high-volume, liquid markets. By focusing on these options, traders can benefit from better price transparency, liquidity, and potential for quick profits. However, trading the Active Options also comes with risks, including increased volatility and the potential for overtrading. To succeed, traders must develop a solid strategy, stay informed about market conditions, and maintain discipline in their trading decisions.

By understanding what drives the activity in the Most Active Options and how to find and trade them effectively, you can enhance your trading performance and take advantage of the dynamic opportunities these options present. Whether you are day trading, swing trading, or employing more complex options strategies, staying attuned to the Most Active Options can be a key component of a successful trading strategy.