Your cart is currently empty!

How Economic Indicators and Market Sentiment Affect Stock Market Performance

Understanding the factors that influence stock market performance is crucial for investors aiming to make informed decisions. Among these factors, economic indicators and market sentiment play pivotal roles. This article delves into how these elements interact and shape the stock market landscape.

Understanding Economic Indicators

Economic indicators are statistics that provide insight into the health of an economy. They can be categorized into three types: leading, lagging, and coincidental indicators.

1. Leading Indicators

Leading indicators are predictive, helping investors forecast future economic activity. Some key leading indicators include:

Stock Market Performance: Often viewed as a leading indicator itself, rising stock prices can signal economic expansion.

Manufacturing Activity: Reports like the Purchasing Managers’ Index (PMI) can indicate business conditions and future economic growth.

Consumer Confidence Index (CCI): High consumer confidence suggests increased spending, which can boost economic growth and, in turn, stock prices.

2. Lagging Indicators

Lagging indicators reflect past economic performance and are used to confirm trends. They include:

Unemployment Rate: A decrease in unemployment typically follows economic growth, confirming a recovering or expanding economy.

Gross Domestic Product (GDP): Changes in GDP indicate the health of the economy, but these are reported after the fact.

3. Coincidental Indicators

Coincidental indicators move in line with the economy. For example, industrial production and retail sales give insights into current economic conditions and can affect stock prices directly.

The Role of Market Sentiment

Market sentiment refers to the overall attitude of investors toward a particular market or asset. It is influenced by various factors, including news, reports, and general economic conditions. Market sentiment can be bullish (optimistic) or bearish (pessimistic), impacting stock market performance significantly.

1. Psychological Factors

Investor psychology is a significant driver of market sentiment. Fear and greed often dictate market movements. During periods of optimism, investors may overlook negative economic indicators, leading to inflated stock prices. Conversely, fear can cause panic selling, resulting in market downturns.

2. News and Events

Current events, such as political changes, economic reports, and global incidents, heavily influence market sentiment. Positive news can uplift sentiment, while negative news can dampen it. For example, a sudden rise in unemployment can trigger concerns, leading to market declines.

3. Technical Analysis

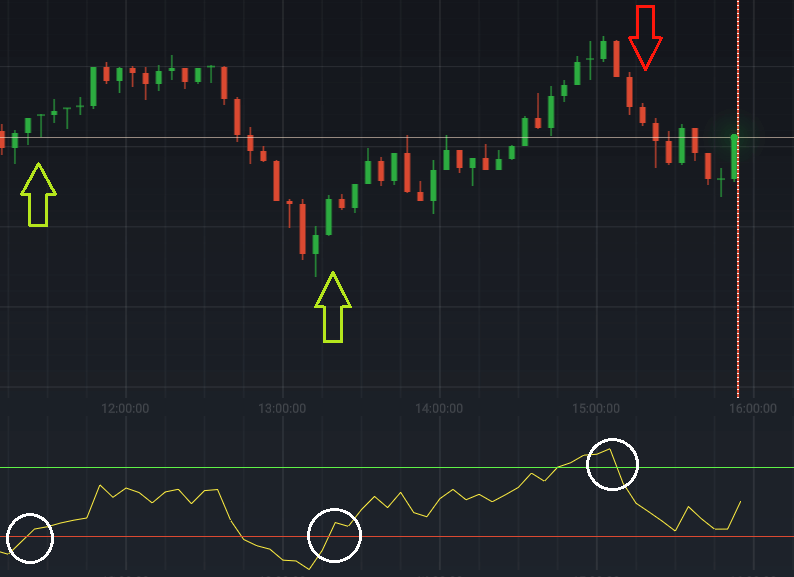

Many investors use technical analysis to gauge market sentiment. Charts, patterns, and trading volumes can reveal trends in investor behavior and help predict future price movements.

The Interplay Between Economic Indicators and Market Sentiment

The relationship between economic indicators and market sentiment is complex and often cyclical. Positive economic indicators can boost market sentiment, leading to rising stock prices. Conversely, negative indicators can sour sentiment, resulting in market declines.

1. Reaction to Data Releases

Investors often react strongly to economic data releases. For instance, a surprisingly high unemployment rate might lead to a sharp decline in stock prices, as investors adjust their expectations based on new information. Similarly, positive data can lead to rapid price increases.

2. Anticipation and Expectations

Market participants frequently attempt to anticipate future economic conditions based on available indicators. If investors expect favorable data (e.g., strong GDP growth), they may drive prices up in advance, resulting in a rally before the data is officially released.

3. Feedback Loops

Market sentiment can create feedback loops with economic indicators. For example, if investors are optimistic and drive stock prices higher, this can lead to increased consumer spending and economic growth, further reinforcing positive sentiment. Conversely, a decline in stock prices can dampen consumer confidence, leading to reduced spending and slower economic growth.

Conclusion

Understanding how economic indicators and market sentiment interact is crucial for investors looking to navigate the stock market successfully. By keeping a close eye on key indicators and being aware of prevailing market sentiment, investors can make more informed decisions and better anticipate market movements.

For personalized insights and strategies tailored to your investment goals, consider subscribing to our daily newsletter. Join our community of investors and gain access to expert analysis, Live trading signals, and market forecasts. Start your journey toward smarter investing today.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.