Your cart is currently empty!

Dow Jones Forecast – US Stock Market

The Dow Jones Industrial Average (DJIA), commonly known as the Dow, is one of the most significant stock market indices globally. Serving as a key indicator of the health of the U.S. stock market and the overall economy, the Dow provides valuable insights into the performance of major industrial and financial companies. This article provides a comprehensive look at the Dow Jones forecast, live trading signals, and detailed predictions for 2024, tomorrow, next week, the next 5 years, and the next 10 years.

Introduction to the Dow Jones

The Dow Jones Industrial Average is a stock market index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ. The Dow serves as a barometer of the U.S. economy and provides insights into the performance of major industrial and financial companies. As one of the oldest and most widely recognized indices, it reflects the overall market trends and investor sentiment.

History of the Dow Jones

The Dow was created by Charles Dow and Edward Jones in 1896. Initially, it included only 12 companies, primarily industrial firms, to reflect the industrial dominance of the U.S. economy at the time. Over the years, the Dow has expanded to include 30 companies, representing a broader range of industries including technology, healthcare, finance, and consumer goods. This evolution reflects the dynamic nature of the U.S. economy and the stock market, adapting to changes in industry and market leadership.

Throughout its history, the Dow has experienced significant milestones and periods of volatility, such as the Great Depression, World War II, the dot-com bubble, the 2008 financial crisis, and the recent COVID-19 pandemic. Despite these challenges, the index has demonstrated resilience and growth, making it a crucial tool for investors and analysts.

Key Factors Influencing the Dow Jones

Several factors influence the performance of the Dow Jones, including:

- Economic Indicators: Indicators such as GDP growth, unemployment rates, inflation, and consumer spending have a significant impact on the Dow’s performance. Strong economic data usually leads to positive market sentiment, while weak data can trigger market sell-offs.

- Corporate Earnings: Earnings reports from Dow-listed companies play a critical role in determining the index’s direction. Strong earnings results often lead to an uptick in the index, while disappointing results can cause declines.

- Interest Rates: The Federal Reserve’s monetary policy, particularly interest rate decisions, can influence the Dow. Lower interest rates typically boost stock market performance by making borrowing cheaper for companies, thereby stimulating economic growth.

- Geopolitical Events: Political instability, trade tensions, and other geopolitical events can cause market volatility. For instance, trade wars or conflicts that affect global supply chains can lead to significant swings in the Dow.

- Technological Advancements: Innovations and technological developments, especially in sectors like information technology, healthcare, and renewable energy, have a substantial impact on the companies within the Dow and their stock performance.

- Market Sentiment: Investor sentiment and market psychology, driven by news, speculation, and market trends, can lead to market swings. Fear and greed are powerful emotions that often cause overreactions in the market.

Dow Jones Forecast for 2024

Analysts predict steady growth for the Dow in 2024, driven by strong corporate earnings, technological advancements, and economic recovery post-COVID-19. However, potential challenges such as geopolitical tensions, supply chain disruptions, and inflationary pressures could lead to market volatility. Investors are advised to stay informed and be prepared for both upward trends and possible corrections.

Key Predictions for 2024:

- Technology Sector: Tech stocks are expected to continue driving growth in the Dow, as companies in this sector benefit from ongoing digital transformation and increased reliance on technology across industries.

- Healthcare Advancements: The healthcare sector is poised for growth due to innovations in biotechnology, pharmaceuticals, and medical devices.

- Renewable Energy: With a growing emphasis on sustainability, companies involved in renewable energy and electric vehicles are expected to perform well.

Our live signals service offers real-time insights to help you make informed decisions. Join now to stay ahead in the market.

Dow Jones Forecast for Tomorrow

The Dow Jones forecast for tomorrow depends on various factors, including market sentiment, economic data releases, and the performance of key sectors like technology and finance. Important indicators include corporate earnings reports, interest rate changes, and macroeconomic data. The performance of other global markets, overnight trading trends, and geopolitical news also play a significant role in shaping the next day’s trading.

Key Focus Areas for Tomorrow’s Forecast:

- Economic Data Releases: Keep an eye on scheduled economic reports such as jobless claims, consumer sentiment, and manufacturing data.

- Corporate Earnings: Earnings announcements from key Dow constituents can drive market direction. Look out for reports from major companies like Apple, Microsoft, and Boeing.

- Federal Reserve Announcements: Any statements or decisions from the Fed regarding monetary policy can have immediate impacts on the market.

Subscribe to our Daily Newsletter for timely market updates and insights.

Dow Jones Forecast for the Next 10 Years

Long-term projections for the Dow highlight sustained growth, bolstered by technological innovations, demographic shifts, and economic expansion. Over the next decade, sectors such as healthcare, technology, and renewable energy are expected to drive significant growth. However, potential risks include policy changes, economic cycles, and unforeseen global events.

Factors Shaping the Next 10 Years:

- Technological Innovation: Advances in artificial intelligence, cloud computing, 5G technology, and the Internet of Things (IoT) will drive significant growth, especially for technology companies within the Dow.

- Demographic Changes: An aging population will increase demand for healthcare services and innovations in biotechnology.

- Sustainability Trends: Companies focusing on renewable energy and sustainable practices are likely to see increased investor interest and growth.

- Policy Changes: Tax reforms, regulatory changes, and fiscal policies will continue to shape market dynamics.

- Global Economic Trends: Economic policies and growth in emerging markets will impact multinational corporations listed on the Dow.

Join our Annual Letter to make informed long-term investment decisions.

Dow Jones Forecast for Today

The Dow’s performance today will be heavily influenced by pre-market trading activity. Monitoring pre-market trends provides early indications of how the index might perform once the market opens. Factors to watch include:

- Futures Contracts: Dow futures indicate market sentiment before the opening bell. Positive futures suggest a potential rise, while negative futures could imply a drop.

- Global Markets: Overnight movements in international markets, particularly in Asia and Europe, can impact U.S. market behavior. For instance, significant changes in Asian indices might affect the Dow’s opening direction.

- Economic Indicators: Look for early data releases or announcements that could influence market sentiment, such as jobless claims or inflation reports.

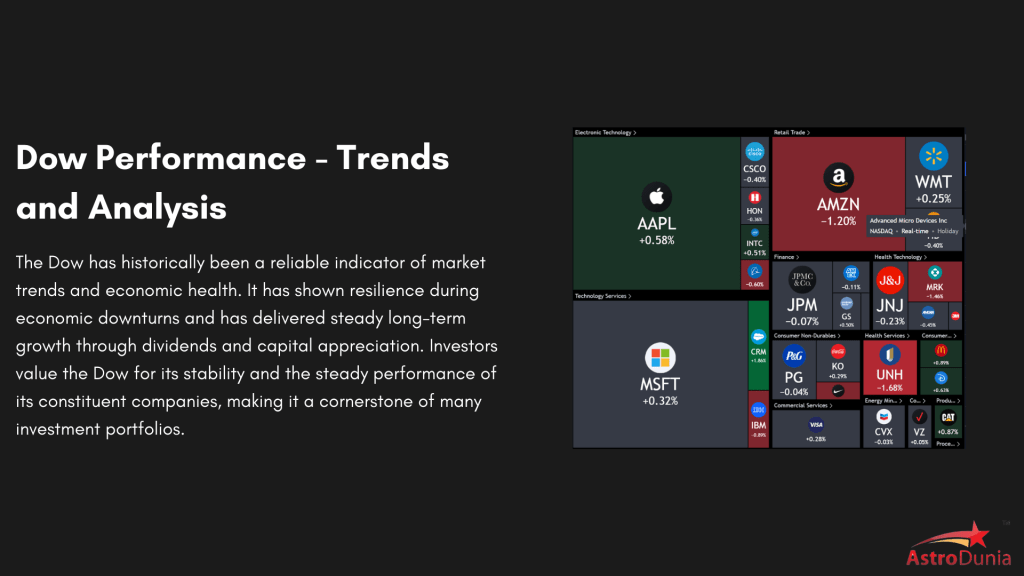

Sector Performance

Analyzing sector performance can offer insights into broader market trends:

- Technology Sector: Given its significant weight in the Dow, the performance of major tech companies can drive the index’s movement. Pay attention to any tech-related news or earnings reports.

- Financial Sector: Banks and financial institutions are also crucial components of the Dow. Any news regarding interest rates or regulatory changes can impact their stock prices.

- Consumer Goods: Reports on consumer spending or confidence can affect companies in the consumer sector, influencing the Dow.

Key Economic Announcements

Today’s economic data releases will be pivotal:

- Corporate Earnings Reports: Major companies within the Dow will report earnings, which can cause significant fluctuations in the index. Monitor the results and guidance provided by these companies.

- Economic Data: Key reports such as the Producer Price Index (PPI) or the Consumer Price Index (CPI) will impact market expectations regarding inflation and interest rates.

Stay informed and make timely investment decisions by joining our live signals service, which provides real-time updates and analysis.

Dow Jones Forecast for Next Week

Weekly forecasts involve a broader analysis of economic indicators and trends:

- Economic Reports: Major reports due next week, such as GDP growth rates or employment statistics, will influence market sentiment. Analyze their potential impact on economic growth and corporate profits.

- Sector Earnings: Companies reporting earnings in the upcoming week can affect sector performance. For example, if a major retailer reports strong results, it could boost the consumer goods sector and, consequently, the Dow.

Technical Analysis

Technical indicators will also play a role in the weekly forecast:

- Chart Patterns: Look for patterns such as head and shoulders, double tops/bottoms, or trend channels that may suggest potential movements.

- Moving Averages: Short-term and long-term moving averages help determine overall market trends. Crossovers between these averages can signal potential buying or selling opportunities.

Market Sentiment

Weekly sentiment will be shaped by various factors:

- Global Events: Any significant global events or geopolitical developments will be factored into market expectations. For example, trade negotiations or international policy changes can impact investor confidence.

- Investor Behavior: Monitor shifts in investor sentiment, which can be influenced by news, earnings reports, and broader economic conditions.

To stay ahead with timely updates and analysis, subscribe to our Daily Newsletter service.

Dow Jones Technical Analysis Today

Detailed technical analysis includes examining specific chart patterns that can provide insights into future movements:

- Candlestick Patterns: Patterns such as doji, engulfing, or shooting star can indicate potential reversals or continuations. Analyze today’s candlestick formations for clues about market direction.

- Trend Lines: Drawing trend lines on daily charts helps identify the current trend and potential points of reversal or continuation.

Key Indicators

Technical indicators help in understanding market momentum:

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. An RSI value above 70 may indicate that the Dow is overbought, while a value below 30 suggests it may be oversold.

- Moving Average Convergence Divergence (MACD): The MACD helps identify changes in the strength, direction, momentum, and duration of a trend. Pay attention to MACD crossovers for potential trading signals.

- Support and Resistance Levels: Identifying key support and resistance levels helps in setting targets and stop-loss orders. Monitor these levels for potential breakouts or reversals.

Live Insights

For real-time technical analysis and trading signals, our live signals service offers up-to-date information and expert insights.

Conclusion

Staying informed about the Dow Jones’ daily performance, weekly trends, and technical indicators is crucial for successful investing. By leveraging our live signals service, daily newsletters, and advanced trading platforms, you can make well-informed decisions and navigate the complexities of the stock market effectively. For further insights and personalized support, reach out to us directly and enhance your trading strategy with expert analysis.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.