Your cart is currently empty!

CAC Forecast – French Stock Market

The CAC 40, or “Cotation Assistée en Continu,” is the benchmark French stock market index, representing the 40 largest companies listed on the Euronext Paris. Launched in 1987, the CAC 40 has since become the leading indicator of the French stock market, providing a snapshot of the French economy and being closely watched by investors worldwide. It includes major players from various sectors, including luxury goods, energy, and banking, reflecting the diverse nature of the French economy.

Historical Overview

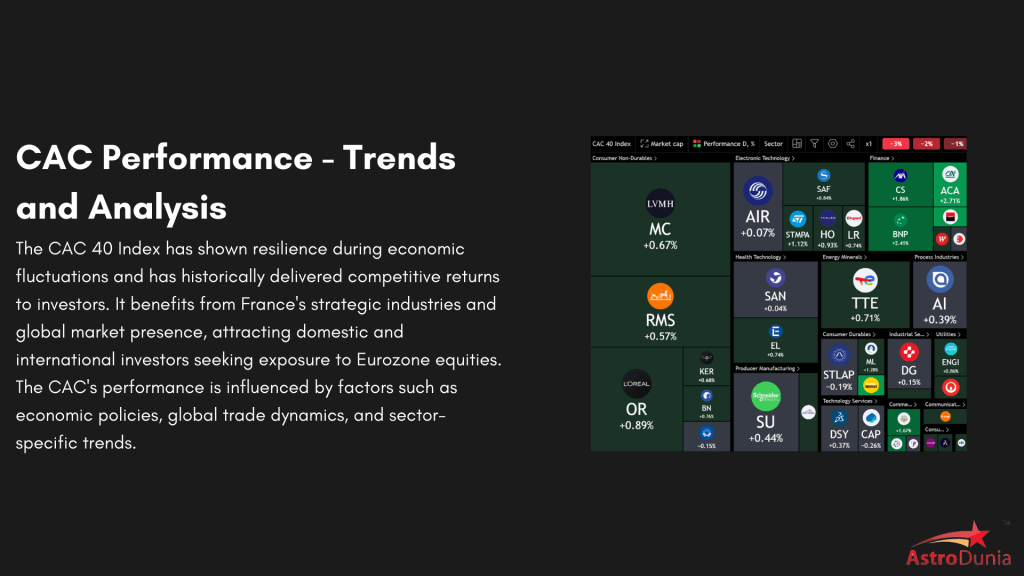

Since its inception, the CAC 40 has experienced significant milestones and periods of volatility, mirroring global economic trends. The index peaked during the dot-com bubble of the late 1990s and faced substantial declines during the financial crisis of 2008. However, it has shown resilience, recovering and growing steadily in the subsequent years. The index’s composition has also evolved, with companies in technology and luxury goods gaining prominence, underscoring France’s strong position in these industries.

CAC 40 Forecast for 2024

Analysts predict moderate growth for the CAC 40 in 2024, supported by a recovering European economy and strong performances in the luxury goods and technology sectors. The consumer goods, industrial, and financial sectors are expected to be key drivers of this growth. With the European Central Bank maintaining accommodative monetary policies and the global economy stabilizing post-pandemic, investor sentiment remains positive. Our live signals service provides real-time insights to help you navigate the market effectively.

Daily Forecasts: What to Expect Tomorrow

Daily forecasts for the CAC 40 are influenced by a multitude of factors, including market sentiment, European economic data releases, and sector performance. Corporate earnings reports, ECB policy changes, and macroeconomic data are critical indicators that investors should monitor. Our Daily Newsletter offers a concise summary of these factors, providing you with the information needed to make informed trading decisions each day.

Weekly Outlook: Navigating Short-Term Volatility

The weekly outlook for the CAC 40 takes into account broader economic trends and sector-specific developments. Factors such as geopolitical events, trade negotiations, and industry news can cause short-term volatility. By understanding these dynamics, investors can better anticipate market movements. Subscribe to our Weekly Insights to stay updated on the latest trends and forecasts.

Long-Term Projections: The Next 10 Years

Long-term projections for the CAC 40 highlight the continued importance of French corporations in the global economy. Innovations in technology, luxury goods, and sustainable energy are expected to drive significant growth over the next decade. Companies in these sectors are likely to benefit from advancements in digital transformation, increasing consumer demand for high-quality products, and the global shift towards renewable energy sources. Our Annual Letter provides a detailed analysis of these trends, helping you make strategic investment decisions.

Technical Analysis of the CAC 40

Technical analysis of the CAC 40 involves examining chart patterns, relative strength index (RSI), moving average convergence divergence (MACD), and support and resistance levels to identify potential trading opportunities. By analyzing historical price movements and trading volumes, investors can gain insights into future market behavior. Join our Live Signals Service for real-time market insights and signals, ensuring you stay ahead of market trends.

Conclusion

The CAC 40 remains a vital barometer of the French and European economies, offering valuable insights into market trends and corporate performance. Whether you are looking for daily forecasts, weekly outlooks, or long-term projections, staying informed is key to making successful investment decisions. Our comprehensive range of services, including live signals, daily newsletters, and annual letters, provide you with the tools and information needed to navigate the complexities of the stock market.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.