The CAC 40 Forecast

The CAC 40 is a benchmark French stock market index that includes 40 of the largest companies listed on the Euronext Paris. It is a key indicator of the health of the French economy and the broader Eurozone. This article explores the history of the CAC 40, provides live trading signals, and offers forecasts for 2024, tomorrow, next week, the next 5 years, and the next 10 years.

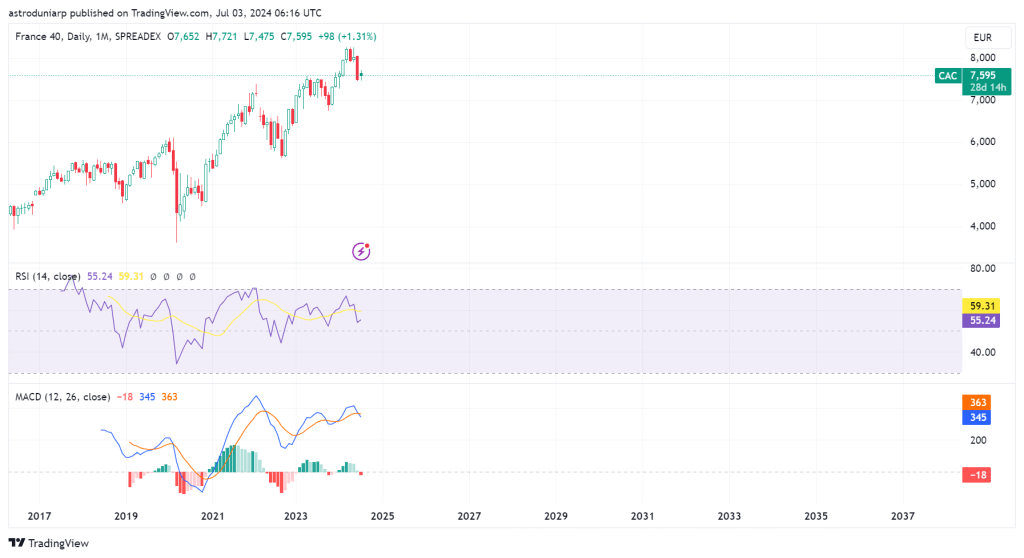

Live CAC Index

This section displays the advanced live chart of CAC Index from TradingView.

History of the CAC 40

The CAC 40 was introduced in 1987 by the Paris Bourse. It was created to provide a comprehensive measure of the performance of the largest and most actively traded stocks on the Paris stock exchange.

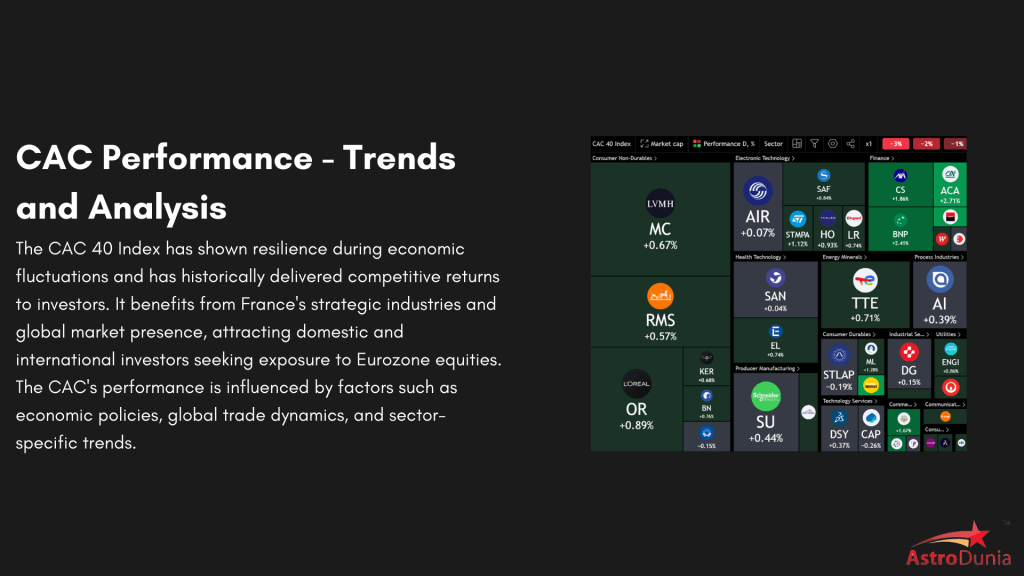

CAC 40 Forecast for 2024

Analysts predict that the CAC 40 will see moderate growth in 2024, driven by economic recovery and corporate earnings growth. However, there may be intermediate phases of correction as detailed in the Annual Letter 2024. Key sectors to watch include financials, consumer goods, and industrials. Join now to stay ahead in the market.

CAC 40 Forecast for Tomorrow

Daily forecasts for the CAC 40 are influenced by market sentiment, economic data releases, and geopolitical events. Traders should monitor key indicators such as Eurozone economic data, corporate earnings reports, and global market trends.. Get your daily dose of market insights and updates delivered straight to your inbox. Try our Daily Newsletter.

CAC 40 Forecast for the Next 10 Years

Long-term projections for the CAC 40 focus on macroeconomic trends, technological advancements, and European Union policies. Over the next decade, the index is expected to benefit from innovations in technology and healthcare, as well as shifts in global trade dynamics. Join Annual Letter now to make informed decisions.

CAC 40 Forecast for Today

Today’s forecast for the CAC 40 involves analyzing pre-market trends, global market performance, and key economic announcements. Investors should keep an eye on European Central Bank decisions, inflation data, and major corporate news. Join now to stay ahead in the market.

CAC 40 Forecast for Next Week

Weekly forecasts combine technical analysis and macroeconomic factors. Key events such as European Central Bank meetings and economic reports will significantly impact market movements. Try our Daily Newsletter service.

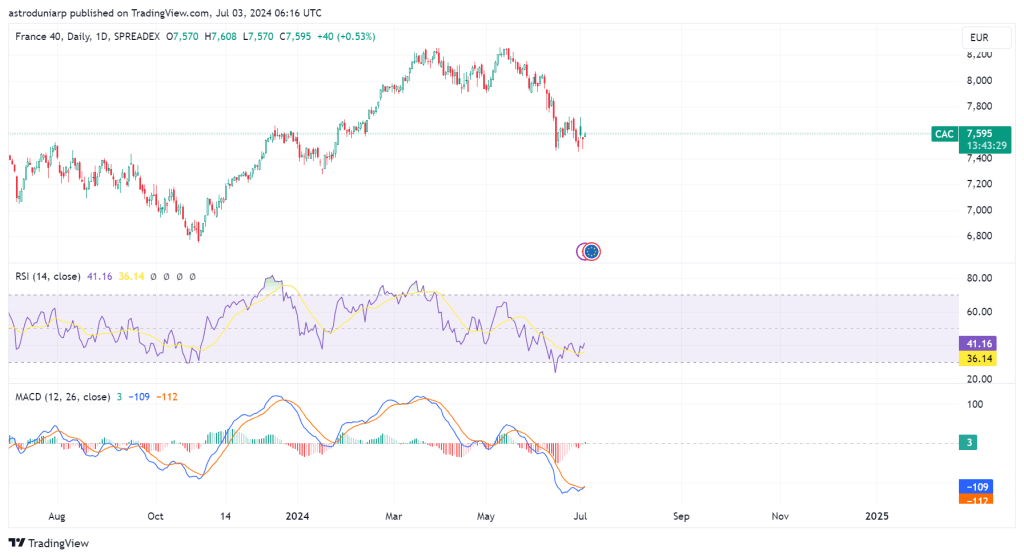

CAC 40 Technical Analysis Today

Technical analysis of the CAC 40 involves examining chart patterns, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and support and resistance levels to identify potential trading opportunities. Join Live signals service for real time market insights and signals.

Chart displaying Cac Index prices over a one year period

Top 20 Stocks in CAC

Find out the best-performing stocks in the CAC 40 Index. Click on the links for detailed information and insights into each stock’s performance and trends.

CAC 40 Forecast for the Next 5 Years

Medium-term forecasts consider economic cycles, fiscal policies, and technological trends. The CAC 40 is expected to grow over the next five years, driven by innovation and increased consumer spending, despite potential risks like geopolitical tensions and regulatory changes.

Chart displaying Cac Index prices over a the 5 years period

Live market Alerts on CAC 40

Stay ahead in the stock market with our comprehensive market alerts and live signals service.For More Information , you can contact us – +91 9669919000

CAC 40 Index (CAC)

The CAC 40 is a benchmark French stock market index representing the 40 largest companies by market capitalization on the Euronext Paris.

| No. | ETF Name | Symbol |

| 1. | Lyxor CAC 40 ETF | CAC |

| 2. | Amundi CAC 40 ETF | CW8 |

| 3. | Lyxor CAC 40 DR UCITS ETF – Acc | CACD |

| 4. | iShares MSCI France ETF | EWQ |

| 5. | Amundi MSCI France UCITS ETF | CFP1 |

| 6. | HSBC MSCI France UCITS ETF | HMCF |

| 7. | Lyxor MSCI France ETF | FR |

| 8. | Xtrackers CAC 40 UCITS ETF | XCAC |

| 9. | Ossiam CAC 40 Equal Weight NR ETF | EQWE |

| 10. | BNP Paribas Easy CAC 40 ETF | E40 |

Whether you’re a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited) – 2025