AST SpaceMobile Inc. (NASDAQ: ASTS) is a pioneering company in the satellite communications sector, aiming to create the first and only space-based cellular broadband network directly accessible by standard mobile phones. With growing investor interest in next-generation telecom infrastructure, ASTS stock has become one of the most discussed small-cap stocks in the space-tech and 5G ecosystem.

What Does AST SpaceMobile Do?

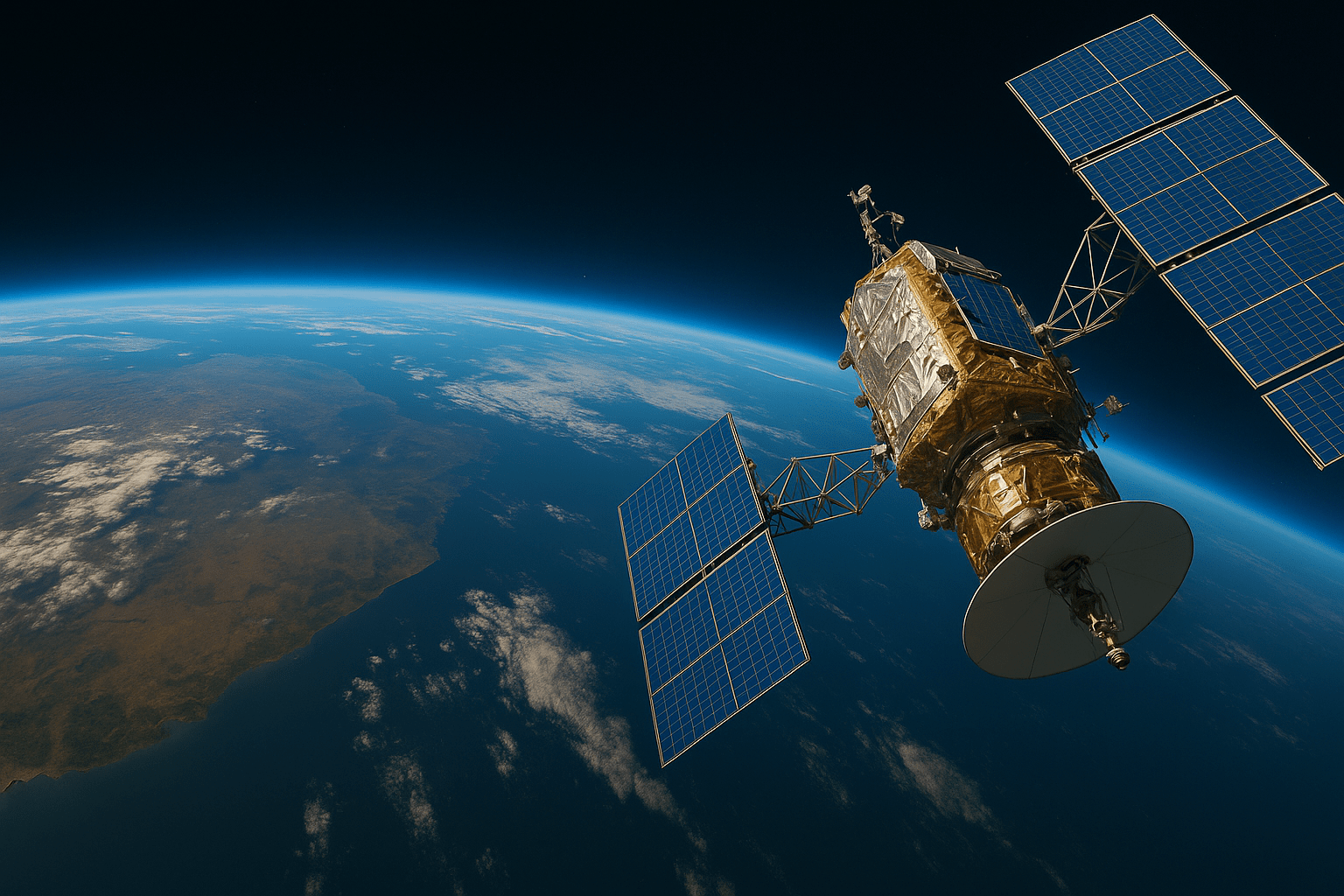

AST SpaceMobile’s mission is to eliminate cellular dead zones across the planet by launching a constellation of Low Earth Orbit (LEO) satellites that can directly connect to standard mobile phones without any modifications or satellite dishes. This technology could revolutionize global connectivity, especially in rural areas, oceans, and underserved regions.

Key offerings and goals of AST SpaceMobile include:

- Direct-to-smartphone satellite communication

- Global mobile broadband coverage

- Partnerships with major telecom operators

- Integration with 4G and 5G mobile networks

If successful, the company could compete with or complement existing terrestrial cell towers and legacy satellite providers like Starlink and Iridium.

ASTS Stock Performance and Recent Trends

ASTS went public via a SPAC merger in 2021 and has attracted speculative attention due to its ambitious mission and potential to reshape mobile communications. Since its listing on NASDAQ, the stock has experienced volatility due to funding concerns, regulatory milestones, and testing progress.

In 2025, ASTS stock has shown renewed interest as the company:

- Successfully tested space-to-mobile connectivity using 4G and 5G signals

- Announced partnerships with telecom giants like AT&T and Vodafone

- Completed multiple satellite deployments, including BlueWalker 3, a critical prototype for its planned network

The stock has become a favorite among retail investors tracking innovation in aerospace, satellite broadband, and emerging 5G markets.

Key Milestones for ASTS Stock

| Date | Event |

|---|---|

| Q4 2021 | ASTS completes SPAC merger and begins trading on NASDAQ |

| Q2 2022 | AT&T collaboration confirmed for U.S. coverage testing |

| Q3 2023 | BlueWalker 3 successfully connects to a standard smartphone |

| Q2 2024 | Additional satellites launched for extended beta coverage |

| Q1 2025 | AST announces global partnerships across Africa and Latin America |

These achievements have made ASTS stock an exciting, albeit risky, opportunity for long-term investors focused on disruptive telecom innovation

Risks and Challenges Facing ASTS

While the vision is bold, investors should be aware of the challenges that AST SpaceMobile faces:

- High Capital Requirements: Deploying and maintaining a global satellite network is capital-intensive. The company relies heavily on funding rounds and partnerships.

- Regulatory Approvals: ASTS needs international approvals and spectrum allocation agreements, which vary across regions and may delay expansion.

- Technology Risk: Real-time direct-to-mobile satellite connectivity is cutting-edge and unproven at commercial scale.

- Competition: Companies like Starlink (SpaceX) and Apple’s Emergency SOS via satellite offer overlapping features, though with different technologies.

- Stock Volatility: As a small-cap stock with speculative appeal, ASTS can be highly volatile in response to news, earnings, or test results.

Long-Term Vision and Market Opportunity

AST SpaceMobile is targeting a $1+ trillion global mobile telecom market, particularly the 5 billion mobile users worldwide. More than half the world’s population still experiences some form of cellular dead zone, making this technology crucial for:

- Emergency communications

- Remote business operations

- Maritime and aviation connectivity

- Developing nations’ access to internet and education

If ASTS can scale its technology and secure regulatory clearances, it may become a cornerstone of future telecom infrastructure.

Investment Outlook: Should You Buy ASTS Stock?

ASTS stock appeals to high-risk, high-reward investors who believe in the long-term potential of space-based communications. It is often compared to early-stage Tesla or SpaceX, in terms of disruption and market skepticism.

Bullish investors highlight:

- Exclusive market niche (direct satellite-to-smartphone)

- Real partnerships with global telecoms

- First-mover advantage

Bearish investors cite:

- Lack of consistent revenue

- Need for multiple funding rounds

- Delays in execution and deployment

A prudent strategy may involve monitoring technical developments, earnings calls, and satellite launches before taking large positions.

How ASTS Technology Works: Direct-to-Phone Explained

At the heart of AST SpaceMobile’s innovation is its direct-to-cell satellite technology. Unlike traditional satellite providers that require specialized phones or bulky terminals, AST’s technology enables standard smartphones to connect directly to satellites orbiting in low Earth orbit (LEO).

This is made possible through:

- Massive phased-array antennas on satellites (like BlueWalker 3) that can transmit signals to Earth with low latency.

- Spectrum sharing agreements with mobile operators to use existing telecom bands (e.g., LTE/5G) from space.

- Cloud-based ground network integration that connects the satellite to the internet and back-end telecom systems.

This means someone standing in a remote village or in the middle of the ocean can potentially make a call, send a message, or access mobile data — without needing to be near a cell tower.

AST SpaceMobile Partnerships: Telecom Industry Backing

ASTS has strategically aligned itself with some of the biggest telecom providers across the globe. This not only enhances its credibility but also expands its operational coverage in the future.

Key partners and collaborators include:

- AT&T (USA) – Testing and potential deployment in North America

- Vodafone (Europe and Africa) – Providing access to millions of users in underserved areas

- Rakuten (Japan) – Technology support and satellite integration for Asia

- Telefónica and TIM Brasil (Latin America) – Partnerships focused on remote regions

These partnerships give ASTS access to spectrum rights, ground stations, and end-user networks, all while reducing its cost of market entry and scaling.

ASTS Financial Snapshot and Valuation Insights

As of mid-2025, AST SpaceMobile remains in its pre-revenue growth stage, which means the company is still burning cash to fund satellite launches, R&D, and network testing.

Key financial highlights:

- Market Cap: ~$800 million to $1.2 billion (fluctuates with speculative interest)

- Revenue: Negligible to low single-digit millions (primarily from research contracts or pilot programs)

- Cash Burn: ~$50–100 million per quarter

- Funding: Raised capital through PIPEs, equity offerings, and strategic investments from partners

Despite the lack of profits, many investors value ASTS based on its technology moat and global addressable market (TAM), which exceeds $1 trillion.

Analyst Sentiment and Price Forecast

ASTS stock has a mixed rating from analysts:

- Bullish Outlook: Analysts who are optimistic believe that once the full constellation is operational (planned between 2025–2027), ASTS could generate billions in revenue annually from telecom licensing, emergency communication services, and data subscriptions.

- Bearish Outlook: Critics warn that the company may run out of cash before achieving commercial scale, especially if regulatory delays or technical issues arise.

Target Price Range (based on current analyst estimates):

- Bull Case: $10–$15 over the next 12–18 months

- Bear Case: <$2 if dilution continues or test launches fail

- Current (as of July 2025): Around $3–4 per share

Investors should expect volatility and monitor each satellite launch and quarterly update closely.

Potential Use Cases for ASTS Technology

ASTS technology has broad commercial and humanitarian applications. Here’s how it could disrupt multiple sectors:

| Sector | Use Case |

|---|---|

| Telecom | Expanding mobile coverage without building towers |

| Emergency Services | Disaster recovery communications during outages |

| Agriculture | Real-time updates and data analytics in rural farms |

| Transportation | Ship-to-shore and remote aviation communications |

| Military & Defense | Encrypted, remote mobile access in tactical zones |

| Tourism | Travelers accessing data on cruises or mountain trails |

This wide range of use cases contributes to the growing excitement around the company’s long-term potential.

ASTS in the News: Key Media Headlines

- “AST SpaceMobile Successfully Demonstrates First Space-Based 5G Call”

– A major milestone for the satellite industry and ASTS shareholders. - “Vodafone Backs AST’s Mission to Close the Coverage Gap”

– Focus on Africa, where millions remain unconnected. - “Investors Cautiously Optimistic as ASTS Begins Beta Coverage in Remote U.S. Regions”

– Early pilot programs gain traction but full coverage is still years away.

These headlines generate spikes in volume and price movement, making ASTS a stock to watch for traders.

Frequently Asked Questions (FAQs)

Q1: Is ASTS a good long-term investment?

ASTS is a speculative long-term play. If it succeeds, it could become a telecom infrastructure disruptor. But execution risk remains high.

Q2: How many satellites does AST SpaceMobile plan to launch?

The company eventually plans to launch over 100+ operational satellites to create a global network.

Q3: What makes ASTS different from Starlink?

Unlike Starlink, which requires a terminal dish, ASTS connects directly to your existing smartphone — no new hardware required.

Q4: Does ASTS have revenue today?

Currently, AST SpaceMobile generates limited revenue, mostly from pilot programs. Full monetization will begin once commercial service launches.

Q5: When will ASTS be profitable?

Analysts predict potential profitability post-2027, depending on successful launches and partnerships.