Your cart is currently empty!

CSPX vs VEEE: A Comprehensive Comparison of Popular ETFs

Exchange-traded funds (ETFs) are a popular investment vehicle that provides diversification, liquidity, and cost-efficiency. Investors often choose ETFs based on their desired exposure to specific markets, sectors, or geographic regions. Two popular ETFs are CSPX (iShares Core S&P 500 UCITS ETF) and VEEE (Vanguard FTSE Emerging Markets UCITS ETF). Although they are both managed by reputable asset management firms, their investment objectives, risk profiles, and overall strategies are significantly different. In this article, we provide a detailed comparison between CSPX and VEEE, covering their fundamentals, market focus, benefits, risks, and suitability for different investors.

1. Overview of CSPX and VEEE

CSPX (iShares Core S&P 500 UCITS ETF)

CSPX, managed by BlackRock under its iShares brand, aims to track the performance of the S&P 500 Index, which includes 500 of the largest U.S. companies by market capitalization. CSPX is a UCITS-compliant ETF domiciled in Ireland, providing a tax-efficient solution for European investors. CSPX is an accumulating ETF, meaning dividends from underlying stocks are reinvested instead of being distributed to shareholders. This structure makes CSPX particularly appealing to investors looking to benefit from the power of compounding.

The S&P 500 is one of the most widely recognized equity indices globally, and CSPX aims to replicate its performance by investing in its constituent companies across sectors like technology, healthcare, financials, and consumer discretionary. It is an excellent way to gain exposure to the U.S. economy, which is often regarded as one of the most stable and dynamic markets in the world.

VEEE (Vanguard FTSE Emerging Markets UCITS ETF)

VEEE, managed by Vanguard, seeks to track the FTSE Emerging Markets Index, which represents stocks from emerging markets like China, India, Brazil, and South Africa. VEEE is also UCITS-compliant and domiciled in Ireland, making it suitable for European investors. The ETF comes in both distributing and accumulating versions, giving investors the choice between receiving periodic income or reinvesting it automatically.

Emerging markets are characterized by high growth potential, though they are inherently riskier than developed markets. VEEE provides exposure to a wide array of sectors, including technology, financials, and consumer goods, allowing investors to tap into economies that are experiencing rapid growth and industrialization.

2. Investment Strategy and Market Focus

The fundamental difference between CSPX and VEEE lies in their investment strategy and geographic focus.

CSPX: The ETF focuses exclusively on the U.S. equity market, investing in well-established, large-cap companies that are part of the S&P 500. The U.S. market is mature, and companies in CSPX are often market leaders in their respective industries. Investors in CSPX are looking for stability, steady growth, and access to companies with proven track records.

VEEE: VEEE, on the other hand, invests in companies from emerging markets. These economies are generally in the growth phase, with high GDP growth rates, expanding middle classes, and increasing industrial output. Emerging markets can provide significant returns, but they are also prone to economic, political, and currency risks. By investing in VEEE, investors gain exposure to high-growth markets that may not be fully represented in developed market indices.

3. Risk Profile

Investing in CSPX and VEEE carries different levels of risk.

CSPX: The risk associated with CSPX is relatively moderate compared to emerging market investments. The S&P 500 consists of blue-chip companies with established businesses and strong financial performance. While U.S. equities are still subject to economic cycles, they are generally considered safer than emerging market equities due to the stability of the U.S. economy, reliable regulation, and transparent corporate governance.

VEEE: VEEE has a higher risk profile compared to CSPX, mainly due to the nature of emerging markets. Emerging economies face greater political instability, economic uncertainty, and currency fluctuations, all of which contribute to the higher volatility of VEEE. Additionally, regulatory frameworks in these markets may be less developed, leading to potential risks related to corporate governance and market transparency.

4. Performance and Returns

The historical performance of CSPX and VEEE highlights their distinct market exposures.

CSPX: Over the past decade, the S&P 500 has delivered strong returns, driven by a booming technology sector and consistent economic growth in the United States. CSPX has mirrored this performance, making it a solid choice for investors looking for long-term, steady growth. Companies like Apple, Microsoft, Amazon, and Tesla have significantly contributed to the overall returns of CSPX.

VEEE: The performance of VEEE is more variable due to the unique nature of emerging markets. While emerging markets have experienced periods of rapid growth, they have also been subject to economic downturns and global instability. For instance, geopolitical tensions, trade wars, and the COVID-19 pandemic have had significant impacts on emerging market performance. However, the long-term potential for growth remains strong, especially as emerging economies continue to industrialize and modernize.

5. Cost Efficiency

CSPX: CSPX has a relatively low expense ratio, making it cost-efficient for investors looking for exposure to the U.S. market. The ETF benefits from economies of scale, allowing BlackRock to keep fees minimal. This makes CSPX particularly appealing to long-term investors who are concerned about minimizing costs.

VEEE: VEEE also boasts a low expense ratio, typical of Vanguard’s emphasis on providing value to investors. While emerging markets may have higher transaction costs due to currency conversion and market access, Vanguard has managed to keep the fund’s costs reasonable, providing an affordable way to gain exposure to high-growth markets.

6. Suitability for Investors

CSPX: CSPX is suitable for investors looking for a relatively stable, long-term investment. It is ideal for those seeking exposure to the U.S. economy and preferring the stability of developed markets. CSPX is particularly appealing to investors who want to benefit from the consistent growth of large-cap companies while minimizing risk.

VEEE: VEEE, on the other hand, is suitable for investors with a higher risk tolerance who are looking to diversify their portfolios by adding exposure to emerging markets. It is ideal for those seeking high growth potential and willing to accept greater volatility. VEEE can serve as a complementary holding to developed market ETFs, providing diversification benefits and the opportunity to capture the growth of developing economies.

7. Diversification Benefits

Combining CSPX and VEEE in a portfolio can provide significant diversification benefits. CSPX provides exposure to the stability and growth of the U.S. economy, while VEEE offers the potential for high returns from emerging markets. By including both ETFs, investors can achieve geographic diversification, reduce overall portfolio risk, and take advantage of different market cycles.

Reduced Correlation: Emerging markets often have a lower correlation with developed markets like the U.S., meaning that their performance may not move in sync. This helps reduce overall portfolio volatility, especially during periods of market turmoil in developed economies.

Growth Opportunities: Emerging markets represent a significant portion of global GDP, and their share is expected to grow in the coming decades. By holding both CSPX and VEEE, investors position themselves to benefit from both the stability of the U.S. and the dynamic growth of emerging economies.

8. Conclusion

CSPX and VEEE are two distinct ETFs that cater to different investment needs. CSPX, the iShares Core S&P 500 UCITS ETF, is a reliable choice for investors seeking stability and exposure to the largest companies in the U.S. It offers consistent growth, moderate risk, and a low-cost way to invest in one of the most influential equity markets globally. On the other hand, VEEE, the Vanguard FTSE Emerging Markets UCITS ETF, provides access to high-growth emerging markets that offer significant long-term potential but come with higher risk and volatility.

Ultimately, the choice between CSPX and VEEE depends on an investor’s risk tolerance, investment goals, and desire for geographic diversification. A well-balanced portfolio may include both ETFs, allowing investors to benefit from the growth opportunities of emerging markets while maintaining the stability of developed markets like the U.S. By understanding the differences between these two ETFs, investors can make informed decisions that align with their financial objectives and risk appetite.

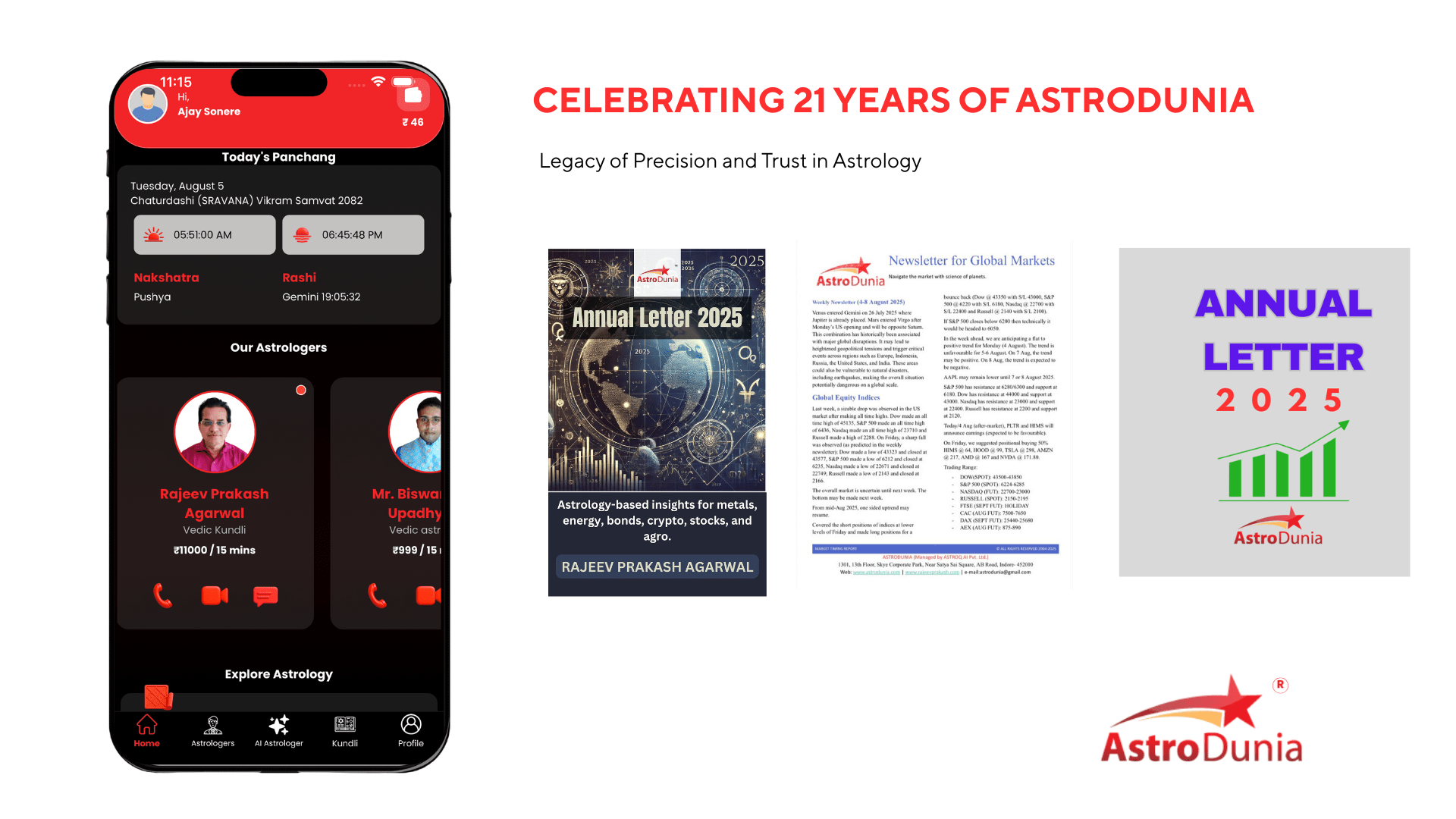

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.