Unleash the Potential of Precious Metals

Grab the market trends

Navigate Market Trends and Economic Forces with Our Expert Guidance, Capitalize on Lucrative Opportunities Despite Volatility in commodity market

Investing Smarter for a

Brighter Future

Silver: Strategic Insights, Forecasts, and Cyclical Market Behavior

Silver is one of the most dynamic and multifaceted metals in the global market. It serves a dual purpose—valued both as a precious metal for investment and as an industrial metal for manufacturing. Its unique positioning makes it highly sensitive to both economic sentiment and industrial trends. At RajeevPrakash.com, we provide comprehensive silver market analysis combining technical and fundamental perspectives with astro-financial timing to support informed decision-making.

Unleashing the Potential of Silver

Silver has long been a prized commodity, valued for its industrial applications, aesthetic appeal, and role as a financial asset. As an investment, silver offers unique opportunities and potential benefits, making it a popular choice for diversifying portfolios and hedging against economic uncertainties. In this guide, we’ll explore the various aspects of silver investment, including its historical significance, current market trends, and strategies for successful investing.

The History of Silver as an Investment

Silver has been used as a form of currency and a store of value for thousands of years. From ancient civilizations to modern economies, silver has played a crucial role in global trade and finance. Historically, silver was used to mint coins and as a standard for economic transactions. Today, it remains a valuable asset due to its industrial uses and its role as a hedge against inflation and economic instability.

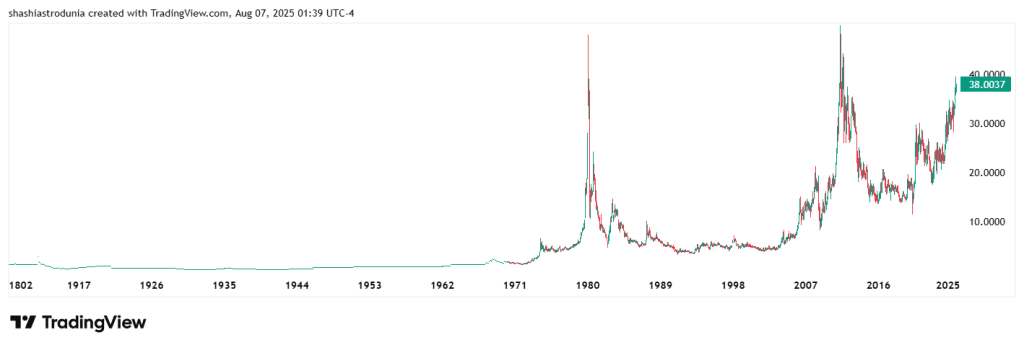

Live Silver Chart

This section displays the advanced live chart of Silver Index from TradingView.

Analyzing Silver Prices: Charts and Forecasts

Long-Term Trends: Understanding long-term trends can help guide your investment strategy. Analyze historical price data and economic indicators to identify patterns and make informed predictions about silver’s future performance.

Live Silver Chart: Use our advanced live chart to monitor silver prices in real-time. This tool helps you track market trends, spot opportunities, and make informed investment decisions based on current data.

Daily and Weekly Forecasts: Stay ahead of market trends with our daily and weekly forecasts. Our expert analysis provides insights into price movements, market sentiment, and economic factors that influence silver prices.

Why Choose Us ?

Astrodunia guides you through the market’s ups and downs with the help of planetary science. Our team of experts in financial astrology provide valuable insights and predictions to assist you in market wise investment decisions and navigate the global market with ease.

Market Forecasting

Experience the advantage of enhanced market predictions. Our unique approach combines traditional analysis with astrological insights for more accurate predictions and better investment opportunities.

Decades of Market Timing Expertise

For over 20 years, we’ve honed our skills in market timing within the stock market. Our extensive experience allows us to navigate market trends with precision and confidence.

Trusted by Discerning Investors

Our clients choose us for our proven track record of success and our commitment to providing them with the most reliable market insights. Join the ranks of satisfied investors who trust our expertise

Why Invest in Silver?

Affordability: Compared to gold, silver is more affordable, making it accessible to a broader range of investors. This lower entry point can be appealing for both new and experienced investors looking to add precious metals to their portfolios.

Industrial Demand: Silver is used in a wide range of industrial applications, including electronics, solar panels, and medical equipment. The growing demand for these technologies often drives silver prices higher, presenting opportunities for investors.

Safe Haven Asset: During times of economic uncertainty or inflation, investors turn to silver as a safe haven. Silver’s value tends to rise when traditional investments, like stocks or bonds, are underperforming.

Diversification: Adding silver to your investment portfolio can help diversify your assets and reduce risk. Silver often behaves differently from other financial instruments, such as stocks and bonds, providing a hedge against market volatility.

Current Market Trends for Silver

Inflation Concerns: Rising inflation can erode the purchasing power of traditional currencies, making silver an attractive investment. Historically, silver has served as a hedge against inflation, preserving wealth during periods of rising prices.

Economic Recovery and Industrial Growth: As economies recover from global disruptions, the demand for silver in industrial applications is expected to increase. Sectors such as renewable energy and technology are driving this demand, which could lead to higher silver prices.

Geopolitical Tensions: Geopolitical events and economic policies can impact silver prices. Uncertainty in global markets often leads to increased investment in silver as a hedge against potential risks.

Daliy and Weekly Silver Forecasts at your fingertips

Make profitable decisions with expert silver forecasts and detailed market analysis. Our insights help you identify trends, manage risks, and maximize your investment returns. Stay informed with our comprehensive reports and expert recommendations to navigate the silver market effectively.

Strategies for Investing in Silver

Silver Futures and Options: For more experienced investors, silver futures and options provide a way to speculate on silver price movements. These financial instruments can offer significant leverage but come with higher risk and complexity. They require a good understanding of the market and careful risk management.

Physical Silver: Investing in physical silver involves purchasing bullion bars, coins, or rounds. This tangible asset can be stored in a safe or a secure vault. Physical silver provides the benefit of owning the metal directly, but requires careful storage and insurance considerations.

Silver ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds offer a way to invest in silver without holding physical metal. These funds track the price of silver or invest in silver mining companies. They offer liquidity and ease of trading, making them a popular choice for investors seeking exposure to silver markets.

Silver Mining Stocks: Investing in silver mining companies provides indirect exposure to silver prices. These stocks can offer potential for higher returns if the companies perform well. However, they also carry risks related to the mining industry and individual company performance.

Key Drivers of Silver Prices

Silver prices are influenced by a combination of factors. These include inflation trends, currency fluctuations, industrial demand growth, and shifts in investor risk appetite. Geopolitical tensions, central bank actions, and fiscal stimulus programs can also impact market direction.

Due to its dual nature, silver often exhibits higher volatility compared to gold. It may outperform during bullish commodity cycles and correct more sharply during downturns. This behavior makes timing strategies and forecast accuracy particularly important for silver traders and investors.

Forecast Methodology and Astrological Timing

Our silver forecasts are grounded in a hybrid methodology. We assess market trends using macroeconomic data, technical charting, and planetary cycles that align with historic turning points. This astro-financial approach enhances our ability to anticipate trend shifts, breakout periods, and reversal zones.

Transits of Mercury and Uranus often correspond with sharp price moves in silver, particularly during periods of geopolitical disruption or sudden demand spikes. Eclipses and lunar cycles may indicate inflection points that coincide with speculative market activity.

Silver Trading and Investment Strategies

Silver offers a wide range of investment vehicles—from physical coins and bullion to futures, ETFs, and mining stocks. Active traders often use technical setups to take advantage of short-term volatility, while long-term holders focus on macro trends and accumulation strategies.

Given silver’s volatility, risk management is essential. Leverage, position sizing, and stop-loss discipline should be tailored to match market conditions and investor goals. Our forecast alerts and planetary timing cycles help traders time entries and exits with greater precision.

Gold – The Foundation of Monetary Stability

While silver reflects both industrial demand and speculative momentum, gold remains the ultimate benchmark for wealth preservation and monetary stability. It has historically served as a global reserve asset and continues to influence central bank policy, investment flows, and global economic sentiment.

Discover the Industrial Pulse: Copper Market Analysis

While silver bridges the world of precious and industrial metals, copper stands as a pure indicator of global economic health. Often referred to as “Dr. Copper” due to its predictive power in economic cycles, copper prices reflect construction demand, manufacturing output, and energy infrastructure trends.

Frequently Asked Questions

History Of Silver

Silver has a rich history, being used for currency, jewelry, and industrial applications for thousands of years. It has played a significant role in global trade and continues to be a valuable asset in modern financial markets.

Silver Forecast For 2024

Analysts predict that silver prices will increase in 2024 due to industrial demand and economic recovery. Factors such as technological advancements and renewable energy projects will drive silver demand. Join our live signal service for real-time trading decisions. Join our Annual Letter now to make informed decisions. For traders, we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Silver Forecast For Tomorrow

Daily forecasts for silver are influenced by market sentiment, economic data releases, and industrial demand. Key indicators to monitor include manufacturing data, currency movements, and economic policies. Subscribe to our Daily Newsletter for market updates.Get your daily dose of market insights and updates delivered straight to your inbox. Try our Daily Newsletter.

Silver Forecast For Today

Today’s forecast for silver involves analyzing pre-market trends, global market performance, and key economic announcements. Investors should watch for industrial activity, inflation data, and economic policies. Subscribe to our live signals service for real-time updates.. we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Chart showing silver prices over 1 year

Silver Forecast For Next Week

Weekly forecasts combine technical analysis and macroeconomic factors. Events like manufacturing reports and economic policies will significantly impact silver prices. Get weekly market insights with our Daily Newsletter service. Get your daily dose of market insights and updates delivered straight to your inbox.Try our Daily Newsletter service.

Silver Forecast For The Next 5 Years

Medium-term forecasts consider economic cycles, fiscal policies, and technological trends. Over the next five years, the S&P 500 is expected to see growth driven by innovation in technology and healthcare, increased consumer spending, and supportive fiscal policies. However, potential risks include geopolitical tensions, regulatory changes, and market volatility. Want to stay long-term in the market?

For More Information , you can contact us – +91 9669919000

Chart showing silver prices over 5 years

Chart showing silver prices over the time

Silver ETFs

Investing in silver ETFs provides an easy and cost-effective method to gain exposure to silver prices without buying or storing the physical metal. This can be a valuable strategy for diversifying one’s investment portfolio.

| No. | ETF Name | Symbol |

| 1. | iShares Silver Trust | SLV |

| 2. | abrdn Physical Silver Shares ETF | SIVR |

| 3. | Sprott Physical Silver Trust | PSLV |

| 4. | Invesco DB Silver Fund | DBS |

| 5. | ProShares Ultra Silver | AGQ |

| 6. | ProShares UltraShort Silver | ZSL |

| 7. | ETFS Physical Silver Shares | SIVR |

| 8. | iPath Series B Bloomberg Silver Subindex Total Return ETN | SBUG |

| 9. | Global X Silver Miners ETF | SIL |

| 10. | First Trust Global Tactical Commodity Strategy Fund | FTGC |

Testimonials

Discover what our satisfied customers have to say about their experience with us. Read our testimonials from people just like who have benefited from our services.

Market singals have helped me to make quick and informed decisions for trades in stock market. resulting in significant profits for my portfolio. The team is highly professsional and always available to answer your questions and provide the best customer service.

SK Jhunjhunwala

Investor based in Mumbai

I have been using the astrodunia’s services for over 4+ years now and have been extremely impressed with level of experties and precions they bring to the table. Their live market signals have helped me make quick and informed decisions.

N. Patel

Pennsylvania , US

Excellent service. This is undoubtedly the best market forecast newsletter that i have ever subscribed. None of the other newsletter are anywhere close to this terms of accuracy. Please continue with the good work !

Withheld

Fixed income trader with a required foreign bank in asia

i am an entrepreneur based in Australia and have been subscriber of astrodunia services from the past two years.i have found their NewsLetter , Live Signals and Annual Letter to be incredibly valueable.

Z. Irani

Australia

Meet Our Team

Get to know our dedicated team of experts. With a diverse range of skills and years of experience, we’re committed to providing you with the best market analysis and investment guidance.

Mr. Rajeev Prakash Agarwal

Founder

Expert in financial & personal astrology for 20 years+. Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology.

Mr. Shashi Prakash Agarwal

Technical Head

Shashi is a technology leader with a strong background in global business.He holds a B. Tech in Computer Science & MBA in Finance from Narsee Monjee Institute of Management Studies, one of the top B-Schools in India.

Illuminate Your Investment Opportunities

Stay informed with market updates

Discover the Power of Silver: Our Market Compass provides expert insights to help you capitalize on the year’s hottest trends and navigate economic forces effectively

Start your journey to financial

success with us

Whether you’re a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited) – 2025