Market Outlook, Risk Factors, and Investment Strategy

Gold remains one of the most closely watched assets for US investors, especially during periods of inflation uncertainty, Federal Reserve policy shifts, and equity market volatility.

Unveiling Historical Gold Price Trends In Your Favour

Gold Market Scenario Selector

Select current US macro conditions to see a practical gold bias (bullish, neutral, defensive) with a short explanation. Educational only. No price predictions.

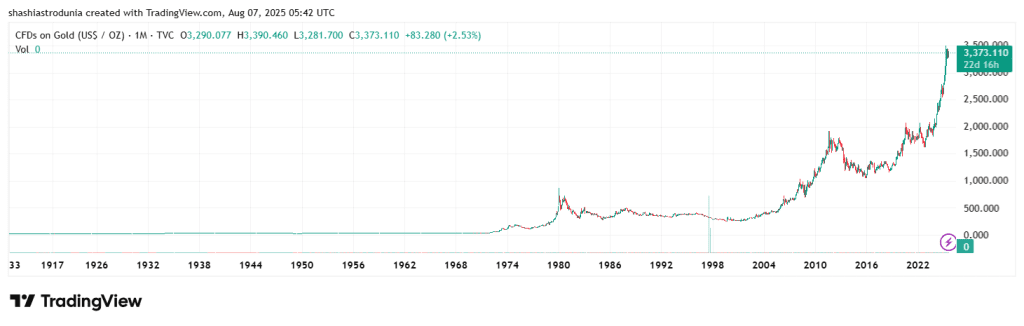

Live Gold Chart

This section displays the advanced live chart of Gold from TradingView.

Gold: Market Overview, Forecasts & Strategic Insights

Gold has earned its place as both a time-tested store of value and a dynamic trading asset. It plays a leading role in portfolio diversification, geopolitical hedging, and inflation protection. At RajeevPrakash.com, we combine traditional market analysis with astrological timing to deliver meaningful insights into gold’s behavior and future trends.

Gold remains a foundational asset in global finance. Its behavior is influenced by competing economic forces, investor sentiment, and macro-political trends. Our unique approach—merging traditional analysis with astro-financial timing—helps our readers navigate gold markets with clarity and confidence. Whether you trade active contracts or hold physical bullion, our insights offer a refined edge in decision-making.

Market Dynamics and Key Drivers

Gold prices fluctuate due to several influential factors. Macroeconomic conditions, monetary policy decisions, inflation expectations, and currency strength—particularly of the U.S. dollar—all significantly impact gold’s market behavior. Additionally, shifts in ETF flows, institutional buying, and physical demand from jewelry and industry influence short-term price moves.

Gold also reflects broader investor psychology. In periods of market stress, geopolitical tension, or tightening fiscal conditions, gold typically acts as a safe haven. Conversely, during risk-on rallies or rising interest rates, gold may underperform relative to other assets.

Medium- and Long-Term Outlook

In the medium term, gold may trade within a defined range as markets stabilize following recent global uncertainties. Its resilience will depend on inflation persistence, central bank policies, and safe-haven demand flows.

Over the long term, the ongoing trend of low or negative real interest rates, coupled with accommodative monetary environments, supports gold’s status as a hedge. Its future trajectory will also depend on fiscal policies, geopolitical risk, and shifts in investor appetite for alternative store-of-value assets such as digital gold.

Stay Ahead of the Curve In Gold Prediction

Make profitable decisions with expert gold predictions and detailed market analysis. Our insights help you identify trends, manage risks, and maximize your investment returns. Stay informed with our comprehensive reports and expert recommendations to navigate the gold market effectively.

Gold in Relation to Global Risk and Inflation

Gold often serves as a barometer for global investor sentiment. It tends to rise during geopolitical tensions, market corrections, and periods of monetary easing. Its performance often correlates with real interest rates and inflation expectations. Rising inflation or growing uncertainty tends to enhance gold demand, while strong economic recovery and rate hikes may limit its upside.

Seasonal & Cyclical Behavior

Gold has seasonal patterns that may affect demand and price. Demand typically increases during certain cultural periods when jewelry purchases rise or festivals are in full swing, particularly in India and China. Shipping disruptions, mining production cycles, and holiday demand cycles can also lead to volatility. By overlaying these cycles with astrological projections, we highlight key periods of market activity.

Gold is often compared with silver, copper, and energy commodities for relative strength analysis. Its correlation with the U.S. dollar is particularly important—when the dollar weakens, gold usually strengthens, and vice versa. Our models evaluate these relationships to contextualize gold’s current and potential price moves within broader commodity cycles.

Also Explore: Silver – The Metal of Dual Value

While gold represents stability and wealth preservation, silver holds a unique dual role as both a precious and industrial metal. Its price behavior is influenced not only by global economic sentiment and inflation expectations, but also by industrial demand from sectors such as electronics, photovoltaics, and medicine.

Copper Market Analysis

While silver and gold bridges the world of precious and industrial metals, copper stands as a pure indicator of global economic health. Often referred to as “Dr. Copper” due to its predictive power in economic cycles, copper prices reflect construction demand, manufacturing output, and energy infrastructure trends.

Why Choose Us ?

Astrodunia guides you through the ups and downs in precious metals (such as Gold or SIlver) with the help of planetary science. Our team of experts in financial astrology provide valuable insights and predictions to assist you in market wise investment decisions and navigate the global market with ease.

Astrological Market Forecasting

Experience the advantage of astrology-enhanced market predictions. Our unique approach combines traditional analysis with astrological insights for more accurate predictions and better investment opportunities.

Decades of Market Timing Expertise

For over 20 years, we’ve honed our skills in market timing within the stock market. Our extensive experience allows us to navigate market trends with precision and confidence.

Trusted by Discerning Investors

Our clients choose us for our proven track record of success and our commitment to providing them with the most reliable market insights. Join the ranks of satisfied investors who trust our expertise

Meet Our Team

Get to know our dedicated team of experts. With a diverse range of skills and years of experience, we’re committed to providing you with the best market analysis and investment guidance.

Mr. Rajeev Prakash Agarwal

Founder

Expert in financial & personal astrology for 20 years+. Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology.

Mr. Shashi Prakash Agarwal

Technical Head

Shashi is a technology leader with a strong background in global business.He holds a B. Tech in Computer Science & MBA in Finance from Narsee Monjee Institute of Management Studies, one of the top B-Schools in India.

Navigate Trends & Forces for Financial Success in commodity market

Our Gold service equips you to profit from the year’s hottest trends and economic forces, guiding you to financial success regardless of global stock and commodity market fluctuations

Start your journey to financial

success with astrodunia’s

commodity services

Testimonials

Discover what our satisfied customers have to say about their experience with us. Read our testimonials from people who have benefited from our services.

Market singals have helped me to make quick and informed decisions for trades in stock market. resulting in significant profits for my portfolio. The team is highly professsional and always available to answer your questions and provide the best customer service.

SK Jhunjhunwala

Investor based in Mumbai

I have been using the astrodunia’s services for over 4+ years now and have been extremely impressed with level of experties and precions they bring to the table. Their live market signals have helped me make quick and informed decisions.

N. Patel

Pennsylvania , US

Excellent service. This is undoubtedly the best market forecast newsletter that i have ever subscribed. None of the other newsletter are anywhere close to this terms of accuracy. Please continue with the good work !

Withheld

Fixed income trader with a required foreign bank in asia

i am an entrepreneur based in Australia and have been subscriber of astrodunia services from the past two years.i have found their NewsLetter , Live Signals and Annual Letter to be incredibly valueable.

Z. Irani

Australia

Frequently Asked Questions

History Of Gold

Gold has been a significant store of value for centuries, with its history dating back to ancient civilizations. It has been used as currency, a symbol of wealth, and an essential component in various industries. Over time, gold has maintained its importance in the financial markets as a hedge against inflation and economic uncertainty.

Gold Forecast For 2024

Analysts predict that gold prices will remain stable or increase in 2024 due to geopolitical tensions and economic uncertainties. Factors such as inflation rates, interest rates, and global demand will play crucial roles. Subscribe to our live signal service to make real-time informed decisions. Want to stay long-term in the market? Join our Annual Letter now to make informed decisions. For traders, we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Gold Forecast For Tomorrow

Daily forecasts for gold are influenced by market sentiment, economic data releases, and geopolitical events. Key indicators to monitor include inflation rates, currency movements, and central bank policies. Get your daily dose of market insights and updates delivered straight to your inbox with our Daily Newsletter. Get your daily dose of market insights and updates delivered straight to your inbox. Try our Daily Newsletter.

Gold Forecast For Today

Today’s forecast for gold involves analyzing pre-market trends, global market performance, and key economic announcements. Investors should watch for interest rate changes, inflation data, and geopolitical events. Subscribe to our live signals service to stay ahead in the market. we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Gold Forecast For Next Week

Weekly forecasts combine technical analysis and macroeconomic factors. Events like Federal Reserve meetings and economic reports will significantly impact gold prices. Get weekly market insights and updates with our Daily Newsletter service. Get your daily dose of market insights and updates delivered straight to your inbox. Try our Daily Newsletter service.

A chart displaying gold prices over a one-year period.

Gold Forecast For The Next 5 Years

Medium-term forecasts consider economic cycles, fiscal policies, and technological trends. Gold prices are expected to remain strong over the next five years due to its safe-haven appeal and increasing demand from emerging markets.

Subscribe Annual Letter now to make informed decisions.

For More Information , you can contact us – +91 9669919000

A chart displaying gold prices over a five-year period.

A chart displaying gold prices over an all-time period.

Gold ETFs

Investing in gold ETFs offers a convenient and cost-effective way to gain exposure to gold prices without the need to purchase or store physical gold. This approach provides a strategic option for diversifying an investment portfolio.

| No. | ETF Name | Symbol |

| 1. | SPDR Gold Shares | GLD |

| 2. | iShares Gold Trust | IAU |

| 3. | Aberdeen Standard Physical Gold Shares ETF | SGOL |

| 4. | Invesco DB Gold Fund | DGL |

| 5. | GraniteShares Gold Trust | BAR |

| 6. | ProShares Ultra Gold | UGL |

| 7. | VanEck Vectors Gold Miners ETF | GDX |

| 8. | VanEck Vectors Junior Gold Miners ETF | GDXJ |

| 9. | GraniteShares Gold Mini-Basket ETF | GBAR |

| 10. | WisdomTree Efficient Gold Plus Equity Strategy Fund | GDE |

Whether you’re a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited) – 2025