Your cart is currently empty!

BRK.B financial analysis and details

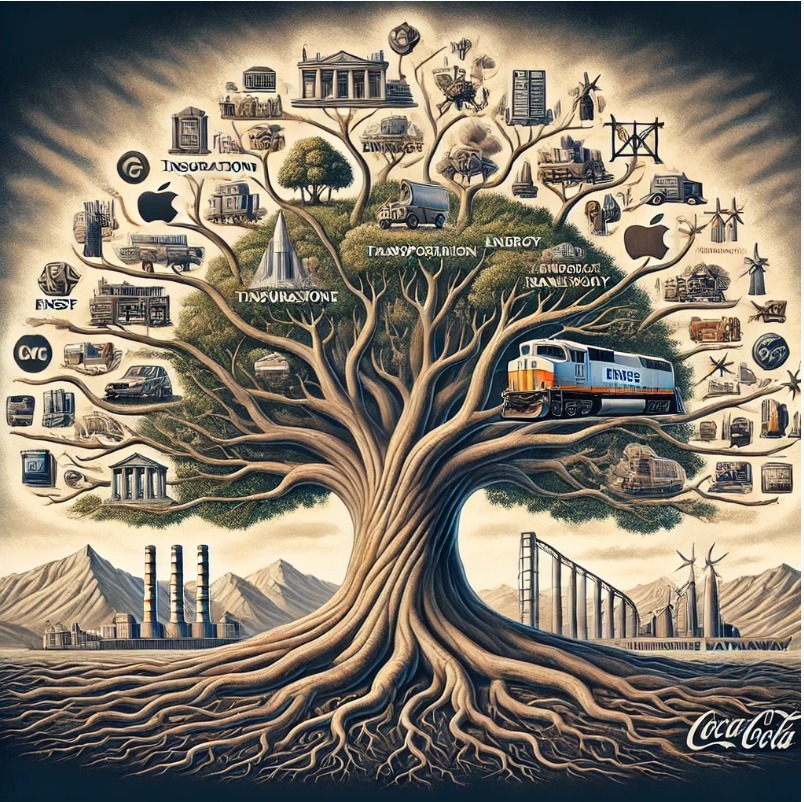

Berkshire Hathaway Inc. (BRK.B), one of the most influential conglomerates in the world, represents the vision and long-term strategy of Warren Buffett. With roots in the textile industry, the company has evolved into a global holding giant, boasting subsidiaries in diverse sectors including insurance, utilities, railroads, and consumer goods.

The Evolution of BRK.B

Berkshire Hathaway’s Class B shares (BRK.B) were introduced in 1996 as a more affordable alternative to the Class A shares (BRK.A), which trade at significantly higher prices. This move allowed smaller investors to gain exposure to the company without the need for significant capital.

Buffett’s investment philosophy, based on value investing and acquiring companies with strong fundamentals, has driven Berkshire’s growth for decades. His strategy revolves around finding undervalued companies with solid management and holding them for long-term gains. Investors conducting a BRK.B financial analysis often examine the company’s evolution, reflecting its path to becoming a dominant force in multiple sectors.

Performance and Key Metrics of BRK.B Financial Analysis

As of October 2024, BRK.B trades around $455 per share. Over the last 52 weeks, the stock has experienced a significant price increase of approximately 31.69%, reflecting strong investor confidence. Its price-to-earnings (P/E) ratio stands at 14.45, with a forward P/E of 22.30, indicating that while it is fairly valued now, expectations for future earnings growth remain high.

Berkshire Hathaway’s impressive financial position is reflected in its vast cash reserves. As of 2024, the company holds nearly $277 billion in cash and cash equivalents, a key factor in its ability to seize strategic opportunities, such as major acquisitions or stock buybacks. Its net cash position of $153 billion further enhances its financial flexibility.

Revenue and Profitability

In the past year, Berkshire Hathaway generated over $370 billion in revenue, with net earnings of $67.86 billion. Its operating margin stands at 23.61%, indicating strong operational efficiency across its business lines. The company’s profitability is underscored by its 18.33% profit margin and its return on equity (ROE) of 11.82%, which demonstrates effective use of shareholder funds to generate profit.

Key Holdings and Investment Philosophy

Berkshire Hathaway’s portfolio is famously diversified, with substantial investments in companies like Apple, American Express, Coca-Cola, and Bank of America. Its subsidiary holdings range from GEICO in insurance to BNSF Railway in transportation.

Buffett has always emphasized owning businesses with sustainable competitive advantages, a principle that has steered Berkshire toward steady, long-term growth rather than speculative investments. When conducting a BRK.B financial analysis, it is important to consider the conglomerate’s vast portfolio and steady financials, which serve as a bedrock for its consistent performance.

Challenges and Market Risks

While Berkshire Hathaway has performed well over time, it is not without risks. The company’s large investments in sectors such as financial services and consumer goods mean that it is sensitive to macroeconomic conditions. Rising interest rates, inflation, and market volatility could impact its financial performance.

Furthermore, the age of Warren Buffett and his eventual succession pose questions for some investors. Although Buffett has built a strong management team, his departure from the company could alter investor sentiment.

Conclusion

Berkshire Hathaway (BRK.B) continues to be a cornerstone for investors looking for stability and growth in an unpredictable market. Its diverse portfolio, prudent management, and robust financial position make it a reliable choice for long-term investors. Despite market challenges, Berkshire’s adaptability and strategic vision have enabled it to maintain its position as one of the most respected and profitable conglomerates in the world.

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Featured Post

Financial Astrology Terminal

The Financial Astrology Terminal is a web platform that combines real-time U.S. market data (S&P 500, Nasdaq, Dow, Russell, key stocks and commodities like gold and silver) with planetary cycles, giving traders and investors astro-timing signals on top of normal charts and analysis.