The Lifeblood of the Global Economy

Crude oil, the lifeblood of the global economy, offers immense investment potential. Navigate this dynamic market with confidence using our expert insights and data-driven analysis.

Your Gateway to Profitable

Energy Investments

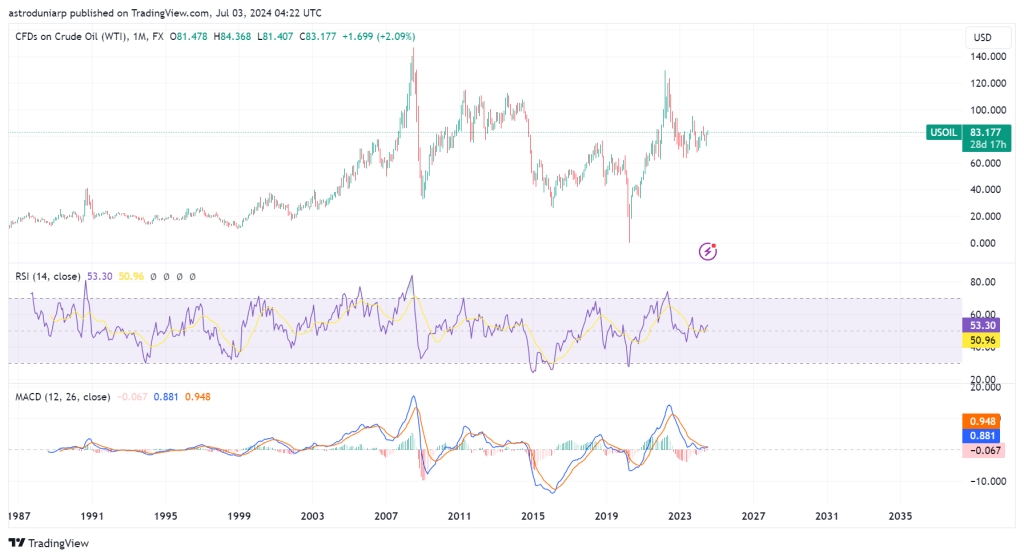

Live Crude Oil Chart

This section displays the advanced live chart of Crude Oil Index from TradingView.

Current Market Overview

In recent years, crude oil prices have experienced heightened volatility due to fluctuating demand, supply chain disruptions, geopolitical tensions, and shifts in production strategies by major oil-producing countries. While global consumption has rebounded post-pandemic, challenges remain in balancing supply with future sustainability goals.

Renewables are rising, but oil remains dominant in transportation and petrochemical sectors.

Crude oil traded in a broad range, driven by OPEC+ decisions and shifting demand from emerging markets.

Refinery outputs, strategic reserves, and currency strength continue to influence short-term price movements.

Crude Oil Forecast: 2025 and Beyond

Our forecasts are informed by a blend of technical indicators, macroeconomic factors, and financial astrology models. The goal is to provide accurate, timely insights to aid both short-term traders and long-term investors.

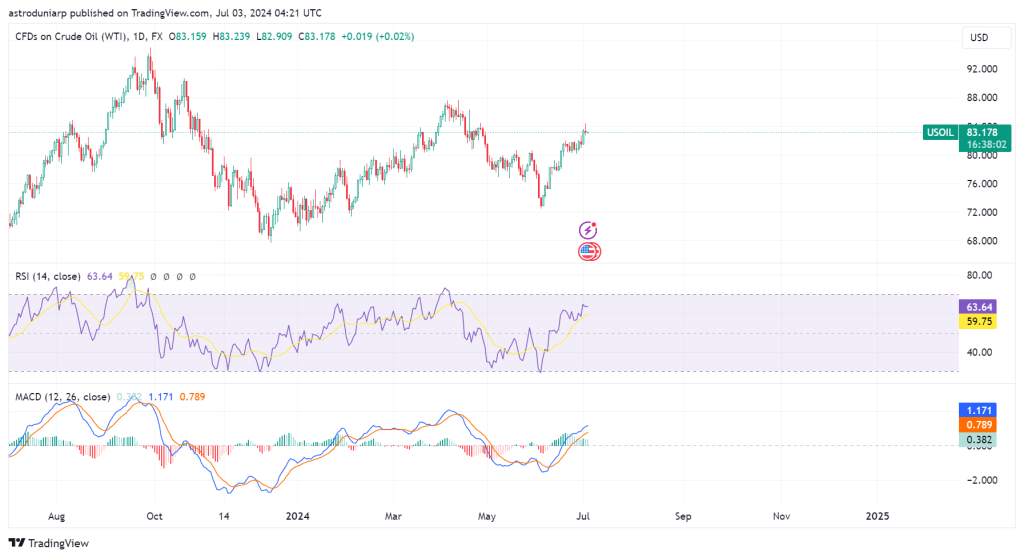

Short-Term Outlook

- Daily and weekly price patterns indicate consolidation within the mid-$70s to mid-$80s per barrel range.

- Market sentiment remains reactive to geopolitical updates, interest rate decisions, and inventory data.

Mid-Term Outlook

- Prices are expected to face pressure from rising global stockpiles and moderation in economic growth across developed markets.

- OPEC+ production adjustments will remain a critical driver of medium-term trends.

Long-Term Perspective

- Despite volatility, crude oil is expected to remain a key energy source through 2030.

- Technological innovation, energy transition policies, and electric vehicle adoption will gradually reshape long-term demand.

Expert Guidance for Optimal Returns

Maximize your portfolio’s performance with our expert asset allocation guidance. We help you diversify across equities, metals, currencies, bonds, energy products, and agriculture to optimize returns in this volatile market.

Crude Oil: Market Dynamics, Forecast, and Strategic Insights

Crude oil is one of the most influential commodities in the global economy. Its role extends far beyond fuel, affecting everything from industrial production and international relations to inflation and investment trends. At RajeevPrakash.com, we provide deep insights into the evolving crude oil market, offering expert forecasts and analysis that blend economic indicators with advanced astro-financial timing.

Crude oil has historically been the backbone of industrial progress. Since its discovery and widespread usage, it has fueled transportation, powered manufacturing, and shaped the course of modern development. Even today, it continues to influence national energy policies and plays a central role in the formulation of global economic strategies.

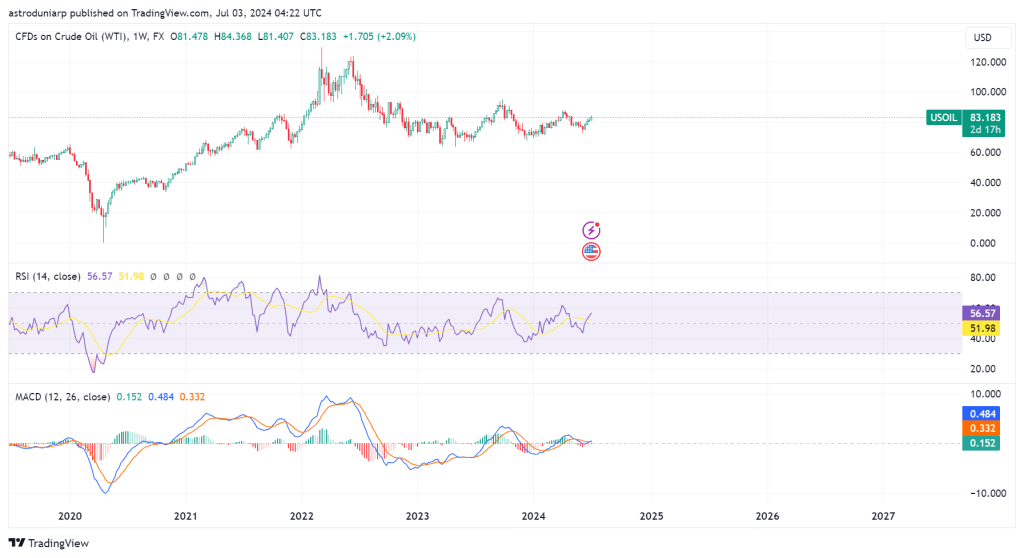

The crude oil market in recent years has witnessed extreme volatility. This has been driven by a combination of factors including global demand fluctuations, geopolitical tensions, and supply-side interventions from alliances such as OPEC+. In 2024, prices remained largely within a defined band despite global economic uncertainty. Moving into 2025, the market remains sensitive to inventory data, central bank decisions, and shifts in global trade patterns.

Our analysis shows that crude oil continues to hold strategic importance in the energy mix. While alternative energy sources are gaining traction, oil remains essential, particularly in the transportation and petrochemical sectors. In the short term, crude oil prices are expected to remain volatile, influenced by production decisions and macroeconomic news. Medium-term expectations suggest moderated demand growth, especially from mature economies, while emerging markets may continue to increase consumption. Over the long term, the balance between energy transition initiatives and oil dependence will define pricing and investment behavior.

Astrological Cycles and Crude Oil Turning Points

At RajeevPrakash.com, we recognize that markets are not only governed by economics but also by cyclical and cosmic rhythms. Through the lens of financial astrology, we identify key planetary transits and retrogrades that historically align with crude oil market tops, bottoms, and trend changes.

For example, Saturn’s transits often coincide with prolonged consolidation or downward movement due to restriction energy. Jupiter’s conjunctions or oppositions can amplify optimism and trigger price surges, especially when aligned with supportive macroeconomic data. Eclipses falling on oil-sensitive astrological points can indicate unexpected volatility or geopolitical flare-ups impacting supply.

These cosmic indicators complement technical and fundamental analysis, allowing us to offer more well-rounded and timely forecasts for traders and investors.

Impact of Crude Oil on Global Economies

Crude oil holds a unique position in global economics. For exporting nations, oil revenue is a lifeline that supports infrastructure development, public services, and foreign reserves. In contrast, oil-importing countries are heavily influenced by price volatility, which can affect trade balances, inflation rates, and even interest rate policies.

In periods of high oil prices, transportation costs, manufacturing expenses, and electricity tariffs rise, leading to broader inflationary pressures. This often prompts central banks to tighten monetary policy.

Seasonal Trends in the Crude Oil Market

Crude oil exhibits seasonal price behavior tied to patterns in global consumption. During winter months, demand for heating oil increases in colder regions, often leading to a seasonal price uptick. Similarly, the summer driving season in North America typically raises gasoline consumption, which can push crude prices higher.

Institutional Participation and Oil Market Volatility

Institutional investors play a growing role in crude oil price behavior. Hedge funds, mutual funds, and proprietary trading desks regularly allocate capital to crude oil futures and options. Their positions can significantly amplify market moves, especially during periods of low liquidity or strong sentiment.

Algorithmic and high-frequency trading strategies are increasingly prevalent, contributing to sudden spikes or drops in crude oil prices even in the absence of fundamental news. These technological factors make it essential to combine quantitative data with pattern recognition and cyclical awareness when formulating trading decisions.

Natural Gas Insights

While crude oil dominates global headlines, natural gas has emerged as an equally critical component of the modern energy mix. As the world shifts toward cleaner fuels, natural gas serves as a transitional energy source—balancing economic efficiency with environmental responsibility.

Diversified Portfolio

Unique Approach

Expert Team

Testimonials

Discover what our satisfied customers have to say about their experience with us. Read our testimonials from people who have benefited from our services.

Market singals have helped me to make quick and informed decisions for trades in stock market. resulting in significant profits for my portfolio. The team is highly professsional and always available to answer your questions and provide the best customer service.

SK Jhunjhunwala

Investor based in Mumbai

I have been using the astrodunia’s services for over 4+ years now and have been extremely impressed with level of experties and precions they bring to the table. Their live market signals have helped me make quick and informed decisions.

N. Patel

Pennsylvania , US

Excellent service. This is undoubtedly the best market forecast newsletter that i have ever subscribed. None of the other newsletter are anywhere close to this terms of accuracy. Please continue with the good work

Withheld

Fixed income trader with a required foreign bank in asia

i am an entrepreneur based in Australia and have been subscriber of astrodunia services from the past two years.i have found their NewsLetter , Live Signals and Annual Letter to be incredibly valueable.

Z. Irani

Australia

Meet Our Team

Get to know our dedicated team of experts. With a diverse range of skills and years of experience, we’re committed to providing you with the best market analysis and investment guidance.

Mr. Rajeev Prakash Agarwal

Founder

Expert in financial & personal astrology for 20 years+. Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology.

Mr. Shashi Prakash Agarwal

Technical Head

Shashi is a technology leader with a strong background in global business.He holds a B. Tech in Computer Science & MBA in Finance from Narsee Monjee Institute of Management Studies, one of the top B-Schools in India.

Frequently Asked Questions

History Of Crude Oil

Crude oil has been a pivotal energy source since the 19th century, fueling industrialization and modern economies. Its extraction, processing, and consumption have shaped global geopolitics and economic policies.

Crude Oil Forecast For 2024

Analysts predict that crude oil prices will remain volatile in 2024, influenced by geopolitical tensions, OPEC decisions, and global demand. Subscribe to our live signal service for real-time trading decisions. Want to stay long-term in the market? Join our Annual Letter now to make informed decisions. For traders, we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Crude Oil Forecast For Tomorrow

Daily forecasts for crude oil are influenced by market sentiment, economic data releases, and geopolitical events. Key indicators to monitor include inventory levels, production rates, and economic policies. Get daily market updates with our Daily Newsletter. Get your daily dose of market insights and updates delivered straight to your inbox. Try our Daily Newsletter.

Crude Oil Forecast For Today

Today’s forecast for crude oil involves analyzing pre-market trends, global market performance, and key economic announcements. Investors should watch for inventory levels, production rates, and economic policies. Subscribe to our live signals service for real-time updates. Subscribe to our live signals service for real-time updates. we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Crude oil price performance over the last one year

Crude Oil Forecast For Next Week

Weekly forecasts combine technical analysis and macroeconomic factors. Events like OPEC meetings and economic policies will significantly impact crude oil prices. Get weekly market insights with our Daily Newsletter service.Get your daily dose of market insights and updates delivered straight to your inbox. Try our Daily Newsletter service.

Crude Oil Forecast For The Next 5 Years

Medium-term forecasts consider economic cycles, fiscal policies, and geopolitical trends. Crude oil prices are expected to remain influenced by global demand, production levels, and geopolitical tensions.

For More Information , you can contact us – +91 9669919000

Crude oil price performance over the last 5 years

Crude oil price performance over the years

Crude Oil ETFs

Investing in crude oil ETFs allows investors to gain exposure to oil prices in a cost-effective manner without having to purchase or store the physical commodity. This strategy is beneficial for portfolio diversification.

| No. | ETF Name | Symbol |

| 1. | United States Oil Fund | USO |

| 2. | United States 12 Month Oil Fund | USL |

| 3. | Energy Select Sector SPDR Fund | XLE |

| 4. | iShares U.S. Oil & Gas Exploration & Production ETF | IEO |

| 5. | Invesco DB Oil Fund | DBO |

| 6. | ProShares Ultra Bloomberg Crude Oil | UCO |

| 7. | VanEck Vectors Oil Services ETF | OIH |

| 8. | SPDR S&P Oil & Gas Exploration & Production ETF | XOP |

| 9. | ELEMENTS Rogers International Commodity Index Energy ETN | RJN |

| 10. | First Trust Natural Gas ETF | FCG |

Navigating the Oil Market with Confidence

Utilize Our Crude Oil Market Compass to Navigate the Year’s Trends and Economic Forces, Steering You Towards Financial Success Despite Global Market Fluctuations in Stocks and Commodities.

Charting Your Course to Financial Success

Whether you’re a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited) – 2025