Master Energy Markets with Expert Timing Strategies

The energy market, driven by commodities such as crude oil and natural gas, is one of the most volatile and opportunity-rich sectors in global finance. At RajeevPrakash.com, we offer precision market timing for energy instruments by combining financial astrology with technical analysis, helping traders and investors anticipate major price movements before they happen.

Navigate the Energy Market with Confidence

Master the Energy Markets with Precision Timing

The energy sector, anchored by crude oil and natural gas, serves as the backbone of global economic activity. These commodities fuel transportation, industry, electricity generation, and countless products used daily. Their prices, however, are highly sensitive to geopolitical events, supply-demand imbalances, climate patterns, and global policy shifts.

At RajeevPrakash.com, we provide expert financial astrology insights and market timing strategies tailored specifically to energy traders and investors. Whether you’re a short-term trader or a long-term investor, our tools help you enter and exit the energy market with strategic clarity.

Why Energy Trading Requires Expert Timing

Energy commodities like natural gas and crude oil are among the most volatile assets. Intraday price swings and overnight gaps are common, often driven by:

- Geopolitical tensions (OPEC meetings, war, sanctions)

- Natural disasters or extreme weather

- Government regulations or emission policies

- Global economic trends and manufacturing demand

- Lunar and planetary cycles impacting mass behavior and sentiment

Understanding when to enter or exit these markets requires more than news headlines. It requires planetary foresight, technical confirmation, and macro timing—a unique blend offered exclusively at RajeevPrakash.com.

Integrated Tools for Serious Energy Traders

Our energy services include more than predictions. They offer an ecosystem of tools and knowledge to support every step of your trading strategy.

- Weekly timing maps highlighting risk and opportunity periods

- Multi-timeframe energy charts with planetary overlays

- ETF watchlists with astro-aligned scores

- Historical price cycles compared to current transits

- Timing reviews of past trades to refine precision

We guide our users in understanding not just when to trade, but also when to wait, a skill often overlooked in high-volatility markets like energy.

Annual Forecasts and Sector Outlooks

Our Annual Letter for Energy Investors provides a strategic roadmap for the entire year. It includes:

- Monthly forecast for natural gas and crude oil

- Key planetary alignments likely to influence energy markets

- High-risk periods for reversal or whipsaw trades

- Sectoral outlook for oil, gas, renewables, and related ETFs

This resource is essential for portfolio managers, hedge fund analysts, and long-term investors who want clarity across all phases of the market cycle.

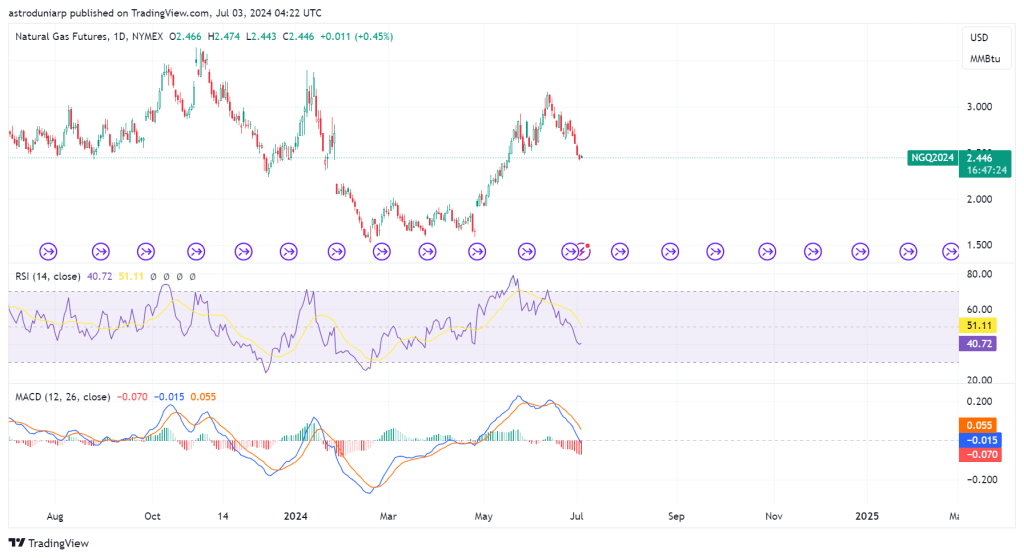

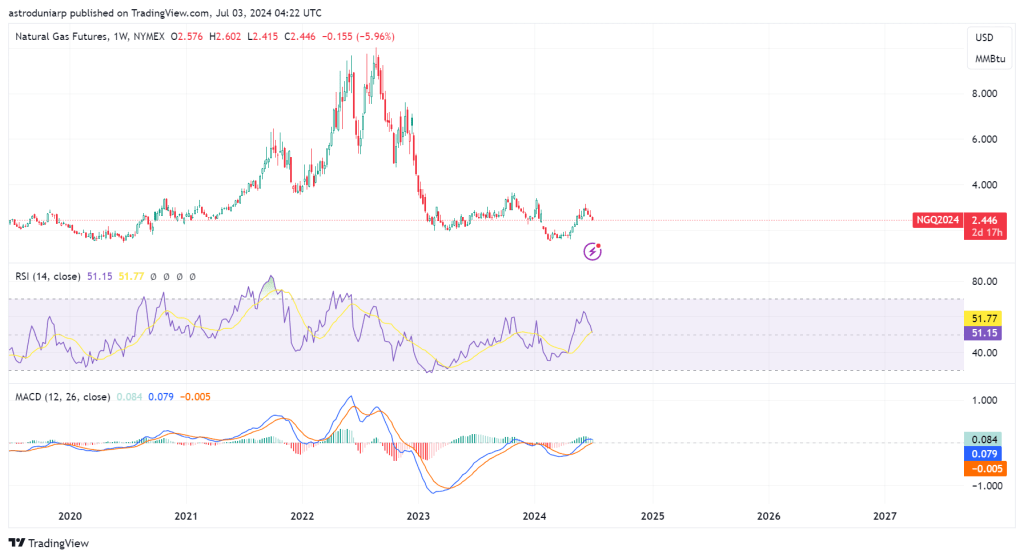

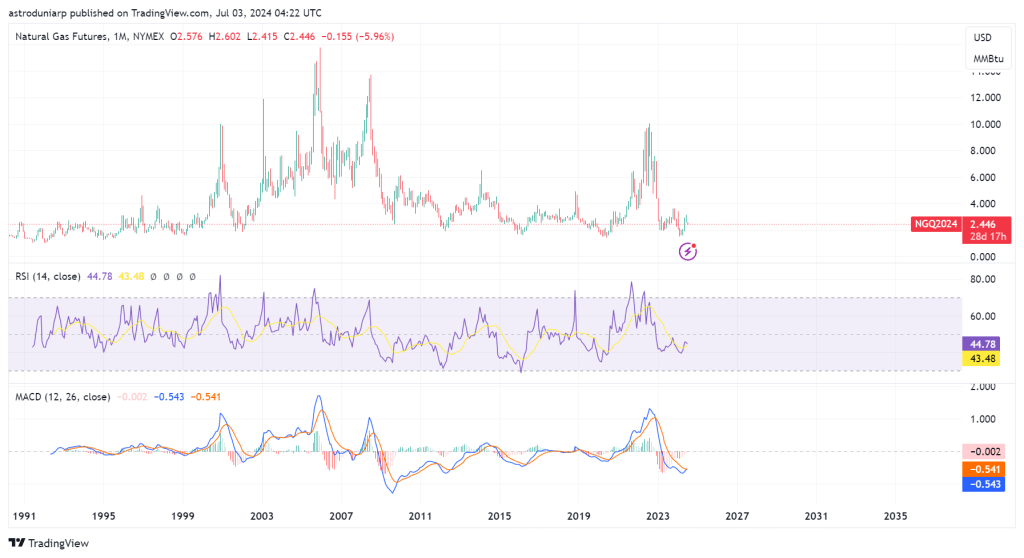

Live Natural Gas Chart

Top 10 Natural Gas ETFs to Watch

| No. | ETF Name | Symbol |

|---|---|---|

| 1 | United States Natural Gas Fund | UNG |

| 2 | First Trust Natural Gas ETF | FCG |

| 3 | ProShares Ultra Bloomberg Natural Gas | BOIL |

| 4 | iPath Series B Bloomberg Natural Gas Subindex ETN | GAZ |

| 5 | Invesco DWA Energy Momentum ETF | PXI |

| 6 | iShares U.S. Oil & Gas Exploration & Production ETF | IEO |

| 7 | Direxion Daily Natural Gas Related Bull 3X Shares | GASL |

| 8 | SPDR S&P Oil & Gas Exploration & Production ETF | XOP |

| 9 | VanEck Vectors Unconventional Oil & Gas ETF | FRAK |

| 10 | Global X MLP & Energy Infrastructure ETF | MLPX |

This section displays the advanced live chart of Natural Gas from TradingView.

Market Timing Services

RajeevPrakash.com offers a comprehensive suite of market timing services specifically designed for energy products trading, empowering you to:

Anticipate price movements

Our expert analysts utilize advanced technical indicators and fundamental analysis to forecast future price trends, allowing you to capitalize on market opportunities.

Make informed trading decisions

We provide regular market updates, insightful analysis, and actionable trading recommendations, keeping you informed of the latest developments and potential shifts in supply and demand dynamics.

Manage risk effectively

Our risk management strategies help you navigate market fluctuations and protect your capital, while our portfolio optimization tools assist in building a well-balanced and diversified energy portfolio.

Why Choose RajeevPrakash.com for Energy Products Market Timing?

Unparalleled Expertise

We have a deep understanding of the energy market and its complex drivers, providing you with invaluable insights and guidance.

Time-Tested Strategies

Our market timing models are based on years of research and proven successful in identifying profitable trading opportunities.. Want to stay long-term in the market? Join our Annual Letter now to make informed decisions. For traders, we offer a live signals to help you make real-time informed decisions. Join now to stay ahead in the market.

Data-Driven Approach

We leverage cutting-edge technology and advanced algorithms to analyze vast amounts of market data, providing you with objective and reliable insights.. Get your daily dose of market insights and updates delivered straight to your inbox. try our Daily Newsletter.

Crude Oil Forecasting

Unlock time-sensitive crude oil insights powered by planetary analysis and technical structure. Our forecasting model anticipates major price reversals, breakout cycles, and volatility windows by tracking Mars alignments, global supply data, and institutional trend shifts. Whether you trade intraday or positionally, our crude oil timing service provides a strategic edge to navigate the energy market with confidence.

Natural Gas Timing Services

Natural gas is one of the most unpredictable commodities—but also one of the most rewarding when timed correctly. Our timing strategy blends lunar triggers, Mercury transits, and weather-driven market sentiment to identify breakout phases and collapse zones. With Rajeev Prakash’s natural gas insights, you’ll gain clarity on when to enter, hold, or exit—before the market reacts.

Energy ETF & Futures Timing

Trade energy with precision using our astrological and analytical timing models tailored for ETFs and futures. Whether it’s XLE, USO, UNG, or NYMEX contracts, we highlight high-probability zones using cycle theory, retrograde-sensitive periods, and price structure confluence. Ideal for portfolio managers, swing traders, and ETF investors seeking an edge beyond standard charts.

A chart displaying natural gas prices over a one-year period.

A chart displaying natural gas prices over a five-year period.

A chart displaying natuarl gas prices over an all-time period.

Natural Gas ETFs

Investing in natural gas ETFs allows investors to access natural gas prices efficiently without the complexities of direct purchase and storage, making it a strategic choice for portfolio diversification.

Astrological Factors That Influence Energy Markets

| Planet/Transit | Market Impact |

|---|---|

| Mars Transit | Aggressive energy spikes, panic supply disruptions |

| Saturn Transit | Long-term pricing reforms, energy restrictions |

| Solar Eclipses | Sudden reversals, policy changes, major production news |

| Mercury Retrograde | Price volatility, data misinterpretation, false breakouts |

| Jupiter in Fire Signs | Expansion in energy production, bullish commodity cycles |

Services Tailored to Energy Traders & Investors

Annual Letter

Receive a long-term energy outlook based on planetary ephemeris, seasonal demand curves, and geopolitical energy astrology.

Live Signals

Timely alerts to buy/sell crude oil, natural gas, or energy ETFs during astro-validated market windows.

Daily & Weekly Newsletter

Access short-term forecasts, technical setups, and upcoming astro events that may trigger price action in energy markets.

Educational Webinars

Learn how to use astrology in energy trading through our masterclass series, covering:

- Solar cycles in oil demand

- Mars-Mercury timing in gas futures

- Astrological impact on EIA Wednesdays

Deep Insights into the Energy Economy

The energy sector does more than power homes and industries. It is a direct barometer of economic resilience, inflationary pressures, and geopolitical dynamics. Investors and traders who understand the rhythm of the energy markets are better equipped to make decisions that can protect and grow their capital.

At RajeevPrakash.com, we offer a strategic approach that combines the precision of technical analysis with the foresight of financial astrology. Our systems are designed to uncover patterns and reversals in energy prices long before they become apparent to the wider market.

How Planetary Movements Reflect Energy Cycles

Financial astrology is not speculation. It is a science of observing how planetary transits and configurations influence human decisions, including those of policymakers, producers, and traders in the energy markets. Our energy forecasts are based on studying how major transits, eclipses, and retrogrades correspond with historical price patterns.

When Mars, the planet associated with energy and aggression, makes a square or opposition with Saturn, historical data has shown increased volatility in crude oil. Similarly, transits of Jupiter can indicate demand expansion or contraction phases in natural gas markets. We apply these insights systematically to refine timing and risk parameters.

Understanding Natural Gas Price Volatility

Natural gas is increasingly important in the global transition to cleaner energy sources. It is more volatile than crude oil and often responds sharply to short-term catalysts such as weather shifts, pipeline updates, and inventory data.

Using lunar cycles, Mercury transits, and seasonal planetary alignments, our model helps traders identify windows of breakout or reversal. Unlike conventional indicators that lag, our astro-timing methods help traders prepare ahead of price swings and reduce unnecessary exposure during risk periods.

Crude Oil and Global Politics

Crude oil remains the most traded energy commodity globally. Its prices are deeply influenced by military conflicts, OPEC+ decisions, and global demand projections. At RajeevPrakash.com, we analyze crude oil’s behavior through both macroeconomic indicators and celestial signals.

Mars in fire signs or in combustion has historically aligned with oil price spikes due to war-like tensions or supply disruption. Our timing tools forecast when sentiment is likely to shift, allowing traders to prepare for trend reversals, whether it is a short-term pullback or a long-term directional breakout.

Additional Services

- Personalized trading recommendations based on your risk tolerance and investment goals.

- Educational resources and webinars to deepen your understanding of the energy market.

- Access to a vibrant community of traders and investors for knowledge sharing and support.

Unlock the Potential of Energy Products Trading

By subscribing to our market timing services, you gain access to a valuable resource that can significantly enhance your energy products trading performance. Contact us today to learn more and start making informed trading decisions.

Whether you’re a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited) – 2025