Your cart is currently empty!

11th April 2014: Predictions for US Stock Market and Bullion

Sent on Friday, April 11, 2014

Stock Markets Around the globe

You are advised to book 50 % profit in short position of S&P500 (last day) at 1,826-1,830 and hold the rest 50% for next week with stop loss 1,841.

Any time by next week, S&P500 could drop to 1,805 or below.

Today, market is expected to be volatile to bearish.

Some short covering is possible in closing hours for majority of indexes.

Avoid long positions for next week as any time, a fall could be seen.

Trading Range:

-DOW(FUT): 16,170-16,040

-S&P500(FUT):1,839-1,818

– NASDAQ(FUT):3,498-3,440

– FTSE(FUT):6,560-6,490

-CAC(FUT):4,395-4,330

– DAX(FUT):9,420-9,320

– HSI (FUT):23,340-22,700 {Make short position for next week}

– NIFTY(SPOT):6,820-6,720

PRECIOUS METALS

Bullion shall trade volatile to positive. Profit booking is expected at US hour.

At closing hour, make long position (50%) in bullion for next week.

Any time in next week, a big bull run could be observed (especially Silver from 18th April onwards).

Around higher levels, book profit in long position for bullion and then buy back at lower levels for next week.

Trading Range:

– GOLD: 1,324-1,309

-SILVER: 20.30-19.90

INDUSTRIAL METALS

Copper shall be volatile to positive.

TRADING RANGE:

-COPPER:3.01-3.05

ENERGY PRODUCTS

CRUDE OIL

Crude Oil shall be volatile to positive till 15th April 2014.

NATURAL GAS

Mix trend shall be observed.

NG has taken a break out. Hence, its advisable to long NG for 4.75.

Trading Range:

– CRUDE: 103.00-104.00

– NG: 4.58-4.72

CURRENCIES

EURO

Sell EUR/USD with stop loss 1.3950 for target 1.3750 in next week.

INDIAN RUPEE (USD/INR)

Any time, USD/INR could cross 60.50. Hold long position with stop loss 59.70.

DOLLAR INDEX

Dollar Index shall rebound from today.

Buy dollar index with stop loss 79.00 for target 80.40.

TRADING RANGE:

– EUR/USD: 1.3910-1.3820

-USD/INR(SPOT): 59.80-60.30

-DOLLAR INDEX: 79.40-79.90

US TREASURY BOND

Bonds shall trade in mix trend.

However, any time, a fall could be seen in Treasury bond.

INDIAN STOCK MARKET

Indian stock market shall be volatile to bearish.

Around closing hour, short covering is possible.

BUY (50%) NIFTY PUT OPTION FOR 6,600 AND (50%) BANK NIFTY PUT OPTION FOR 12,500.

BUY DLF PUT OPTION FOR 170.00.

And hold this position for next week.

Any time, a big fall could be observed.

PROFIT BOOK IN RELIANCE INDUSTRIES LIMITED.

TRADING RANGE:

– NIFTY (FUT) : 6,860-6,760 & BELOW

– BANK NIFTY: 13,100-12,750

BUY:

– DR. REDDY

– LUPIN

– HUL

– SUN PHARMA

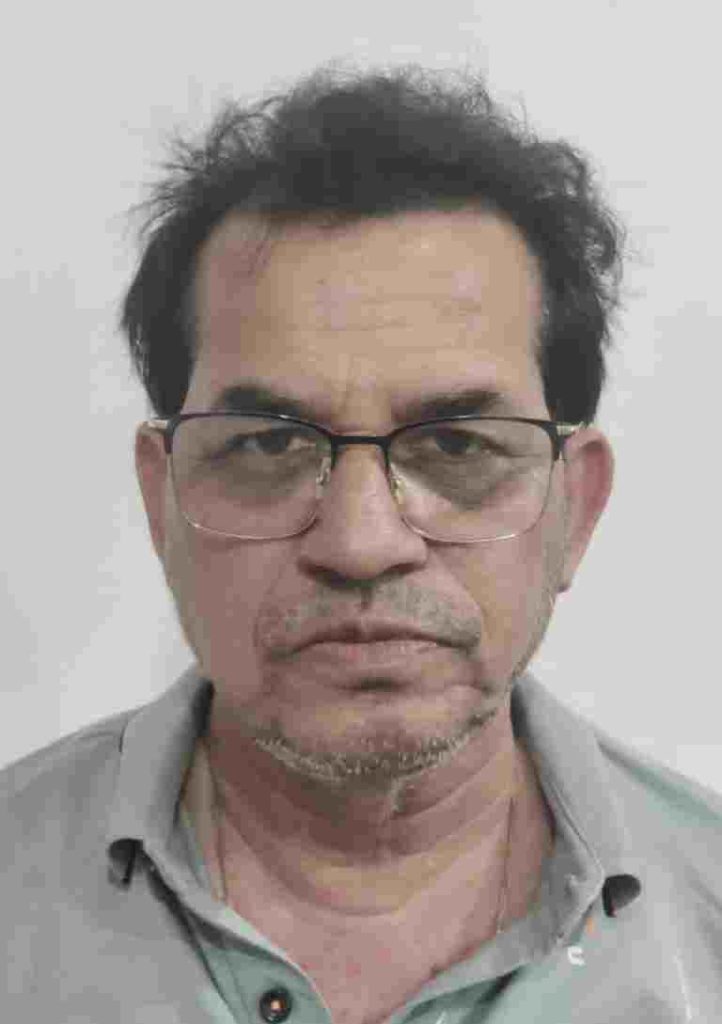

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply

You must be logged in to post a comment.