Your cart is currently empty!

What is Financial Astrology?

Financial astrology is the use of astrological principles to forecast financial markets. It combines the study of planetary movements and celestial events with financial analysis to make predictions about market trends.

Looking to make better investment choices? At RajeevPrakash.com, we use financial astrology to help you understand the financial markets more clearly. This unique approach can give you insights to improve your investment strategies and potentially double your returns compared to traditional methods within 12-24 months. Find out how financial astrology can add value to your investment journey and help you reach your financial goals.

Key Components of Financial Astrology

Planetary Influences

Planetary alignments correlate with cyclical economic patterns and individual financial behaviors.

Zodiac Signs

Vedic astrology divides the sky into twelve equal zodiac signs, each influencing planets passing through it.

Houses

A birth chart’s twelve houses represent life areas, with planetary positions indicating their influence.

Why Us ?

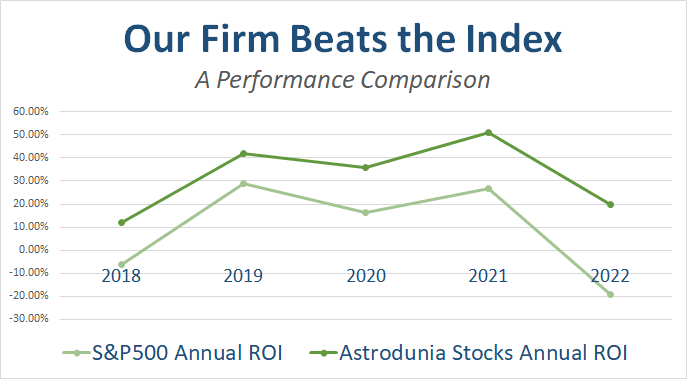

Stay Ahead of the Game with Our Accurate Financial Predictions. Our track record speaks for itself. We accurately predicted the last two major financial crises, 2008 and 2020, before they even hit the market. Our Annual Letters, dating back to 2018, signalled that 2020 would be a year of concern, and we were right. But that’s not all, our stock picks performed 2x higher than the index, ensuring that our subscribers were always in the know and ahead of the curve. Join the elite community of investors and make informed financial decisions today with our expert guidance.

Optimize Investments with Financial Astrology for Long-Term Profit

Our precise financial astrology predictions and expert services provide insights into global markets, including American, European, and Asian markets, with a strong emphasis on U.S. stocks. For the Indian market, we offer only an astrological perspective. Stay ahead in the financial world with our expert guidance.

Annual Letter 2025

Timing the market is a crucial aspect of investment success. Our Annual Letter provide insights and timeframes for the major trends across different markets in the upcoming year.

Live Signals

Live Signals provide entry and exit instructions during live market conditions. This service also includes 24/7 support, which is highly beneficial for traders.

Daily Newsletter

Our daily and weekly newsletters provide insights and trading ranges to help you prepare your trading portfolio for the near term. These newsletters are especially valuable for position traders.

Testimonials

Discover what our satisfied customers have to say about their experience with us. Read our testimonials from people who have benefited from our services.

Market signals have helped me to make quick and informed decision for trades in stock market, resulting in significant profits for my portfolio. The team is highly professional and always available to answer your questions and provide the best customer service.

SK Jhunjhunwala

Investor based in Mumbai

I have been using Astrodunia’s services for over 4+ years now and have been extremely impressed with the level of expertise and precision they bring to the table. Their live market signals have helped me make quick and informed decisions.

N. Patel

Pennsylvania ,US

Excellent service. This is undoubtedly the best market forecast newsletter that i have ever subscribed. None of the other newsletters are anywhere to close to this in terms of accuracy.

Withheld

Fixed income trader with a required foreign bank in asia

I am an entrepreneur based in Australia and have been a subscriber of market timing services from the past 3 years. I have found their newsletter, live signals and annual letter to be incredibly valuable.

Z. Irani

Australia

Client Voices

Explore how Rajeev Prakash’s insights have transformed lives across the globe. From traders and investors to entrepreneurs and professionals, real people share their experiences of success, clarity, and accurate market timing through astrology.

Integrate Market Timing Today

Latest Content

Dive into our insightful articles featuring industry insights, expert tips, and the latest trends. Stay ahead with our informative content designed to keep you informed.

Discover Your Perfect Investment Strategy

Discover personalized investment recommendations tailored to your financial goals. Our innovative product recommendation calculator analyses your income to suggest ideal investment solutions, whether you prioritize long-term stability or short-term growth. Take the first step towards financial success by clicking below!

Financial Astrology: Unlocking the Secrets of the Market through the Stars

Financial astrology, often referred to as astro-economics, is a field of study that combines the principles of astrology with financial market analysis. By tracking the positions of celestial bodies and interpreting planetary movements, practitioners of financial astrology aim to predict market trends, forecast economic cycles, and guide investment decisions. While financial astrology may seem unconventional, it has a dedicated following of traders and investors who believe the stars can offer unique insights into market behavior.

The Origins of Financial Astrology

The roots of financial astrology can be traced back to ancient civilizations like Babylon and Egypt, where astrology was used to guide decisions in various aspects of life, including agriculture, politics, and commerce. Over time, the practice evolved, and in modern times, figures like W.D. Gann—an American trader and market theorist—have popularized the use of astrological principles in financial markets.

Gann believed that planetary cycles influenced stock market trends, and his methods have inspired many modern financial astrologers. Today, financial astrology draws from both traditional astrology and modern financial theory to create a unique blend of market analysis.

Basics of Financial Astrology

Financial astrology is grounded in several key concepts that practitioners use to make market predictions:

Financial astrology is used in several ways by traders and investors:

1. Planetary Cycles

The movement of planets through the zodiac is believed to affect financial markets. For instance, Saturn’s transit can signify a period of restructuring and discipline in the economy, while Jupiter’s influence may point to growth and expansion.

2. Retrogrades

When planets appear to move backward in their orbit, it’s known as a retrograde. Mercury retrograde, in particular, is infamous for causing disruptions in communication and technology, and financial astrologers often interpret this as a period of volatility in the stock market.

3. New and Full Moons

The lunar cycles, particularly new and full moons, are considered significant for market behavior. New moons are associated with new beginnings and often align with market shifts, while full moons may bring culmination points, signaling a time to reevaluate investments.

4. Aspects and Alignments

The angles formed between planets (aspects) are key to understanding how celestial energies interact. Favorable aspects like trines and sextiles are thought to bring positive market conditions, while challenging aspects like squares and oppositions may indicate turbulence.

Applications of Financial Astrology

Financial astrology is used in several ways by traders and investors:

1. Market Timing

One of the primary uses of financial astrology is market timing. Astrologers analyze planetary transits to determine optimal times to buy or sell stocks, commodities, or other assets. For example, if a favorable alignment between Venus and Jupiter occurs, this may signal a bullish trend, leading investors to enter the market. Conversely, challenging aspects between Mars and Saturn may suggest a time to be cautious and avoid large investments.

2. Long-Term Forecasts

In addition to short-term predictions, financial astrology can be used to forecast long-term economic cycles. For instance, astrologers might look at the 20-year Jupiter-Saturn conjunction to predict significant shifts in the global economy. Historically, these conjunctions have aligned with major market turning points, such as the Great Depression and the dot-com bubble.

3. Industry-Specific Analysis

Financial astrologers often focus on specific sectors of the market based on planetary rulerships. For example, Venus is associated with luxury goods and the arts, while Mars rules over industries related to metals, energy, and machinery. By analyzing the position of these planets, astrologers can make predictions about the performance of specific industries.

4. Personal Financial Guidance

Beyond market trends, financial astrology can offer personalized financial advice based on an individual’s natal chart. By examining the astrological houses that govern wealth, career, and investments, an astrologer can provide insights into favorable times for making significant financial decisions, like starting a business or purchasing property.

Real-World Examples of Financial Astrology in Action

There are several examples of successful investors and traders who have used it to their advantage. W.D. Gann, one of the most famous proponents of financial astrology, is said to have made accurate predictions about market crashes and rallies by observing planetary movements.

In more recent times, some traders have noted correlations between significant astrological events and market movements. For instance, the 2020 stock market crash, which coincided with the COVID-19 pandemic, occurred during a major alignment of Saturn and Pluto—two planets associated with transformation and upheaval.

Conclusion: Can Financial Astrology Predict Market Trends?

Financial astrology offers a fresh perspective on market trends. By combining traditional technical and fundamental analysis with astrological insights, you can gain a deeper understanding of market cycles and potentially identify hidden opportunities.

Discover the mathematical power of planetary combinations. Our experts can help you leverage the predictive potential of astrology to make more informed investment decisions.

Whether you're a seasoned investor or just starting out, our financial astrology tools can be tailored to your specific investment goals. Gain valuable insights to achieve your financial aspirations.

Address

1301, 13th Floor, Skye Corporate Park, Near Satya Sai Square, AB Road, Indore 452010

+91 9669919000

© All Rights Reserved by RajeevPrakash.com (Managed by AstroQ AI Private Limited ) - 2025