Your cart is currently empty!

View on Equities and Bullion

Asian stocks are expected to be weak in first half. In the second half, it shall recover. For next day, positive opening is indicated. This positivity shall continue till Wednesday. A correction is expected on Thursday-Friday.

European market shall be positive till Wednesday. On Thursday-Friday, correction is expected.

In American markets as well, trend shall be positive till Wednesday. On Thursday-Friday, a correction is expected.

S&P500 can go up to 2,0– – 2,0–.

BUY S&P500 on dips for the first 3 days of the week.

Around 20– – 20– you can make short position in S&P500 and hold till Friday.

PRECIOUS METALS

After US hours, precious metals trade with positive sentiment. It shall continue to be positive till next day.

Gold can go up to 1,— -1,— while Silver can go up to 1-.-0 in this time frame.

Between Wednesday and Thursday, bullion could experience correction. In this correction, Gold could drop to 1,— – 1,–0 while Silver could drop to 1-.00.

Again from Friday, Gold and Silver are expected to recover.

INDIAN STOCK MARKET

Indian market shall open in negative trend.

In the second half, recovery is expected.

For next day, positive opening is indicated.

Till Wednesday, trend shall be positive.

Between Thursday-Friday, trend shall be negative.

You can make BTST position.

Nifty Fut, BANK NIFTY has support at 8,700; 19,500 respectively.

In this week, NIFTY can again move up to 9,000 while BANK NIFTY can again move up to 21,000.

TRADING RANGE:

-NIFTY FUT: 8,800-8,900

-BANK NIFTY: 19,700-20,400

BUY ON DIPS :

– JET AIRWAYS

– AXIS BANK

– LIC

– DABUR

– HUL

– GODREJ INDUSTRIES

– DLF

– HDFC

– HDIL

– IDFC

– TATA MOTORS

– MARUTI

– HCL TECH

– INFOSYS

– TCS

– RELIANCE CAPITAL

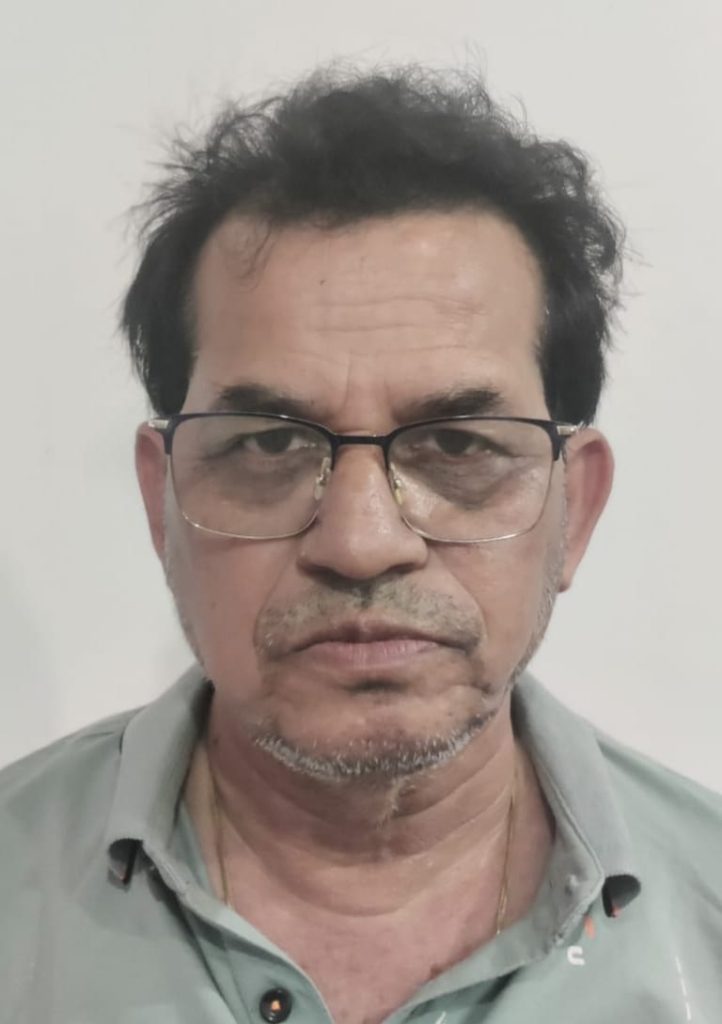

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply