Your cart is currently empty!

Prediction for global markets on 19 July 2018

Global Stock Indices

In the previous session, US market closed flat. Here onwards, it is ready for a downside trend (we are more sure about the negativity from next session).

In the next week, considerable decline is indicated. Steep correction is possible.

We may see S&P500 trading at 2760 anytime in the next week. This weakness will continue in the month of August as well.

Strategy shall be “sell at higher level”. One can alternatively buy put options for September contract. The impact will be visible in European markets as well.

Positional short can be made in AEX. Hang Seng also went through negativity in the previous session. It is advised to remain short in Hang Seng and other Asian indices.

Precious Metals

In the previous session, Gold made a low of 1220.60 while Silver made a low of 15.41. There onwards, Gold bounced back to 1228 while Silver bounced back to 15.59.

For today as well, trend is uncertain.

If Gold trades above 1230 then one can long Gold with S/L 1220. If Silver sustains above 15.60 then one can long Silver with S/L 15.30.

We are positive about bullion from next session.

Industrial Metals

Copper made a low of 2.71 in the previous session and high of 2.77. With S/L of 2.70, hold long position in Copper. A breakout is possible above 2.80.

Zinc went through an uptrend of 3.5% in the previous session.

ENERGY PRODUCTS

CRUDE OIL

Crude oil went through a recovery in the previous session. It made a high of 67.96. It is advised to remain short in oil at higher level. In next week, it has potential to drop to 64. Positional traders shall short oil with S/L 69.00

NATURAL GAS

Long NG with S/L 2.70. It may move up.

CURRENCIES

EURO (EUR/USD)

Buy EUR/USD at lower level and hold for target 1.1750. In next week, it can cross 1.1800.

POUND (GBP/USD)

It is advised to long GBP/USD at lower level for target 1.3300 in the next week.

YEN (USD/JPY)

Hold short position in USD/JPY.

INDIAN RUPEE (USD/INR)

Book 50% profit in USD/INR @ 68.90.

DOLLAR INDEX

The high of dollar index has been made. By next week, it can breach 94.00 and correct down to 93.50.

INDIAN STOCK MARKET

Indian market saw a high of 27220 for Bank Nifty and 11073 for Nifty in the previous session followed by a sudden decline as predicted in the daily newsletter. In this weakness, Nifty and Bank Nifty made low of 10955 and 26870. For today and tomorrow, bearish trend may continue. Market may open positive today and then decline. Till 13.30 HRS IST, mixed trend is indicated. From 13.30 HRS IST, major correction is possible.

Bank Nifty may see considerable decline owing to the weekly expiry of BANK NIFTY options.

It is very surprising to watch Nifty at 11,000 and most renowned stocks (TATA MOTORS, TATA STEEL, JET AIRWAYS, NTPC, NHPC) trading near 52-week low. It appears as if there is an artificial surge in value of index not backed by present fundamentals.

In the previous session, we asked you to stay away from PSU banking stocks; a sudden decline was observed yesterday. You’re still advised to remain away from PSU banks and use “sell at higher level” strategy.

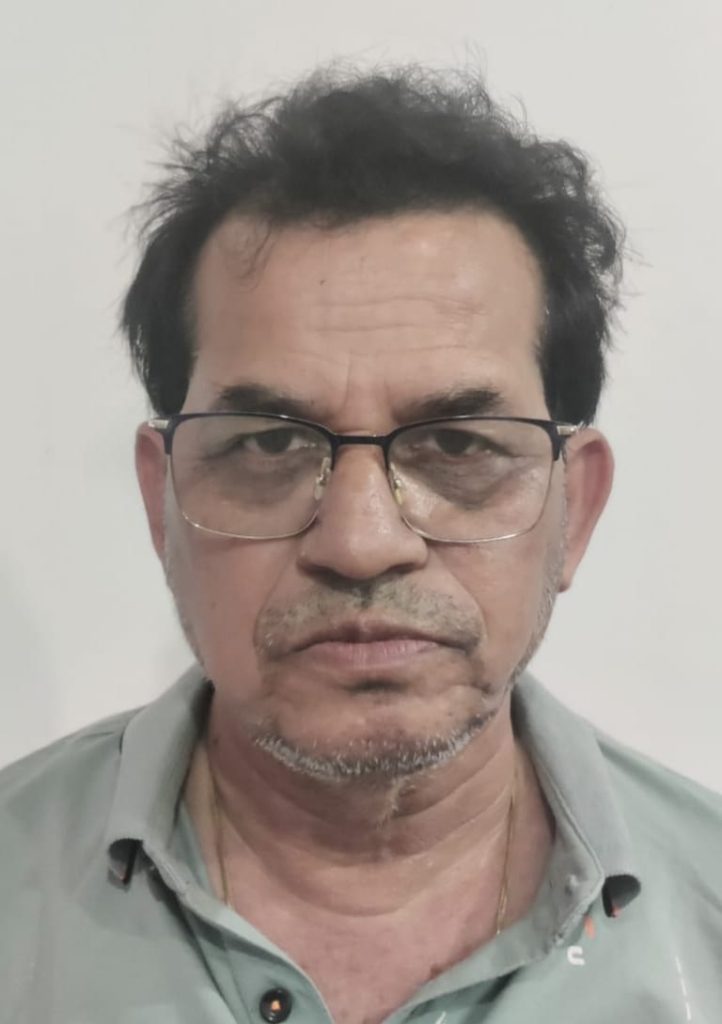

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply