Your cart is currently empty!

Part of weekly newsletter : equity section

Global Equity Indices

On Friday, US market closed bullish. DOW closed at 24326 while S&P500 and FTSE closed at 2663 and 6778.

In the current week, the trend is mixed to positive until Wednesday. On Thursday, the market can be volatile. On Friday, negative closing is possible.

On 14th May 2018, positive opening is indicated but it is advised to maintain “sell at the higher level” strategy in the next week. From 15th May 2018 (+/- 1 day), a sharp fall is possible which will continue with volatility till 25th.

In the current week, Tuesday will be more positive. On Wednesday, the market will take a U-turn at higher levels.

On the higher side, S&P500 can move up to 2688-2715. It has support at 2650 and resistance at 2688.

AEX has achieved our higher target of 554. It is advised to book 50% profit here. Around 550, you can add AEX.

It is advised to buy Hang Seng at dips. It shall move up from the second half. Next day is positive for Hang Seng.

BUY FOLLOWING STOCKS IN US MARKET FOR THIS WEEK:

- NETFLIX

- ALPHABET

- APPLE

- BABA

- TESLA

- AMAZON

INDIAN STOCK MARKET

Indian market shall be trading upward till Wednesday. On Thursday-Friday, trend can be downward.

More of positive is anticipated in the next session (one-sided positivity is possible).

Intraday perspective:

Trend shall be mixed till 11.30 HRS IST. From 11.30 to 14.30 HRS IST, trend shall be positive. From 14.30 HRS IST, profit booking is possible.

TRADING RANGE:

- NIFTY FUT: 10650-10750

- BANK NIFTY FUT: 25600-25850

It is advised to hold the long position in Nifty with S/L 10600.

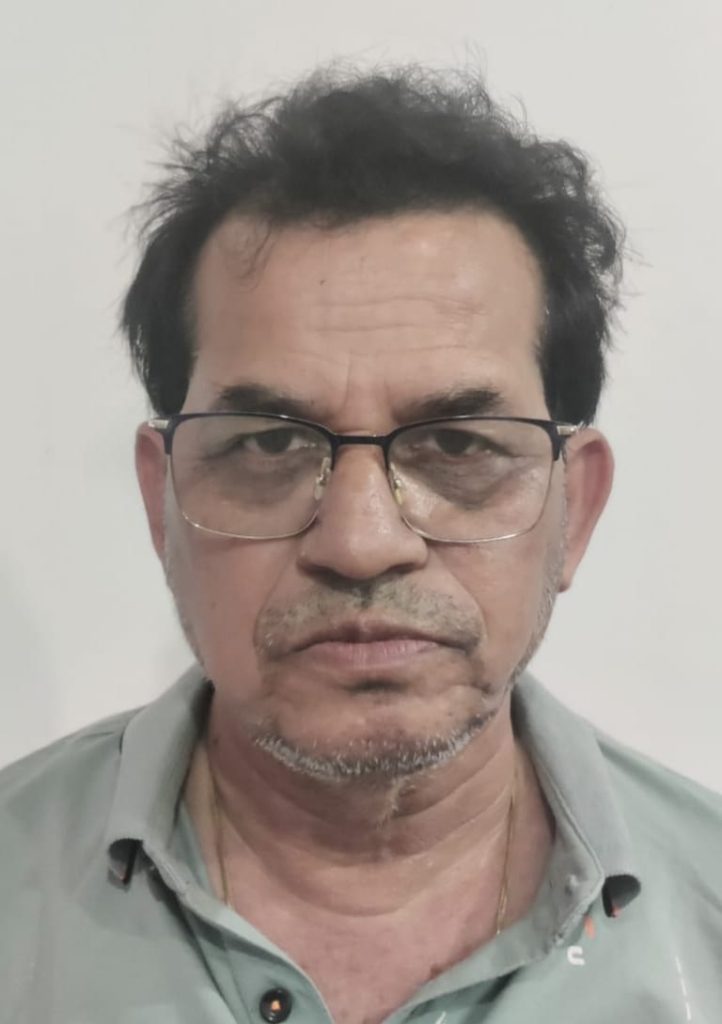

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply