Your cart is currently empty!

BULLION: READY FOR NEW CYCLE

ANNUAL LETTER 2015 TO BE LAUNCHED ON 9TH January 5, 2015; YOU CAN STILL PRE-ORDER THE ANNUAL LETTER @ 100$ (6,000 INR) ! IN OUR ANNUAL LETTER, WE HAVE MENTIONED OF THE DATES ON WHICH MARKET SHALL BE EXTREMELY VOLATILE. IT IS FOR THE FIRST TIME IN OUR ANNUAL LETTER THAT WE ARE INCLUDING SUCH A DETAIL!

Global Stock Indices

Stocks are expected to trade in both sides till 14th January 2015.

On Friday, slightly bearish trend is indicated. After 14th, equities are expected to turn towards the positive trend with volatility.

From 20th / 22nd January, the intensity of positivity shall increase gradually. This bullish trend shall last till first week of February 2015.

After 12th February, a sharp decline is indicated in equities, which would continue till the end of Feb leading equities to a considerable drop. A big bearish pattern is expected in this time frame.

For today, market is expected to be weak. From Tuesday to Thursday, mixed to slightly positive trend is expected. On Friday, after non-farm payroll data, market shall turn bearish.

European market shall remain weak for today and recover from tomorrow. European market shall correct on Friday.

Next day onward, if bearishness increases; it shall continue for the entire week. DO NOT BUY S&P500. SHORT S&P500 AT HIGHER LEVEL.

PRECIOUS METALS

In this week, the trend of bullion is positive. Gold can go above 1,220 while Silver can go above 17.20.

Mars has already entered Aquarius. This is a bullish condition for bullion. Bullion shall remain bullish till 12th February 2015. Especially, after 20th / 22nd, bullion shall turn highly positive. In this time period, GOLD can cross 1,300 while SILVER can cross 18.00.

In the current week, Monday is range bound. On Tuesday & Wednesday, positive trend is expected in precious metals. On Thursday & Friday, volatile trend is expected.

After non-farm pay roll data, precious metals can turn bullish.

Your strategy shall be to “buy bullion on dips”.

You can buy GDX, GDXJ, SIL, JNUG, NUGT and hold till 12th February 2015.

INDUSTRIAL METALS

Due to change in position of Mars, Copper and other base metals may be back on positive track. But it should be noted that, big bull move is expected only after 20th January 2015.

NATURAL GAS

NG is in highly bullish trend. You can long NG stocks. In coming days, NG shall cross 4.00.

EURO

EUR/USD made a low of 1.1857 today. As per our analysis, this low shouldn’t be breached till 12th February.

EUR/USD is expected to climb up to 1.2300-1.2400 by 12th February 2015.

INDIAN RUPEE (USD/INR)

Hold long position in USD/INR for target 64.00.

DOLLAR INDEX

Dollar index shall be range bound to negative till Thursday. From Friday, after non-farm pay roll announcement, a sharp correction is expected in dollar index. After 20th / 22nd Jan, a big correction is indicated in dollar index, which would last till 12th February 2015.

US 10 YR-TREASURY BOND

Bonds shall remain positive for this week. By this weekend, bonds can go up to 2.00.

BUY BONDS @ 2.15

INDIAN STOCK MARKET

Indian market shall be weak for the day.

Again on Friday, a correction is expected.

However, from 14th January, a positive trend shall be observed with volatility. From 20th / 22nd, market shall turn bullish till 8th / 10th February 2015.

After 12th February, Indian market is expected to experience a sharp correction, which would continue till last week of February.

The last week of March shall also be very bearish for Indian equities.

In 2015, global equities will make bottom around July. For details, you are advised to check out our ‘ANNUAL LETTER 2015’.

TRADING RANGE:

# NIFTY FUT:8,4800-8,400 & BELOW

# BANK NIFTY: 19,300-18,900

This week is positive for following stocks:

– BANK OF INDIA

-LIC HOUSING

-INDIA BULLS

– JUBILANT FOOD

– ASIAN PAINTS

– COLGATE

– HINDUSTAN UNILEVER

– ABAN OFFSHORE

– ARVIND MILLS

– TATA POWER

– YES BANK

SELL:

DLF

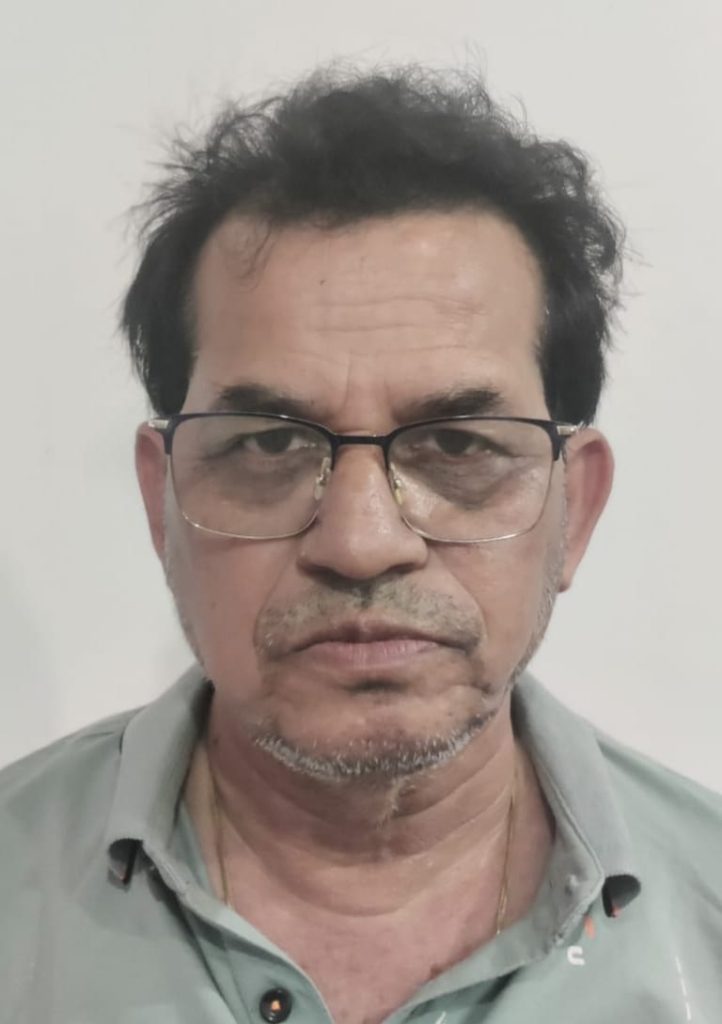

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply