Your cart is currently empty!

Astrology Indicators for Stock, Commodity, EUR/USD, Gold, Silver, Oil on 21st August

21st August 2012: Today, the market is expected to be highly volatile (for Bullion, Crude Oil). Some weakness is possible. But it’s still recommended to buy on dips.

Astrology indicates that Gold, Silver & Crude Oil can see a bearish tone after 11.30 hrs (IST). This bearish tone can continue till evening.

But from 22nd August onwards, recovery from lower level is possible. Once again, we are strictly mentioning ‘BUY ON DIPS!’.

A big up move is forecasted for 23rd August.

According to financial astrology, next week is very bullish for Gold, Silver, Copper & other base metals. So our basic strategy is to keep buying on dips.

S&P- Highly volatile. Some weakness is indicated. But don’t worry. It’ll go up so buy on dips again with keeping in mind the lower level as 1405. Our target for S&P in short term is 1445 and above.

———–Predictions that was correct——

Our target for Gold (1611-1624) & Silver (28.05-28.60) & Crude Oil (96.50-95.00) & EUR/USD( 1.2370-1.2295) were successfully achieved. This again remarks the quality effort that we put in for preparing this report.

Trading Range for Global Cues (on 21st August 2012):

GOLD: 1625-1610 and below (BUY ON DIPS / SELL ON RISE)

SILVER: 28.80-28.40-28.20 and below

CRUDE OIL: 96.50-95-94.50

S&P 500: 1418-1408

COPPER: 341-333

EUR/USD: 1.2390-1.2300-1.2280

DOLLAR INDEX: 82.45-82.80

USD/INR: 55.50-56.00

(SPOT) NIFTY: 5320-5420

ALERT: Platinum, Corn, Sugar, Soya-bean, Mustard, Cotton, Rice – volatile to bullish in short term.

(Updated on 21st August 2012 at 12.03 AM – IST – Indore, India)

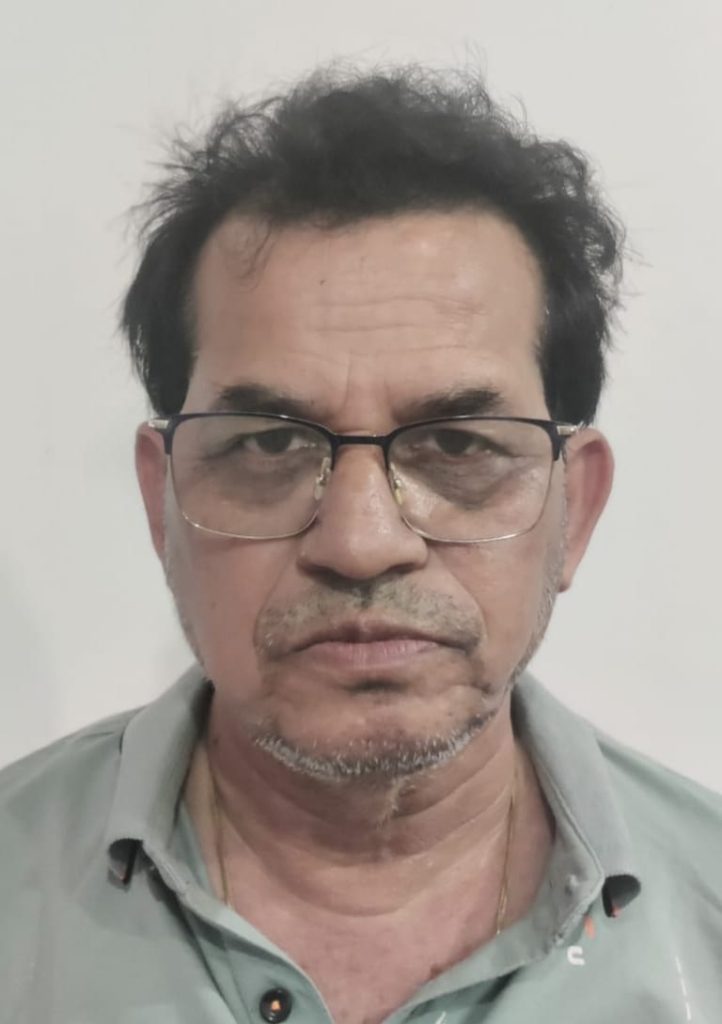

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply