Your cart is currently empty!

NRE Deposit interest rates- HIKE

Reserve Bank of India deregulated non-resident external (NRE) deposits, allowing banks to offer higher interest rates to dollar-denominated accounts, five Indian banks, including HDFC Bank and Yes Bank upped their interest rates on such deposits in order to lure foreign money.

State Bank of India (SBI) and a few other banks, including Kotak Mahindra Bank, today announced a sharp hike in interest rates offered on non-resident external (NRE) deposits.

- SBI raised the interest rates on fixed deposits bynon-resident Indians of less than Rs 1 crore with a maturity of one to two years to 9.25 per cent, as against 3.82 per cent earlier

- Kotak Mahindra Bank has also hiked interest rates on NRE deposits with a maturity of one to two years to 9.25 per cent with effect from today, while the rate for deposits of 2-3 years’ tenure will be 9 per cent, the bank said in a release.

- Federal Bank also revised the interest rate on NRE deposits of select maturities. NRE deposits with a maturity of less than year will earn 8.25 per cent to 9.10 per cent interest at the bank, depending on the amount.

- Punjab National Bank (PNB), the country’s second largest public sector lender, Tuesday said it will hike interest rates on non-resident external (NRE) accounts to 9.25 percent – effective from the beginning of next year.

The bank has decided to increase the rate of interests on NRE term deposit to 9.25 percent for period ranging from 1 year to 5 years with effect from Jan 1, 2012, PNB said in a statement.

Integrate Market Timing in your Portfolio

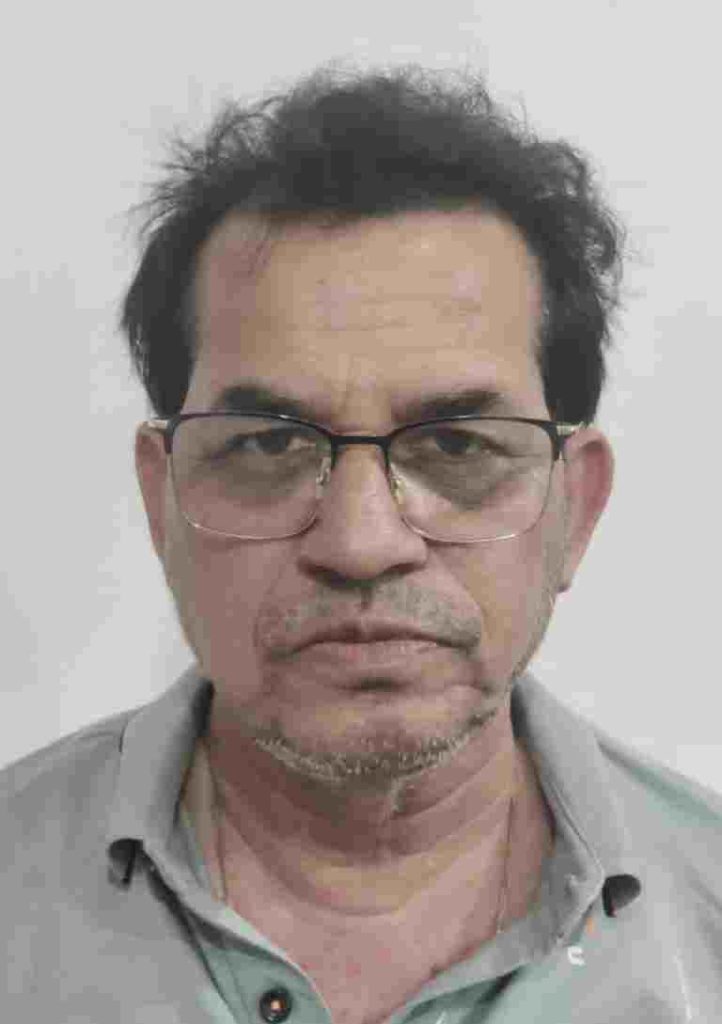

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply

You must be logged in to post a comment.