Your cart is currently empty!

15th November 2012

15th November 2012

Global Stock Indices:

Today’s late night, Sun to enter in Scorpio and Moon to enter in Sagittarius tomorrow morning.

Today is the last day for bearish trend in global stock indices.

From tomorrow, new bull rally will start with volatility for next one month.

Also in case o f S&P, it’s the last day of weakness.

Today, S&P will bottom out. You can slowly accumulate S&P and other stock indices for next a month.

A very good return is possible till 15th December 2012.

Today’s eve (from US Opening), recovery will start in US & UK market.

Till mid-February 2013, we expect Gold to be at 1920 while Silver to be above 52.

Target for Crude Oil, Copper is $108+, $375+.

Trading Range:

- DOW JONES (FUT): 12,500-12,640

- S&P 500 (FUT) :1,349-1,373

- NASDAQ (FUT): 2,520-2,545

- FTSE (FUT): 5,620-5,720

- CAC40(FUT):3,380-3,420

- DAX (FUT): 7,090-7,140

- HANG SENG IDX (FUT)21,140-21,295

- NIFTY (SPOT):5,620-5,680

Precious & Industrial Metals:

Today, bullion is highly volatile. Recovery is expected to start from UK opening. Good rise from US opening. Positive trend to also start in BULLION and other base metals from tonight which shall continue till mid-February 2013 with volatility.

Trading Range:

- GOLD: 1,718-1,740-1,760

- SILVER: 32.30-32.85-33.30

- COPPER: 341.00-352.00

Today, accumulate COPPER at lower levels for next 20 days. Good profit is possible.

Positional investors can buy Copper with stop loss 340.00 for target 365.00-375.00

Energy Products:

Crude Oil will be bullish with volatility for next 1 month. Our target is $105+ in Oil.

Trading Range:

- Crude Oil: 84.30-86.50-87.20

Currencies:

Trading Range:

- EUR/USD: 1.2680-1.2780-1.2820

- USD/INR (SPOT): 55.10-54.40 (TODAY SELL USD AGAINST INR WITH STOP LOSS 55.40 FOR TARGET 54.20-53.80)

- DOLLAR INDEX: 81.30-80.60

Indian Commodity Market/ MCX:

Today, bullion is highly volatile. Recovery is expected to start from UK opening. Good rise from US opening. Positive trend to also start in BULLION and other base metals from tonight which shall continue till mid-February 2013 with volatility.

Our gold target shall be 32,600-33,400+ and Silver target shall be 65,000-72,000+ by mid-Feb 2013.

Crude Oil will continue positive with volatility for target 5,100-5,500 in coming days (for December contract).

Copper’s volatility to end tomorrow and bullish from next week. You can buy Copper for target 440-460+.

Trading Range:

- GOLD: 31,600-31,840

- SILVER:60,500-61,500-61,900

- CRUDE OIL:4,680-4,780

- COPPER: 415.00-423.00

Indian Stock Market:

Today, it’ll be bearish opening and recovery to start after noon. Closing may be flat. But Indian stock market is also positive from tomorrow with volatility till 15th December 2012.

Our target for Nifty, Bank Nifty shall be 6,200+, 12,500+ by 15th December 2012.

ALERT: Accumulate positions in SBI, HDIL, JP ASSOC, DENA BANK, CENTRAL BANK, TATA STEEL, HINDALCO, LIC Housing, DLF, GMR Infra, Godrej Industries, ICICI Bank, RELIANCE CAPITAL, RELIANCE INFRA at lower level and hold till mid-December 2012. A very good return is possible in the said stocks.

Today, you can make buying position for HDIL, RELIANCE CAPITAL, GODREJ INDUSTRIES, SBI, LIC Housing.

HAPPY DIWALI!

(Updated at : 15/11/2012 7:58:44 AM (IST))

Disclaimer: The above calculations are based on astrology and technical analysis. This is an indicative report only and not to be considered as live trading calls, which is a proprietary service by our team. This report is meant for educational purpose only.

ALERT: SUBSCRIBERS WHO HAVEN’T YET PAID THEIR SUBSCRIPTION FEE MUST DEPOSIT THE FEE BY TODAY ITSELF. OTHERWISE, WE’LL BE FORCED TO DISCONTINUE YOUR SERVICE FROM TOMORROW.

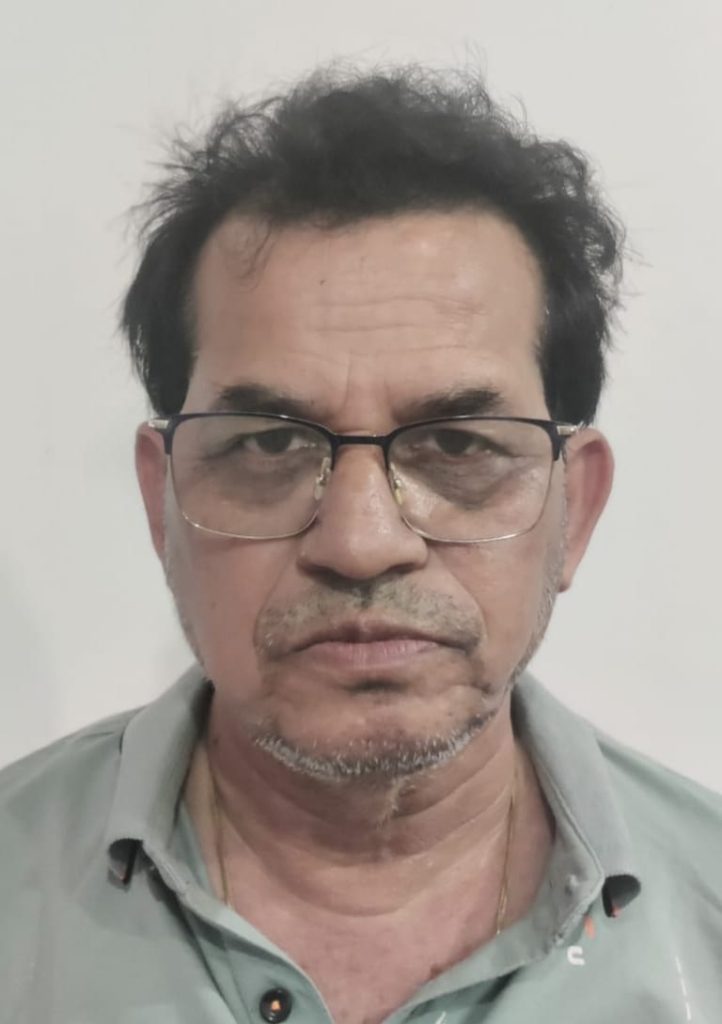

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply