Your cart is currently empty!

Bullion,Crude Oil, Copper and stocks bullish from tomorrow- Trading Range till Friday

First of all, Team Astrodunia salutes the nation ! Happy Indepence Day!

Till Friday, Gold, Silver, Crude Oil & Copper are volatile to bullish.

Today, 15th August 2012- Wednesday :

volatile to bullish. This trend to continue on 16 & 17th August.

Today till late evening, market is expected to be volatile to bearish. But it’s recommended to buy on DIPS! Recovery to start from late night and next 2 days are bullish.

Good recovery possible in S&P, EUR/USD.

INR to be strong against USD.

Trading Range Till Friday(17th August 2012):

Dollar Index: 82.72-82.20 and below

S&P 500: 1390-1420

(Spot) Nifty: 5360-5450-5500

Bank NIfty : 10,600-10,575-10,850 and above

Gold: 1590-1629-1640-1660

Silver: 27.60-28.20-28.30-28.50-29.20 and above

Copper: $335-342

EUR/USD: 1.2265-1.2400 and above

(Spot) USD/INR: 55.80-55.25 and below

Crude Oil: 92.50-94.00-95.00

ALERT: SOFT COMMODITIES (SUCH AS WHEAT, RICE, SUGAR, CORN, SOYABEAN) are expected to be volatile to bullish in next 10 days.

Once again, HAPPY INDEPENDENCE DAY. May God bless our nation and let’s pray for it’s progress. Rich India does mean Strong India.

This is a report only and not live trading calls. For live trading calls (intra-day, over night and positional time frame) in Stock & Commodity Market (MCX,NYMEX,COMEX) during the market hours, please refer to astrodunia.com, call us on +91-9669919000.

Yesterday, our lower and higher levels (both) were achieved in Nifty, Gold, Silver, EUR/USD and USD/INR were successfully achieved.

(Updated at 7.43 HRS IST- 15 AUGUST 2012 – INDORE, INDIA)

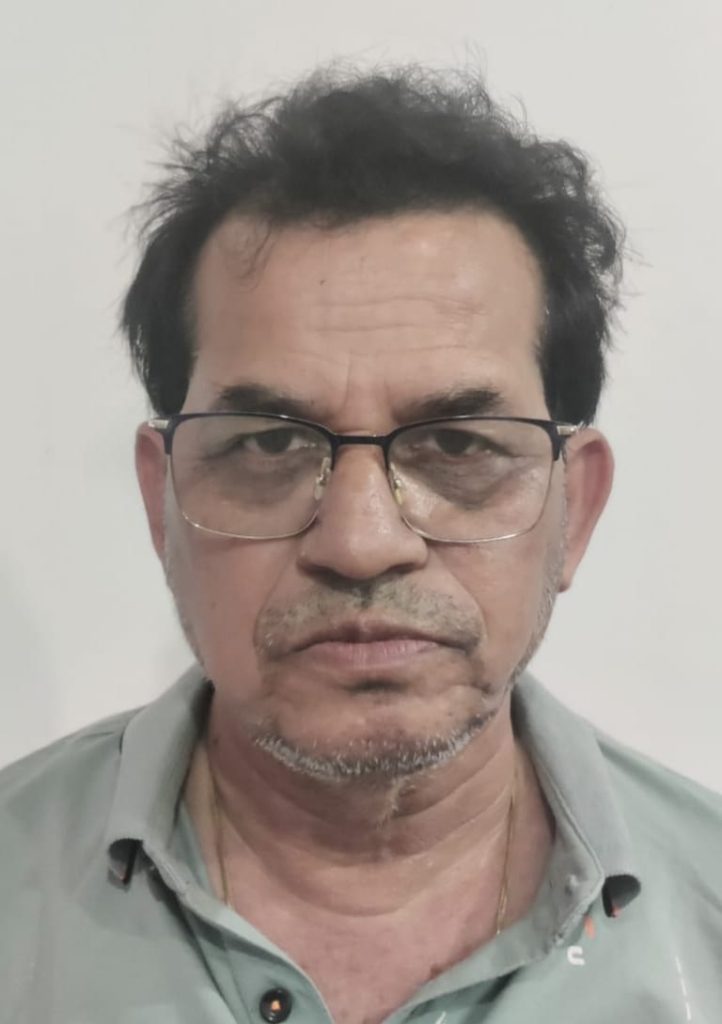

Mr. Rajeev Prakash

Rajeev is a well-known astrologer based in central India who has a deep understanding of both personal and mundane astrology. His team has been closely monitoring the movements of various global financial markets, including equities, precious metals, currency pairs, yields, and treasury bonds.

Leave a Reply